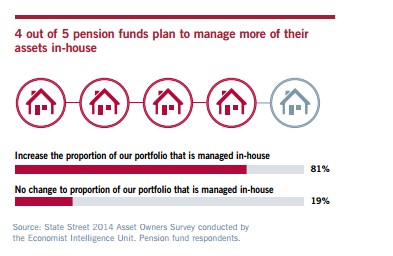

Pension funds across the world are looking to bring asset management responsibilities in-house, according to a recent survey by State Street.

In addition, a majority of funds are thinking of turning to lower-cost investment strategies.

From ValueWalk:

Over the next three years, a whopping 81 percent of pension fund respondents said they are exploring bringing more asset management responsibilities in-house. A primary reason? Fees and costs were a major issue, with 29 percent saying it was a challenge for the pensions to justify the fees of their asset managers.

An unspoken issue is the relatively low returns, as many hedge funds are both highly correlated to the performance of the stock market as well as underperforming major stock market indices. This leads to the question: why not just primarily invest in an stock index ETF for the primary equity exposure?

As part of this shift to internal investing, 53 percent of the respondents are expecting to use more lower-cost strategies to achieve desired investment outcomes. This would likely include low cost ETFs designed to capture the beta of the stock market.

“Pension funds’ desire to deliver strong investment returns to their participants coupled with improved oversight and governance and is leading to a need for more in-house accountability for asset and risk management,” said Martin J. Sullivan, head of Asset Owner sector solutions for North America, State Street. “However, this undertaking requires pension funds to carefully evaluate how to achieve a balance of in-house and external talent, tools and technologies.”

The survey polled 134 pension executive from the Americas, Europe, the Middle East, Africa and Asia.