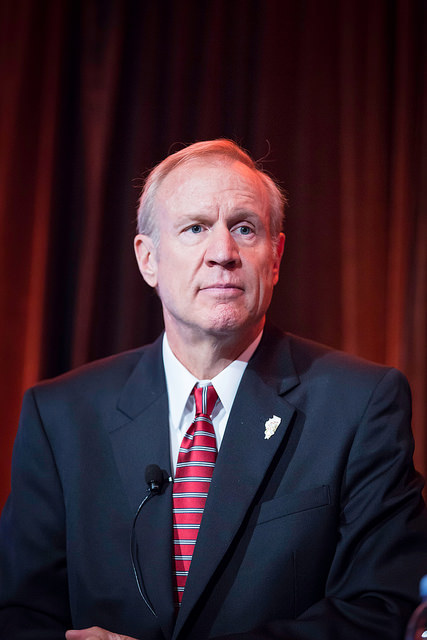

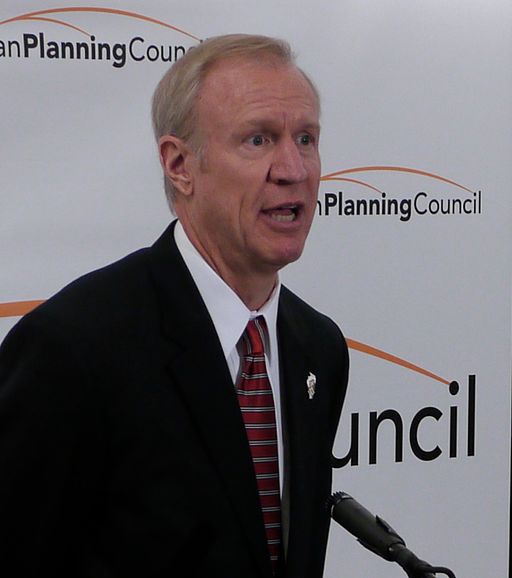

Illinois Gov. Bruce Rauner laid out his budget plan on Wednesday, and it included a number of pension cuts – decreasing annual COLAs, freezing benefits, and moving employees into a plan that yields fewer benefits.

(Under Rauner’s proposal, police and firefighters would be exempt from these changes.)

One lawmaker on Wednesday accused Rauner of using “fuzzy pension math” to calculate the savings the cuts would yield.

That followed the accusatory words of another top lawmaker, who claimed Rauner’s pension changes produced “phantom savings”.

Here’s Illinois Senate President John Cullerton:

The basic math still doesn’t work in his proposal. Governor Rauner leaves a $2.2 billion hole in the budget by relying on unrealistic revenues from a questionable pension proposal. Even as the courts review a significant test case, the governor’s plan banks phantom savings for a pension plan that may fail key legislative and judicial tests. When we passed pension reform last year, we took care to exclude possible savings from budget plans pending a legal resolution. The governor’s plan rejects that wisdom.

Indeed, when the state passed its pension overhaul in late 2013, it never included the savings in the budget. That’s because a legal challenge was sure to be brought against the law and Illinois didn’t want to assume savings only to get burned later.

Rauner’s proposals, if enacted, are likely to end up in court as well, depending on the outcome of the state’s current pension lawsuit.

Photo by Tricia Scully via Flickr CC License

![Video: Understanding the Illinois Pension Problem [Part 2]](http://pension360.org/wp-content/uploads/2014/08/640px-Gfp-illinois-springfield-capitol-and-sky.jpg)