Sangamon County Judge John Belz spent Thursday hearing arguments for and against Illinois’ major pension overhaul.

On Friday, he is expected to release his ruling on the law. If he declares it unconstitutional, the debate could move to the halls of the Supreme Court sooner than later.

More from the Chicago Tribune:

[Judge Belz] could move to hold hearings in the case, or he could declare the measure unconstitutional, which would likely send the matter directly to the state Supreme Court.

Even then, it could take several more months before the justices make a final decision, meaning Rauner may not get the clarity he’s seeking in time to drive cost-saving pension changes during the spring legislative session.

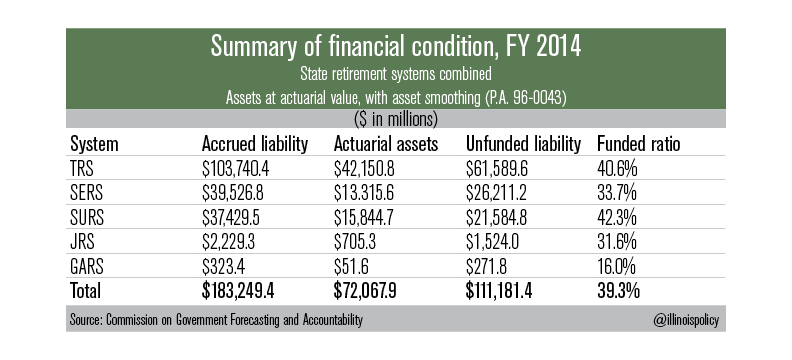

Belz held a hearing Thursday, and Illinois Attorney General Lisa Madigan’s office argued the pensions could be modified in times of emergency — such as the financial straits caused by the state’s worst-funded pension system in the nation.

A battery of attorneys for state employees and retirees argued strenuously the law should be tossed out because it is unconstitutional — a move that would put it on a likely path to the Illinois Supreme Court.

In July, the high court threw out a different law that cut health-care benefits that had been guaranteed to retirees, saying lawmakers had overstepped what they were allowed to do. That decision alone buoyed the hopes of state pensioners — as well as the city of Chicago retirees who don’t want their own pensions plans reduced.

Friday’s ruling is key because it is the first step toward determining whether officials can scale back public pensions in any way once they are set.

Unions believe the law represents an unconstitutional breach in contract. From the Chicago Tribune:

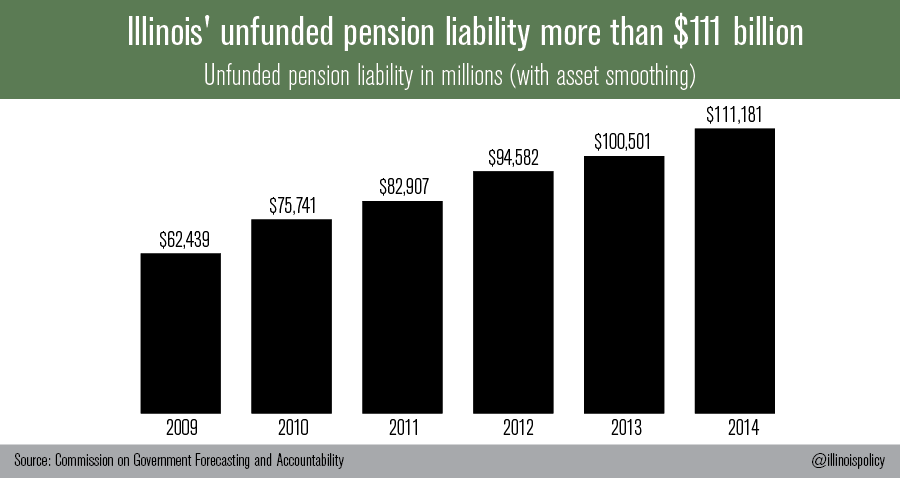

Unions representing government workers are asking Judge John Belz to declare unconstitutional a law approved nearly a year ago that aims to rein in costs of a retirement system reeling from more than $100 billion in debt.

At the heart of the pension issue is a clause in the Illinois Constitution that says membership in any state pension system is an “enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

Employee unions argued that the pension law, which curbs annual cost-of-living pension increases for current retirees and delays the age for retirement for many current public workers, clearly violated those protections.

Illinois governor-elect Bruce Rauner believes the law will be overturned by the Supreme Court. Rauner has said in the past that the law doesn’t go far enough to reduce pension liabilities.