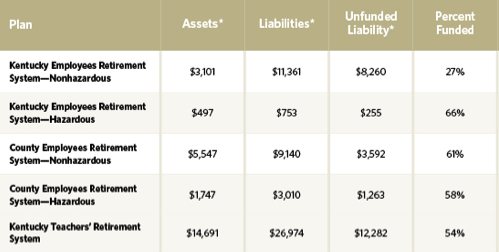

A Kentucky teacher has filed a lawsuit against the Kentucky Teachers’ Retirement System (KTRS), claiming KTRS has “failed in their fiduciary duty” by letting the system become one of the worst funded teachers’ plans in the country.

From WFPL:

A Jefferson County Public Schools teacher filed a lawsuit Monday against the Kentucky Teachers’ Retirement System, which has been called one of the worst-funded pension systems for educators in the U.S.

The plaintiff, duPont Manual High School teacher Randolph “Randy” Wieck, told WFPL that the system supporting over 140,000 teachers in Kentucky is billions of dollars in debt; also that teachers pay about 12 percent of their paychecks into the retirement system.

“We have raced to the bottom and we’re neck and neck with the worst funded teachers plan in the country,” he said.

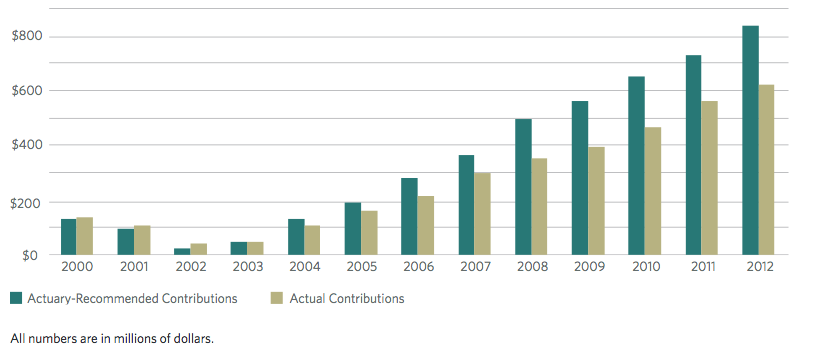

As WFPL reported, the General Assembly during this year’s legislative session funded KTRS at around 50 percent of what the retirement system requested.

The federal Government Accounting Office and Standard & Poor say Kentucky’s pension system is being funded at an unhealthy rate.

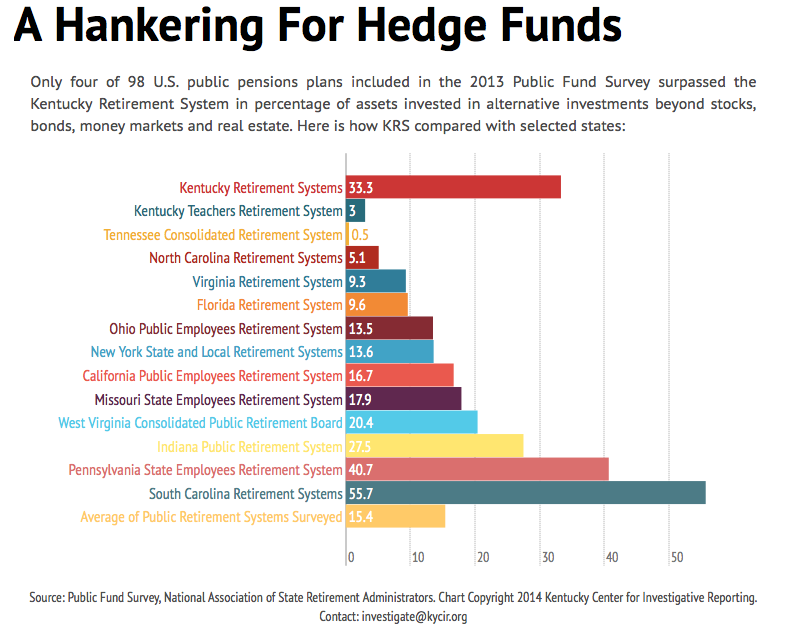

KTRS has “failed in their fiduciary duty by not aggressively and publicly demanding the full funding they need to stay solvent,” Wieck argues in a copy of the complaint he provided to WFPL. The complaint further alleges that KTRS has not been transparent enough in the “system’s dire funding status,” and that the investments made by KTRS are not responsible.

The teacher, Randy Wieck, is giving KTRS one year to become fully funded. After that, he says he will bring the lawsuit to the steps of Kentucky’s General Assembly; for many years, lawmakers have failed to pay the state’s actuarially-required contribution to the pension system – although they did make the full payment to the teachers’ system in 2011.

TRS’ attorney commented on the suit:

“I am very optimistic that we are going to find a solution for this,” said Beau Barnes, general counsel for KTRS.

There are positive signs among members of the General Assembly to come up with a plan, he said, adding that next week, KTRS will appear before the state’s Interim Joint Committee on State Government to discuss a financing plan for the pension fund. Wieck, who was joined by “Kentucky Fried Pensions” author Chris Tobe, seemed skeptical of previous conversations that seemed to excite Barnes.

The state legislature is not poised to discuss budget issues during the 2015 legislative session, but Wieck said Kentucky is violating its duty to keep the pension system solvent.

“You don’t actually have to wait for the bus to hit you to experience danger. And that is what is happening to Kentucky Teachers’ Retirement System. It is being damaged every year,” he said.

KTRS manages $17.5 billion in assets. The system is about 51 percent funded.