Pensions & Investments released an interesting report yesterday outlining the balance of power in the private equity world between general partners and pension funds.

Pensions & Investments released an interesting report yesterday outlining the balance of power in the private equity world between general partners and pension funds.

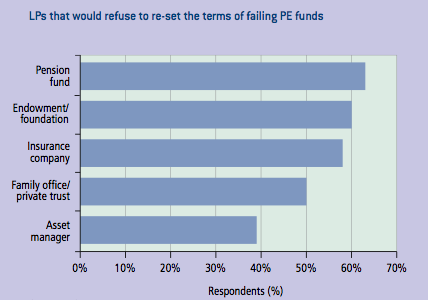

In the last few years, the balance of power has shifted dramatically towards GP’s, according to the report.

From Pensions & Investments:

Until the 2008 financial crisis, general partners pretty much set the rules, leaving most limited partners little say on terms, including on fees and expenses, when they committed to funds. Then fundraising got harder, and even the most popular private equity managers had to accept investors’ demands for lower fees and expenses and a greater degree of transparency.

Now, the highest-returning general partners are regaining the upper hand.

“Certainly, the pendulum has swung more toward the GP compared to 2009,” said Kevin Campbell, managing director and portfolio manager in the private markets group at fund-of-funds manager DuPont Capital Management, Wilmington, Del. The firm was spun out from the pension management division of DuPont’s pension plan in 1993.

[…]

Said DuPont’s Mr. Campbell: “I’ve seen the pendulum of power change positions several different times during the last 15 years,” where private equity fund terms are determined by the GP and sometimes they are more influenced by the LP.

Strong-performing managers that retain the same team and the same investment strategy used when they earned their strong returns have the most influence over fund terms, Mr. Campbell said. These managers also are raising a fund that is similar in size to their last fund and they have a “good investor base,” meaning investors who routinely commit to their funds, he said.

[…]

Some are increasing their negotiating clout by getting large capital commitments from sovereign wealth funds before the first close, enabling them to give other interested institutional investors a take-it-or-leave-it deal, said Stephen L. Nesbitt, chief executive officer of Marina del Rey, Calif.-based alternative investment consulting firm Cliffwater LLC.

Part of the reason GPs have power over LPs has to do with fundraising. GPs are having an easy time raising capital, which means they don’t have any incentive to negotiate terms with LPs. From P&I:

It’s easier to raise capital now; funds are raised more quickly and general partners have more influence on terms, he added.

Indeed, some private equity funds are closing very quickly, with access to much more capital than they need. Instead of holding several fund closings — giving general partners the ability to invest the capital commitments before the final close — a number of firms are having “one-and-done” closings. Because there are asset owners willing to invest on those terms, the GPs have little reason to give in to limited partners demanding changes to fund terms.

For example, Veritas Fund Management in August held a first and final close at $1.875 billion for its latest middle-market private equity fund, after just three months of fundraising. And private equity real estate manager Iron Point Partners LLC in November closed the Iron Point Real Estate Partners III LP at $750 million, well above its $450 million target.

And KPS Capital Partners LP held a first and final closing last year of its $3.5 billion KPS Special Situations Fund IV, above its $3 billion target. It was KPS’ third oversubscribed institutional private equity fund, according to a statement from the firm at the time.

Read the full report here.