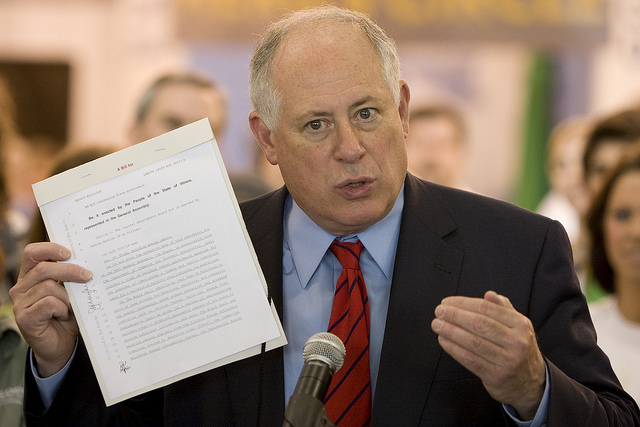

Illinois Gov. Pat Quinn has signed into law a measure that allows the Illinois Attorney General to strip pension benefits from public officials who have been convicted of felonies related to their job.

The bill was passed unanimously by the state Senate earlier this month.

From the Associated Press:

A new state law will make it tougher for felons to receive a public pension.

Gov. Pat Quinn signed legislation Monday giving Illinois’ attorney general more power to stop pension payments to convicted felons.

[…]

The Illinois Supreme Court in July upheld a lower court ruling that Attorney General Lisa Madigan couldn’t challenge a Chicago police pension board decision allowing Burge to keep his taxpayer-supported pension.

State Sen. Kwame Raoul is a Chicago Democrat. He says it’s “unconscionable” that Burge receives a pension and the law allows “taxpayers a way to fight back.”

The bill came about after former Chicago policeman Jon Burge was allowed to keep his pension even after being convicted of a serious felony. From the Sun-Times:

In July, the Illinois Supreme Court ruled a Cook County court was correct in not allowing Madigan to intervene in a police pension matter. The decision allowed disgraced former Chicago Police Cmdr. Jon Burge, who was convicted in 2010 for lying about the torture of police suspects, to keep his public pension of about $54,000 a year.

The police pension board deadlocked 4-4 on a motion to strip Burge of his pension. Some argued his conviction was not related to his police work, since he was convicted on perjury and obstruction of justice from a civil suit filed after he left the force.

Under the law, the state attorney general will be able to petition the court to strip pension benefits from public officials. Previously, the attorney general wasn’t allowed to intervene in the decision, which was left to pension boards.

Photo credit: “Gfp-illinois-springfield-capitol-and-sky” by Yinan Chen. Via Wikimedia Commons