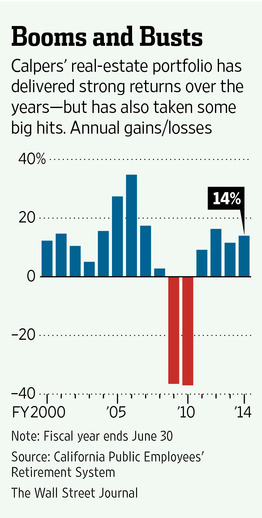

CalPERS has seen strong real estate returns since 2011. But a consultant for the pension fund warns in a new report that the consistent double-digit returns are unlikely to continue.

[The report, from Pension Consulting Alliance, can be read here, or at the bottom of this post.]

More details from Randy Diamond of Pensions & Investments:

The PCA report, which is contained in agenda materials for CalPERS’ Nov. 17 investment committee meeting, said sustaining those returns is unlikely because of a challenging and highly competitive investment market.

The report cites increased competition from sovereign wealth funds, high-net-worth investors and other large direct investors in real estate as among the reasons for the potentially declining results. It says persistently low interest rates are fueling the demand for income-producing assets.

In 2011, CalPERS changed the focus of its real estate program to focus on investing in income-producing properties — and away from opportunistic real estate — after suffering massive losses following the crash of the real estate market.

CalPERS spokesman Brad Pacheco said in an e-mail: “We recognize that recent high returns will be difficult to achieve in the current real estate market. Our goals now are to diversify portfolio risk and generate steady, modest gains.”

CalPERS manages $25.6 billion in real estate assets, and is planning to expand its real estate portfolio by 27 percent by 2016.

The report:

[iframe src=”<p style=” margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;”> <a title=”View Real Estate Report on Scribd” href=”https://www.scribd.com/doc/246505443/Real-Estate-Report” style=”text-decoration: underline;” >Real Estate Report</a></p><iframe class=”scribd_iframe_embed” src=”https://www.scribd.com/embeds/246505443/content?start_page=1&view_mode=scroll&show_recommendations=true” data-auto-height=”false” data-aspect-ratio=”undefined” scrolling=”no” id=”doc_90379″ width=”100%” height=”600″ frameborder=”0″></iframe>”]