Russia is planning to take billions from its pension fund and use the money to aid banks and other companies that have been targeted by Western sanctions.

From BusinessWeek:

During flush years of high oil prices and economic growth, Russia salted away more than $80 billion in a sovereign wealth fund to ensure the long-term health of the country’s pension system. Now the Kremlin is raiding the fund to bail out Russia Inc.

Russian companies and banks are lining up for aid as Western sanctions, capital flight, and the plummeting ruble curb their ability to invest and repay debt. Finance Minister Anton Siluanov told the Itar-TASS news agency last month that state-controlled oil giant Rosneft (ROSN:RM) and private gas company Novatek (NVTK:RM), both headed by close associates of President Vladimir Putin and hit by sanctions, could get as much as $4 billion apiece from the fund, whose current balance is $83 billion.

Although the exact amount of aid to the two companies hasn’t been confirmed, Vice Premier Arkady Dvorkovich said today that the government is ready to use the fund to support both public and privately owned energy companies. “The funds will be provided for a long term,” he told Itar-TASS.

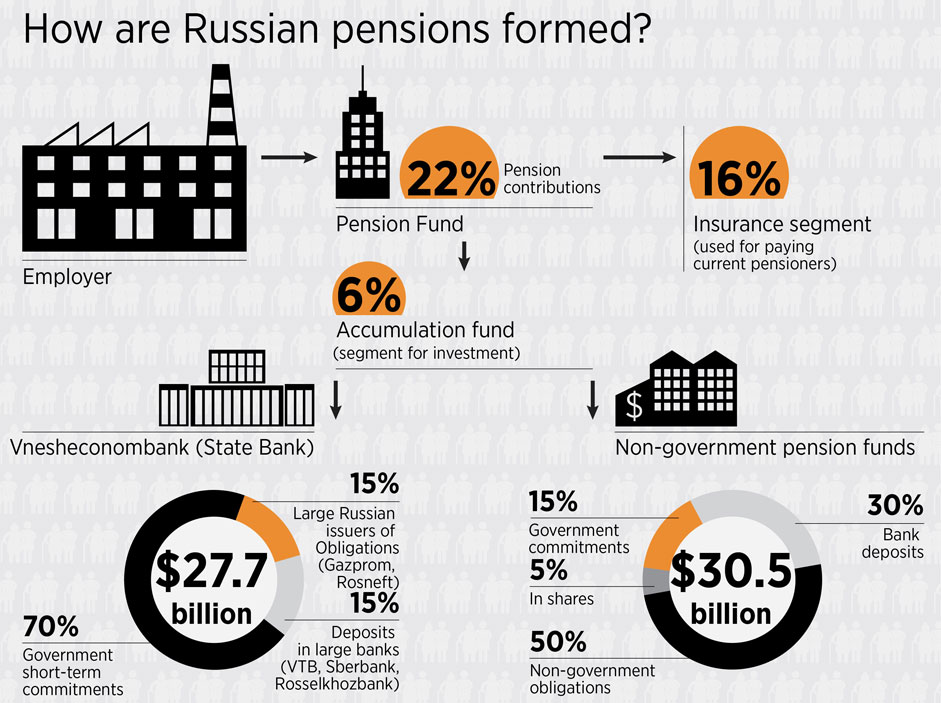

Russia has diverted $30 billion from its pension fund since 2013 to plug holes in its general budget.

Russia’s Economy Minister indicated last month that taking money from the country’s pension fund to shield ailing companies from U.S. sanctions was a distinct possibility.