In 2012, the city of San Bernardino, California made an unprecedented move: bankrupt and financially handcuffed, the town defied pension juggernaut CalPERS and simply stopped paying its contributions to the system. It has since resumed making those payments, but the fight is far from over. Now, CalPERS wants the city to pay back the payments it missed:

At issue is the $17 million in back payments and penalties that San Bernardino failed to make between declaring bankruptcy in August 2012 and resuming payments in July. Calpers has maintained that it is owed in full. But now in bankruptcy negotiations, the city is hoping to pay only a fraction of that, arguing that the city’s creditors must all share in the bankruptcy pain. The amount may be small, given the system’s assets, but if San Bernardino gets a reduction, the precedent could be huge, opening the door to other struggling municipalities using bankruptcy law to justify delaying or withholding payments to the pension system.

“This city has taken on the 800-pound gorilla, which is Calpers,” said Ron Oliner, a lawyer for the San Bernardino Police Officers Association, which represents the city’s uniformed officers. “Everyone in California is watching San Bernardino, and everybody in the nation is watching California.”

Calpers has for many years resisted all efforts to allow cities, for whatever reason, to stop making their required payments. (Federal law allows bankrupt companies to slow them greatly.) While agreeing that “significant progress has been made in the mediation,” Rosanna Westmoreland, external communications manager for Calpers, said the pension system’s hands were largely tied by statutes mandating that all the pension system’s participants make their full contributions on time and that no workers’ benefits be reduced. “It is the law,” she said.

The problem is that it remains unclear whether, in cases like this, federal bankruptcy law trumps state pension laws. A federal judge hearing the Detroit bankruptcy case ruled, for instance, that federal laws took precedence in that case, so the benefits of city workers in Detroit could be reduced in defiance of state law. But Calpers has insisted that this does not apply to the situation in California, an assertion that may be tested in court, if the mediation provides no solution.

Even before a recent wave of municipal bankruptcies hit California, the California Public Employees’ Retirement System, known as Calpers, had also insisted that under state law, no local government or public agency could reduce the benefits of current workers or retirees.

Cutting pension costs have proved difficult in California. That’s due to the so-called “California Rule”, which prohibits the rollback of pension benefits, even on a go-forward basis. Economist Sasha Volokh explains:

Most states are free to alter public employee pensions, as long as they do so on a purely prospective basis. For instance, a state can reduce cost-of-living adjustments (COLAs), say from 3% to 2%, as long as the amount accrued so far is still subject to the old COLA. But the rule is otherwise in California: California courts have held that ‘upon acceptance of public employment [one] acquire[s] a vested right to a pension based on the system then in effect.

In California, when a public employee begins work, he not only acquires a right to the pension accumulated so far—presumably zero on the first day, and increasing as he works longer—but also the right to continue to earn a pension on terms that are at least as generous as the ones then in effect, for as long as he works. And if pension rules become more generous in the future, then those more generous terms are the ones that are protected. Any changes to these rules must be reasonable, meaning that they ‘must bear some material relation to the theory of a pension system and its successful operation,’ and any disadvantages to the employees ‘should be accompanied by comparable new advantages.’ This is the ‘California rule.

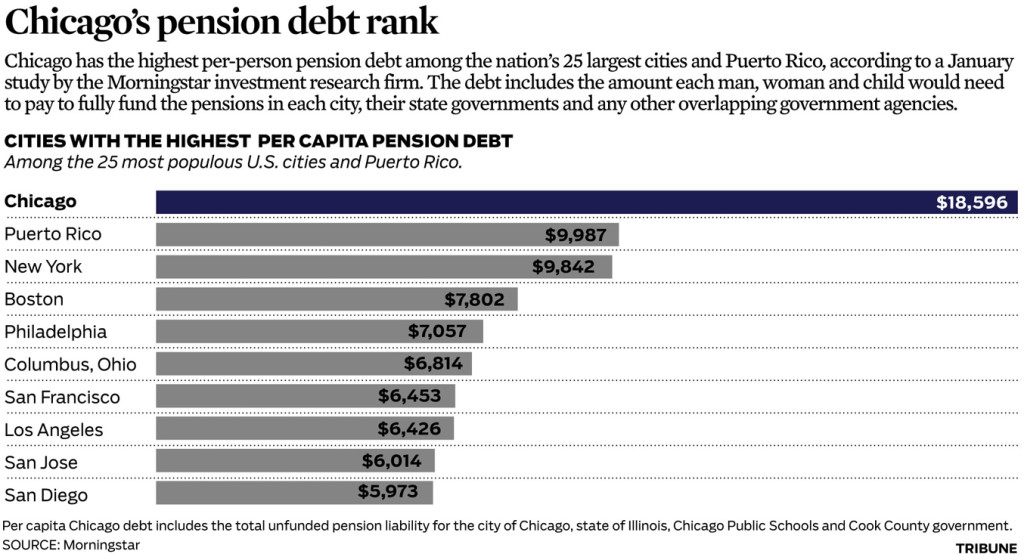

Cities have tried to roll back their pension obligations. San Jose was one such city; earlier this year, it passed a plan forcing employees to pay more towards pensions. But the courts responded with a resounding “you can’t do that”. Volokh, for one, doesn’t like the economics behind that ruling.

When pensions are given special protection that’s unavailable for other job characteristics, the mix of wages and pensions is distorted relative to what it would otherwise be (given collective bargaining, tax policy, employee time and risk preferences, and other factors). If market or fiscal pressures mean government compensation must become less generous, it’s salaries and other benefits that must take the hit, even if some employees would prefer to take some of the blow in terms of decreased pension benefits. Those with shorter life expectancies — men, the less-educated, the poor, minorities, and those in bad health — suffer the most from policies that protect pensions at the expense of current salaries. Some of the pain will also fall on taxpayers, and some of that pain may result in trimming state government services (e.g., police, fire, garbage collection, DMV, schools). The California rule thus makes reductions in government compensation either more painful for employees or more expensive to taxpayers than they would be if pension terms could adjust together with salaries and other benefits.

Anyhow, CalPERS is setting a precedent with its action towards San Bernardino. It’s a precedent that indicates, bankrupt or not, cities still owe CalPERS its money.

Photo by Pete Zarria via Flickr CC