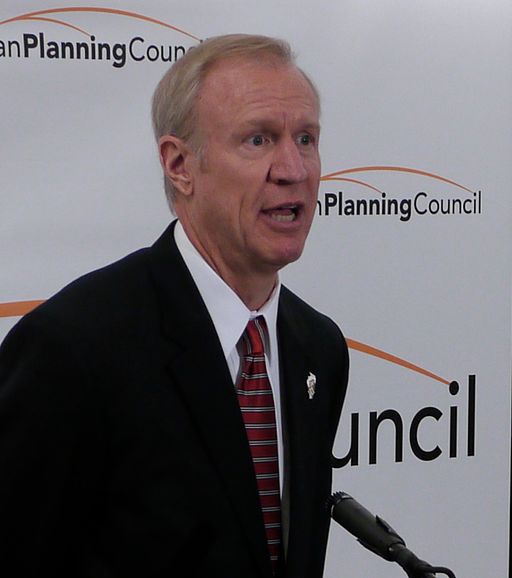

Bruce Rauner won the Illinois governorship, in part, by campaigning as a reformer and a political outsider who would “shake up Springfield.”

Rauner targeted the state’s underfunded pension systems as a prime candidate for reform in at least one campaign ad, when he noted that Illinois carries “$8,000 of pension debt for every man, woman and child.”

The governor-elect recently appointed Glenn Poshard to his transition team, which spurred an investigation by the Better Government Association and CBS 2 News.

The investigation found that Poshard “triple dips” – or, pulls in pensions from three separate retirement systems, netting him nearly $200,000 annually in pension benefits. Poshard is breaking no laws, but the situation demonstrates the “loopholes” in the Illinois pension system that can sometimes lead to ballooned benefits.

Andy Shaw, CEO of the Better Government Association, told CBS: “Governor-elect Rauner could probably learn a lot about how to reform the pension system by looking at the ways in which Glenn Poshard used loopholes to enrich his own pension.”

More from the Better Government Association:

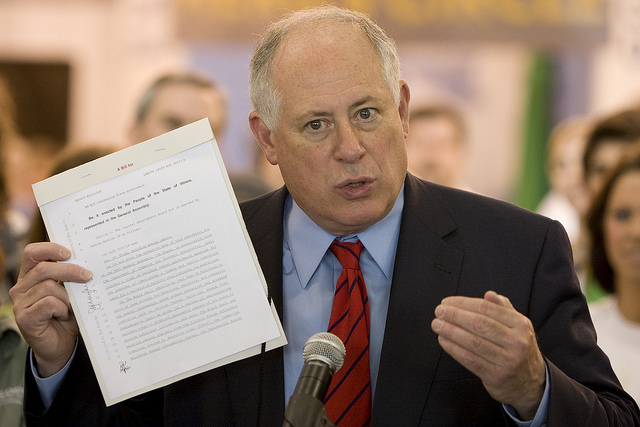

Poshard collects $189,979 a year in state pensions from three separate public-sector retirement systems, more than the $177,412 salary currently paid to Gov. Pat Quinn, the BGA found. Among former governors, only Jim Edgar gets more in retirement: $205,425, having recently picked up a second pension from his days teaching at the University of Illinois. Former Gov. Jim Thompson gets $143,181 in state pension benefits, records show.

In addition to his state-government pensions, Poshard collects a $15,000-a-year federal pension for his 10 years in the U.S. Congress representing a southeastern Illinois district, bringing his total retirement package to slightly more than $200,000 annually, according to records and interviews.

To date, he’s collected more than $1.4 million in state pension benefits, and if he lives until he’s 80, that $200,000 he’s now getting could increase to an estimated $280,000 a year.

[…]

The cornerstone of Poshard’s generous state pension is the five years he served as a state senator. Of all state pension systems, the General Assembly Retirement System, or GARS, has the most deluxe features, designed and passed by members of the General Assembly.

Chief among those features is a formula that allowed him to collect a pension starting at 85 percent of his final state-government salaries – which averaged $165,000 as an SIU administrator during his first of two stints at the state government-run college.

Poshard also was allowed to increase his years of state service and thus boost his state pensions by counting unused sick time, un-served state Senate time, and credits purchased for past jobs in the military and while working his way through college, the BGA found. Overall, Poshard’s state pensions are based on 30 years of service and credit.

Poshard commented on his pension benefits to CBS:

“I am very appreciative for the retirement benefits I now receive which were determined by the laws in place at both the state and federal levels. If some of those laws need to be changed in order to more fully fund the pension system, as I myself have advocated before the legislature, then I am more than happy to see a reduction in my own retirement benefits.”

He also gave a phone interview to the Better Government Association:

In a telephone interview, Poshard said he has done nothing unethical and “never tried to game the system.”

“I can tell you, I worked hard my whole life,” said Poshard, 69. “I never shortchanged the state.”

[…]

“I’m grateful for what I got. I’m happy with it. I can’t pass judgment on whether the overall pension was too generous,” said Poshard.

A spokesman for Bruce Rauner said the Poshard’s role on the transition team will not be focused on pension issues.

The entire BGA investigation can be read here.

The corresponding CBS investigation can be read here.