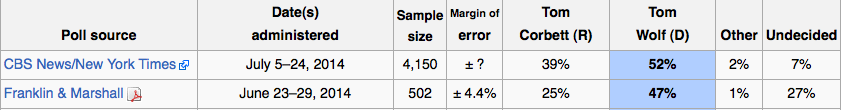

Pennsylvania Gov. Tom Corbett (R) is trailing by double-digits in many polls to opponent Tom Wolf (D) – but his campaign strategy of pushing the need for pension reform appears to be unchanged.

Corbett has been the most vocal critic of his state’s pension system, but most of his fellow lawmakers – and voters, for that matter – have not reciprocated that enthusiasm for major reform.

On Monday Corbett said that “entrenched interests” are preventing pension reform. And those interests, according to the governor, have seeds in both parties.

Reported by the Intelligencer:

“There are entrenched interests out there,” the governor said. “The public sector unions are all against change … There are Republicans that don’t like me. I’m pushing change. It’s very hard to get change in Pennsylvania.”

[…]

Corbett traces the current pension problem to 2001.

That’s when the state Legislature boosted the retirement package for state lawmakers and judges by 50 percent and increased pensions by 25 percent for 300,000 active state workers and school employees. Corbett wants to roll back those increases to pre-2001 levels for current employees — an annual multiplier of 2.0 rather than 2.5 for employees and from 3.0 to 2.0 for lawmakers and judges — and place new employees in a 401(k) style retirement plan.

But the Legislature, backed by the might of public section unions, has stood in his way.

“We said to present-day employees, going forward, that we need to ratchet it back to two,” Corbett said of the annual multiplier. “Did you earn that (2.5)? I don’t think so. You did nothing new.”

Corbett said he favors the state rolling back the benefits and letting the courts decide when the unions sue. The real problem for taxpayers, he said, would occur once the issue landed in court because the judges who benefited from the enhanced pensions would be asked to rule on the matter.

“What judge in this state can hear that case?” he asked. “It’s an economic conflict of interest. … People should be upset with that. I say, let’s try it.”

Corbett re-iterated that, if re-elected, he would call a special legislative session to push through pension reform measures.