A lawsuit alleging that JP Morgan knew more than it let on about Bernie Madoff’s massive Ponzi scheme was dismissed yesterday by a judge, who said there wasn’t enough evidence that the bank’s board members breached their duty to shareholders by ignoring alleged “red flags” around Madoff’s fraudulent activities.

The suit was filed by two pension funds – the Steamfitters Local 449 Pension Fund in Pittsburgh and Central Laborers’ Pension Fund in Jacksonville, Illinois – that are both shareholders of JP Morgan.

More from Bloomberg:

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon and board members won dismissal of an investor lawsuit over $2.6 billion in penalties and settlements paid by the bank because of its relationship with convicted Ponzi scheme operator Bernard Madoff.

U.S. District Judge Paul Crotty in Manhattan today threw out the suit, which sought damages on behalf of the bank based on claims that JPMorgan executives and directors turned a blind eye to Madoff’s fraud. The investors claimed the defendants harmed the bank through breaches of fiduciary duty, securities law violations and waste of corporate assets.

In dismissing the case, Crotty said that the investors weren’t excused from the requirement that they demand that JPMorgan’s board pursue the legal claims before filing the suit. Crotty ruled they didn’t show that a majority of the board couldn’t have exercised disinterested and independent business judgment in considering such a demand.

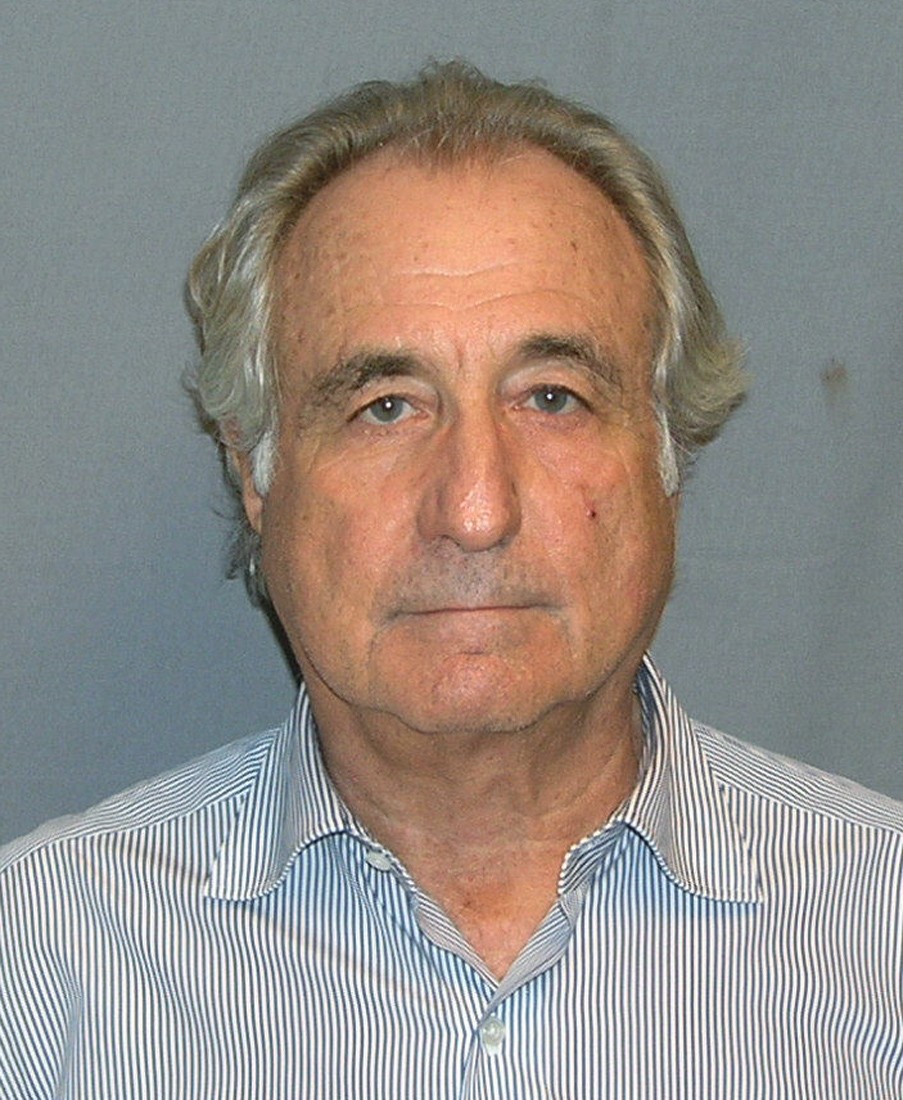

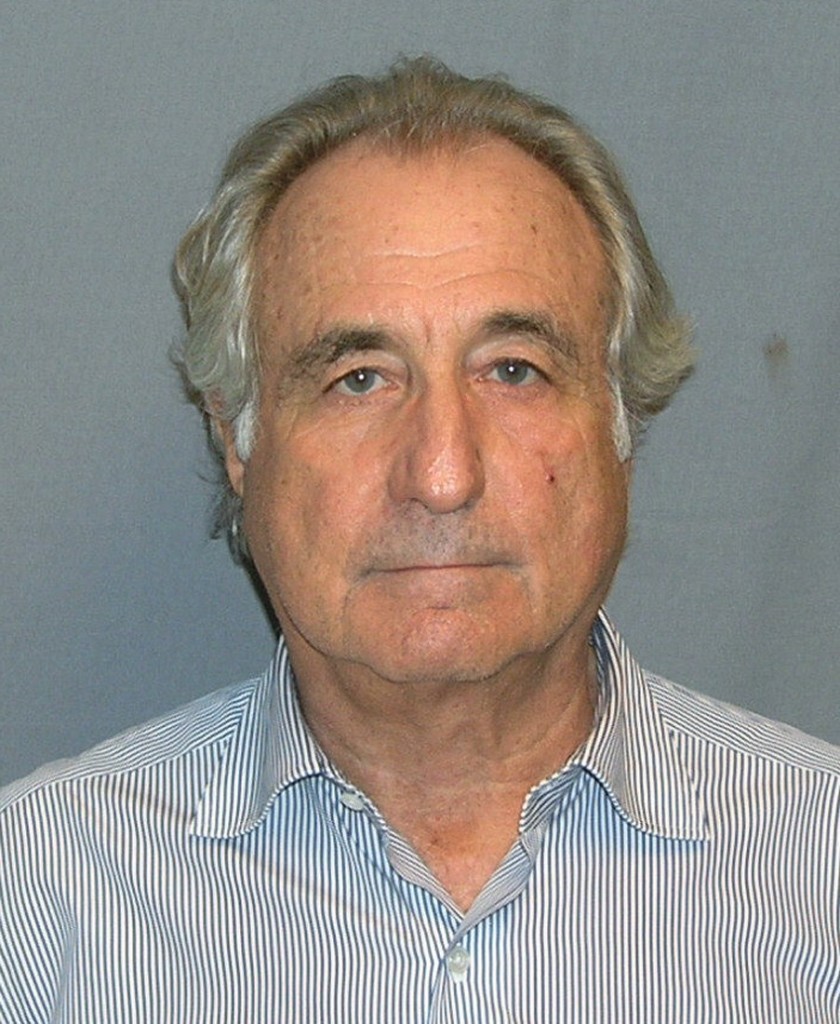

Madoff, 76, pleaded guilty in 2009 to orchestrating the biggest Ponzi scheme in history. He’s serving a 150-year sentence in a North Carolina federal prison. Beginning in 1992, Madoff deposited almost all of the proceeds of the fraud with JPMorgan Chase, Crotty said in his opinion.

JP Morgan had already entered into a “deferred prosecution agreement,” under which the bank admitted its responsibility in not stopping Madoff’s scheme. The agreement helped the bank avoid criminal charges.