The results of a recent survey, conducted and released by Pyramis, indicate that institutional investors are more confident than ever about their investment returns.

But funds in Asia and Europe are much more optimistic about market volatility than their counterparts in Canada and the U.S.

The survey of 811 pension fund managers found that Canadian pension funds were the most pessimistic of the bunch about future markets.

From Chief Investment Officer:

Despite the return of volatility, confidence in meeting investment goals has resurged as more than nine in 10 institutional investors said they would hit their targeted returns.

Some 91% of 811 investors told a survey, run by fund manager Pyramis, they believed their goals would be hit over the next five years, a large increase on the 65% who said the same in the company’s 2012 survey.

“While the travails of 2008 are far back enough for investors to feel significantly more confident that they will hit their five-year investment targets for their assets, they still remain concerned that there will be a return to volatility, as has been the case in recent weeks,” said Nick Birchall, head of UK institutional business at Fidelity Worldwide Investment, which distributes Pyramis’ products outside North America.

[…]

Volatility cast the longest shadow on institutional investors, according to the survey. Some 22% cited it as their top concern, while investors in the UK were the most nervous, with 31% saying it was their biggest worry.

However, their peers in the US were also concerned by erratic market moves.

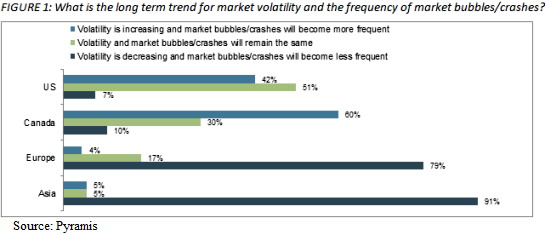

Just 7% of US investors agreed with the following statement: “Volatility is decreasing and market bubbles/crashes will become less frequent.”

Some 10% of their Canadian neighbours agreed, while European and Asian investors took the opposite view, with 79% and 91% respectively thinking the statement was dead on the money.

It’s important to note that the survey was conducted back in June, before recent bouts of market volatility.

Canadian pension funds showed some impressive clairvoyance, as they were by far the most pessimistic of the group back in June: 6 out of 10 Canadian respondents said they anticipated increased market volatility in the near future.

From the Business News Network:

The survey, conducted in June and July, found 60 percent of Canadian pension fund managers believe that over the long term, “volatility is increasing and market bubbles/crashes will become more frequent,” while 42 percent in the U.S. agreed with the statement. However, only 4 percent of pension managers in Europe and 5 percent in Asia agreed volatility is increasing.

The survey included 90 Canadian pension funds representing about 25 percent of all pension plan assets in Canada, Pyramis said.

Mr. Young said he believes the findings reflect the broader global focus of Canadian pension funds, saying funds in other regions are often more inward-looking and focus more on their regional markets. They may have responded based on a consideration of their own local economies, while Canadian pension funds may have been assessing the volatility more broadly in all major markets, he said.

“I do believe that Canada has a very unique and global perspective compared to most countries,” [Pyramis vice-chairman] Mr. Young said.