The Dallas Police and Fire Pension System knew that its real estate losses were bad, but they didn’t learn the exact figures until a Thursday board meeting.

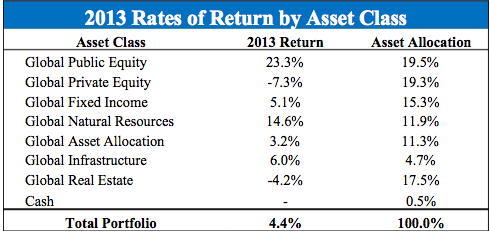

Trustees of the $3.3 billion pension fund learned Thursday that it has lost $196 million on real estate investments made in 2005 and later. Those losses were a big reason why the fund’s overall portfolio in 2013 returned just 4.4 percent.

More on the losses, from Dallas News:

The $196 million in losses came from three real estate plays:

– A set of ventures that included tracts of land in Arizona and Idaho ($90 million loss).

– Luxury resort properties in the wine country of Napa County, Calif. ($46 million loss).

– Ultra-luxury homes in Hawaii and elsewhere ($60 million loss).

[…]

The losses were reported during a presentation by fund staffers and a fund consultant, William Criswell. The presentation did not specify the losses, but The Dallas Morning News tallied them from numbers that were provided and confirmed them afterward with fund officials. Board members, looking grim, commented little but quizzed the presenters on various details.

Of the losses, $96 million was recognized on the fund’s 2013 books, which were completed late this summer.

It’s interesting to note that the pension fund didn’t outsource the handling of these investments, as is common practice for pension funds, particularly smaller funds. From Dallas News:

[Fund administrator Richard] Tettamant led the fund into these deals with little oversight from outside investment advisers. Instead, he and his staff handled many of them personally. He met developers, who introduced him to other developers.

[…]

The ventures prompted the fund’s staffers and board members to travel extensively over the years, trips they said were necessary to scope out and protect the investments. They traveled to the Napa area more than any other out-of-state destination — making 45 trips there from 2009 to 2012.

Dallas attempted to audit the pension fund in 2013, but the fund refused to turn over key documents relating to real estate and private equity investments. For that reason, it wasn’t clear until recently the extent of the losses the fund had sustained.