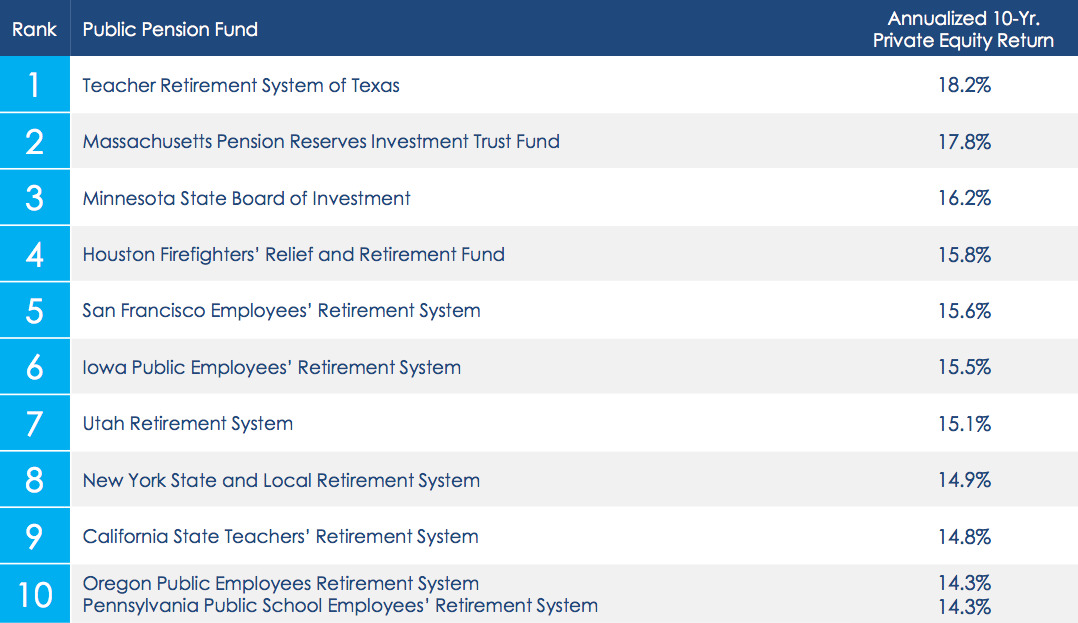

A new report from Bison and the Private Equity Growth Capital Council (PEGCC) ranked the ten pension funds seeing the best private equity returns over the last decade.

[List can be seen above.]

More from HedgeCo.net:

The Texas pension’s 10-year annualized private equity return was 18.2 percent, followed by the Massachusetts Pension Reserves Investment Trust (17.8 percent), and the Minnesota State Board of Investment (16.2 percent).

Other rankings and key findings include:

– Private equity delivered a 12.3 percent annualized return to the median public pension over the last 10 years, more than any other asset class. By comparison, the median public pension received a 7.9 percent annualized return on its total fund during the same period.

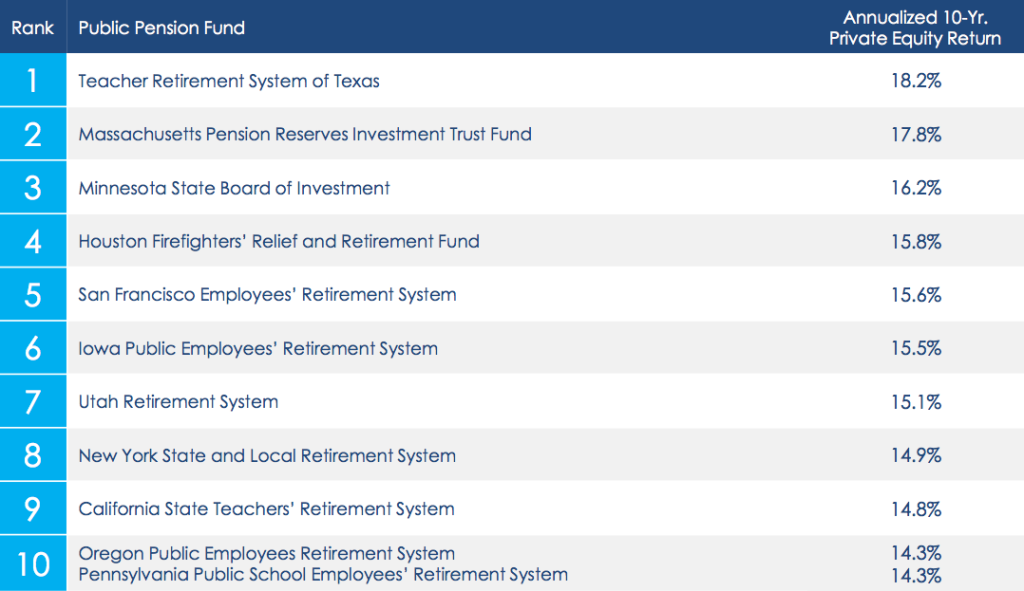

– CalPERS currently invests the most capital ($32.3 billion) in private equity compared to all other pension funds in the country. CalSTRS and the Washington State Investment Board invests the second and third greatest amounts ($21.9 billion and $16.2 billion, respectively) to private equity funds.

– Based on the 150 pensions studied, private equity investment makes up 9.4 percent of total public pension fund investment.

Read the full report here.

Here’s another chart of the ten pension funds holding the most private equity assets.