What obstacles do institutional investors face when making cross-border investments? And what strategies do they use to overcome those obstacles?

A survey was recently conducted to find out, and the results have been published in the Rotman International Journal of Pension Management.

The survey asked respondents to identify and rate the biggest obstacles to cross-border investment:

We first asked respondents to rate, using a five-point Likert- type scale (1 = strongly disagree, 5 = strongly agree), to what extent 20 different issues identified in the investment obstacles literature would “decrease the likelihood your fund will invest in another country.”

[…]

The top two issues, as identified by summing the percentages of “agree” and “strongly agree” responses, were “financial regulation uncertainty” (FP, 80%) and “unfavorable comments by government officials in recipient country” (IC, 73%). While the latter is an IC factor, it focuses on the nation-state and the use of informal suasion by officials, and thus is related to FP factors. Following these items almost two-thirds (64%) of the funds agreed or strongly agreed that “unfavorable tax treatment of your fund type” (FP) and “non-transparent investment review policies” (FP) would reduce the possibility of their fund’s investing in another country. Of these four factors, “financial regulation uncertainty” (FP) and “non-transparent investment review policies” (FP) elicited the highest proportion of “strongly agree” rankings.

The survey also asked respondents to identify the strategies they used to address the barriers:

Respondents were asked to indicate whether or not they used eight specific strategies to address the 20 possible barriers: increase transparency; co-invest; use external managers; restrict voting rights; accept outside investors; use debt; other strategies; and no strategy. Respondents could select all applicable strategies used to address each issue. The strategy identified most often (124 times) to address all three factor classifications was “no strategy,” followed by “external managers” (68) and “increase transparency” (55). Rounding out the top five were “co-investing” (34) and “other strategies” (30). The fact that “other strategies” was selected least often suggests that the survey included the most commonly used strategies.

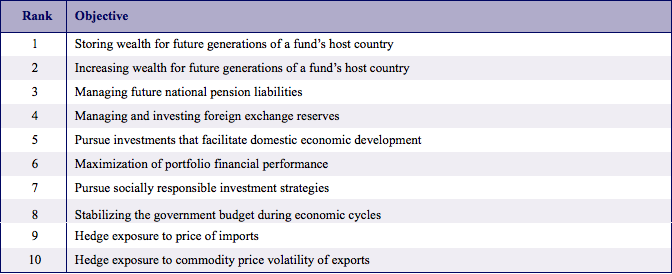

Finally, the survey asked respondents to rank ten long-term investing objectives. The aggregate results:

The article, authored by Rachel Harvey, Patrick Bolton, Laurence Wilse-Samson, Li An, and Frédéric Samama, can be read in full here.

Photo by Satya via Flickr CC License