Everyone appreciates a pat on the back for a job well done.

But auditors are raising concerns about whether the Wisconsin State Investment Board, the entity that handles investments for the state’s pension funds, went a little overboard by handing out $13.3 million worth of bonuses in 2013—the most ever handed out by the Board.

The Legislative Audit Bureau, the agency set up by Wisconsin to evaluate and audit other state agencies, is asking the Investment Board to review its compensation policy in light of the bonuses.

Bonuses included, the overall compensation the Board paid employees was 14 percent higher than the median among its peers, according to the Twin Cities Pioneer Press.

More from TC-PP:

Michael Williams, executive director of the Wisconsin Investment Board, says in a written response to the audit that “experience shows that paying for performance has been a success.”

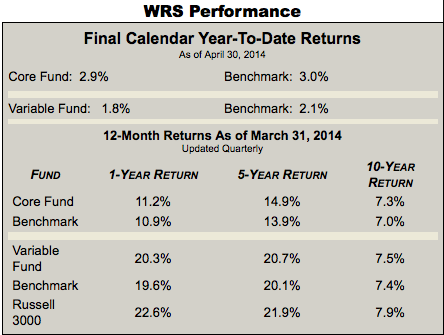

The bonuses are based on investment performance. The board ended 2013 beating one-, three- and five-year benchmarks.

The bolded is important: the bonuses are performance based, and the Board raked in strong returns in 2013.

But the Board’s own data may raise doubts that the performance was strong enough to justify the amount of the bonuses.

(The Board operates two pension funds—the Core Fund and the Variable Fund. The Core Fund invests entirely in equities, while the Variable fund follows a more traditional asset allocation.)

As of April 30, the both funds’ calendar YTD returns have come in below their respective benchmarks.

But the bonuses in question were handed out based on 2013 performance. In fact, both funds were beating their benchmarks for one-year, five-year and 10-year returns as of March 31.

Still, those returns still fall short of what the Russell 3000 returned over the same periods.

The Russell 3000 index is considered a benchmark for the entire U.S. stock market, as the index encompasses the 3000 largest U.S.-traded stocks.

So, the Investment Board beat their benchmarks but not the broader index. Does that performance merit a big bonus?

That’s the $13.3 million dollar question.

Photo by Miran Rijavec aka Stan Dalone via Flickr CC License