New Jersey’s largest union, New Jersey AFL-CIO, has filed an ethics complaint with the state regarding the entity that oversees the state’s pension investments – the State Investment Council – and the man that chairs the Council – Robert Grady.

The union alleges that politics have played a large role in the state’s pension investments, which have increasingly included hedge funds and other alternative investments.

From NJ.com:

In an 11-page letter to the ethics commission, New Jersey AFL-CIO President Charles Wowkanech said that the chair of the State Investment Council, Robert Grady, “has violated the Division’s own rules barring politics in the selection and retention of such funds and investments, and has further created an appearance of impropriety.”

At issue is the state’s investment of hundreds of millions of dollars of pension money with Wall Street firms, including hedge funds and other types of “alternative investments” that charge higher fees than more traditional types of investments — a practice that started before Christie was governor but has increased under him.

Some “key executives” of the firms donated to state and national Republican organizations that helped Christie, according to Wowkanech, who said those donations potentially broke state pay-to-play laws, and at the least violated the state officials’ code of ethics. Wowkanech wants an investigation.

The complaint is based on a series of reports on the websites Pando Daily and International Business Times, written by the reporter David Sirota, that explain the pension fund’s increase in alternative investments since Christie took office.

The complaint also takes issue with Grady’s involvement with Chrisite’s re-election campaign as an adviser, in close contact with Christie and top staffers, while he was leading the council.

“It should not be seen as mere coincidence that the reports show Robert Grady was listed as a required attendee on a series of regular weekly phone conference calls held by high-level staff on the Governor’s re-election committee in or around September 2013,” Wowkanech’s letter reads.

The Christie administration and the state treasury department have responded to the complaint, according to the Associated Press:

Christie spokesman Kevin Roberts calls the filing “a cheap political stunt based on shoddy, distorted reporting.”

Christopher Santarelli, a spokeswoman for the state treasury department, said it is state employees who decide who will manage pension fund money, not the investment council.

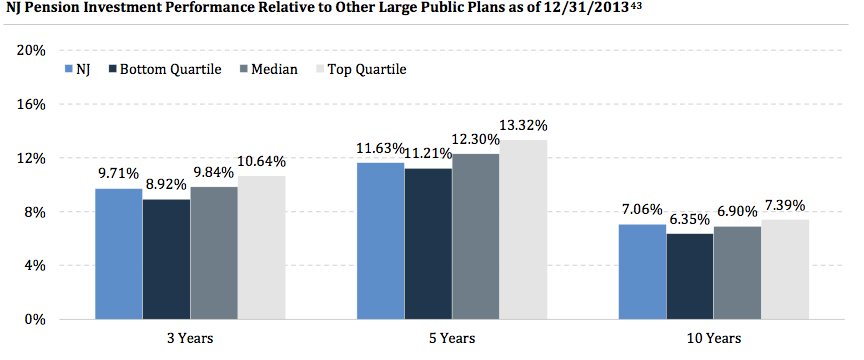

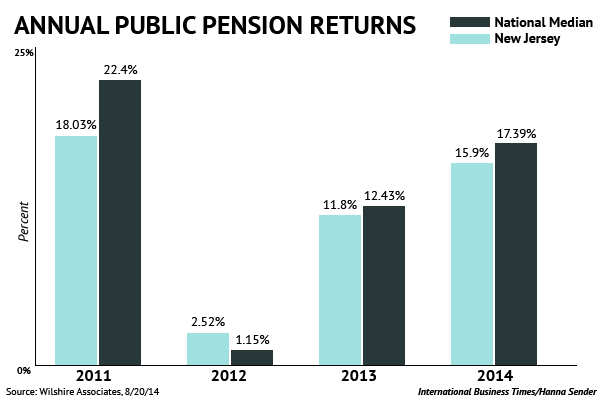

He also said that the state’s use of alternative investments including hedge funds and bank plans is in line with peers. He said the strategy helped minimize losses in 2008 and 2009, when stock prices fell sharply.

Grady did not immediately return a message from The Associated Press, but he previously said in an email to the International Business Times that he was cleared by the state treasury department’s ethics officer before he participated as a policy adviser to Christie’s re-election campaign. He says that no pension investment decisions were discussed with campaign officials.

The Associated Press wasn’t able to contact Grady. But Grady has previously stated that pension investment decisions had nothing to do with campaign politics.

Photo by Truthout.org via Flickr CC License