In 2008, Warren Buffett made a $1 million wager with alternatives firm Protégé Partners. The money came from Buffet’s own pocket, not Berkshire’s. Around the country, the ears of pension funds began perking up in anticipation. The bet:

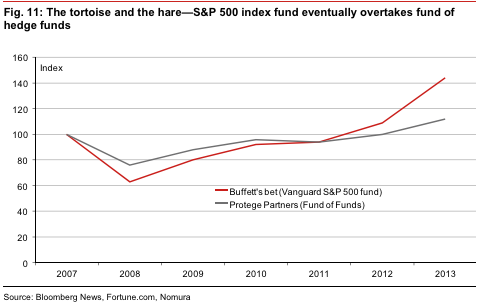

“Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.”

In other words, Buffett bet that, taking into account investment expenses, an index fund would outperform a fund of hedge funds over a ten-year period. The thinking is in line with what Buffet has publicly said in the past. And, six years later, Buffett is winning his bet.

(The winner of the bet, by the way, will donate the money to a charity of his choice).

This bet is of particular interest to pension funds because alternative asset classes have increasingly become part of their investment portfolios. Regardless of who wins the bet, however, the results will be largely symbolic.

But the over-arching philosophies behind the wager are still interesting to examine. For Buffett, his dislike of hedge funds comes down to fees.

Costs skyrocket when large annual fees, large performance fees, and active trading costs are all added to the active investor’s equation. Funds of hedge funds accentuate this cost problem because their fees are superimposed on the large fees charged by the hedge funds in which the funds of funds are invested.

A number of smart people are involved in running hedge funds. But to a great extent their efforts are self-neutralizing, and their IQ will not overcome the costs they impose on investors. Investors, on average and over time, will do better with a low-cost index fund than with a group of funds of funds.

On the other end, Protégé Partners defends hedge funds:

Mr. Buffett is correct in his assertion that, on average, active management in a narrowly defined universe like the S&P 500 is destined to underperform market indexes. That is a well-established fact in the context of traditional long-only investment management. But applying the same argument to hedge funds is a bit of an apples-to-oranges comparison.

Having the flexibility to invest both long and short, hedge funds do not set out to beat the market. Rather, they seek to generate positive returns over time regardless of the market environment. They think very differently than do traditional “relative-return” investors, whose primary goal is to beat the market, even when that only means losing less than the market when it falls. For hedge funds, success can mean outperforming the market in lean times, while underperforming in the best of times. Through a cycle, nevertheless, top hedge fund managers have surpassed market returns net of all fees, while assuming less risk as well. We believe such results will continue.

Pension360 has covered the emerging trend of pension funds, including CalPERS, reducing their investments in hedge funds.

Photo by Fortune Live Media via Flickr CC