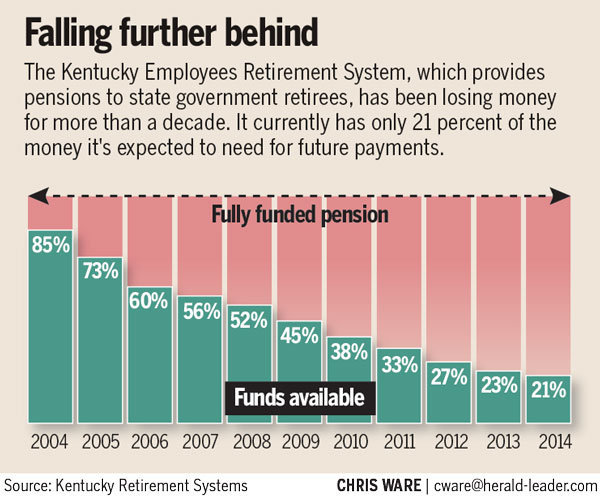

Jim Carroll, co-founder of the Kentucky Government Retirees group, has penned a column in the Courier-Journal calling for lawmakers to explore and implement solutions to the funding crisis facing the Kentucky Employees Retirement System.

Carroll explains how the KERS non-hazardous fund came to be one of the worst-funded systems in the country:

Imagine that you purchased a house with a 30-year mortgage and for 15 out of the past 22 years, you made only partial payments toward the principal and interest. Obviously, long before now, you would have lost that home. But in the bizarre world of state funding policy, a succession of governors and legislators has done precisely that with the state pension plan that covers 38,000 retirees and 40,000 active workers, the Kentucky Employees Retirement System non-hazardous fund.

Consistently for more than a decade, budgets have short-changed the employer contribution to the pension fund. That in a nutshell describes how the plan is “upside down,” is in deep fiscal trouble, and has no short-term prospect for asset growth without a substantial injection of new money.

When year after year, we stakeholders paid our employee contributions like clockwork, Frankfort decision-makers let the employer contributions slide. Actuaries for Kentucky Retirement Systems, the umbrella agency that administers various pension funds, calculated the amount of employer contribution needed to sustain the fund, and governors and legislators approved budgets that methodically and consistently allocated lesser amounts.

Carroll goes on to discuss how assets are declining despite double-digit investment returns, and how the system is one economic downturn away from disaster:

The harmful effects of underfunding can be seen in recent declines in assets. I testified before the legislature’s Public Pension Oversight Board in October, and I pointed out an alarming fact: that investment gains have become disconnected from asset growth. Two years ago, the plan made more than 11 percent on its investments, yet assets declined by more than $200 million. Last fiscal year, a bull market in full swing led to a 15.5 percent return on investments — twice the assumed rate of return. The result? A decline of $183 million in assets. We know of no other state pension plan in the country where investments have soared, but assets have dropped.

[…]

KERS non-hazardous assets now stand at a little under $2.5 billion, while the fund pays out $915 million annually in benefits and expenses. KRS officials delivered the bad news recently that the market was flat in recent months, a trend that if it persisted to the end of the fiscal year, would lead to a decline of $500 million, leaving the fund with a balance of about $2 billion. This takes into account the additional funds provided by the full employer contribution.

[…]

What happens if the market hits a trough before the cumulative effects of future full employer contributions take effect? The KERS non-hazardous fund saw $2.1 billion in assets vanish during the 2008-09 crash. At the time, the fund held $5 billion in assets. It is of course far more vulnerable now.

If assets dropped to about $1.3 billion, KRS would be forced to liquidate its non-cash investments to maintain liquidity. At that point, it would no longer be a sustainable defined benefit plan, because such a plan relies primarily on investment holdings to pay benefits. In today’s low interest-rate environment, KRS investment returns in cash equivalents would be negligible.

Read the full column here.