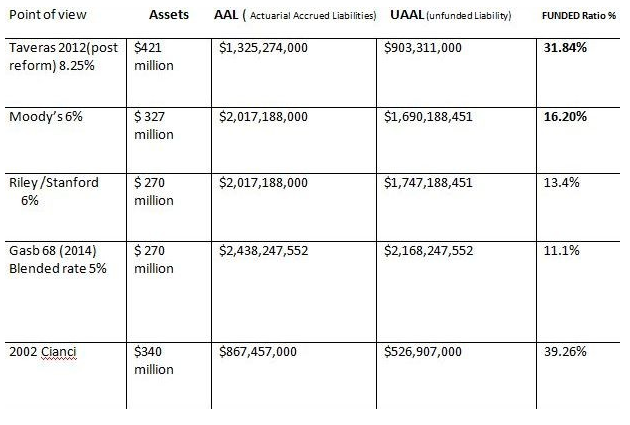

Sometimes, a pension plan’s official funded ratio can be deceptive. That’s because there are many different assumptions that play into that final number, including the fund’s assumed rate of return.

Michael G. Riley, vice chair at Rhode Island Center for Freedom and Prosperity, has done some number-crunching to see what Providence’s pension funding would look like if the city lowered it’s return assumption, which currently stands at 8.25 percent.

The results of the analysis can be seen in the table above. Riley’s methodology can be read below. From Go Local Prov:

I have calculated the TRUE pension liability given certain relevant assumptions. Let me first say that if Bondholders did not currently have first lien on Tax revenues, due to a 2011 law passed by the assembly placing public workers and taxpayers at the end of the line, then Providence, Rhode Island would already be rated “junk” by Moody’s, S&P etc. and would have very little flexibility to finance anything.

Mayor Taveras uses among the highest discount rate in the country 8.25%. Moody’s will use and analyze using between 5.5% and 6%. We will use 6% for their analysis and a blended rate based on crossover points indicating 70% muni rate and 30% the providence assumption for returns. The 2012 CAFR is used and assets were then reported as $421 million dollars ( even though assets in the fund were only $247 million) First we will adjust assets down by $57 million based on the auditors admonition against Taveras accounting gimmick, next we will use market value as prescribed by gasb 67.

This table reveals the truth through analysis, if you want to believe Taveras lies then keep reading the Projo and WPRI. If you are an accountant or actuary including those employed by Providence please refute these numbers in public.

According to NASRA research, the average pension fund in 2013 assumed a rate of return of 7.72 percent.

NASRA used a sample of 126 public pension plans. Only four plans had return assumptions higher than 8 percent.