David Sirota is shining more light on the Rhode Island pension system’s investment returns—and fees—under Treasurer Gina Raimondo. According to his reporting, the combination of fees and “below-median” returns are costing the state’s taxpayers. From Sirota:

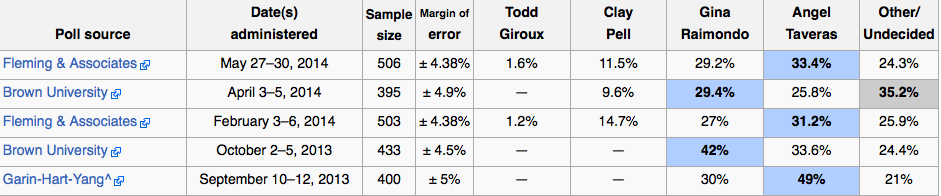

According to four years’ worth of state financial records, Rhode Island’s pension system has delivered an average 12 percent return during Raimondo’s tenure as general treasurer. That rate of return significantly trails the median rate of return for pension systems of similarly size across the country, based on data provided to the International Business Times by the Wilshire Trust Universe Comparison Service.

Meanwhile, the pension investment strategy that Raimondo began putting in place in 2011 has delivered big fees to Wall Street firms. The one-two punch of below-median returns and higher fees has cost Rhode Island taxpayers hundreds of millions of dollars, according to pension analysts.

Under Raimondo’s watch, the state’s pension fund has adopted an investment strategy that heavily utilizes private equity, hedge fund and venture capital investments. The New York Times reported that those alternative investments constitute almost a quarter of the fund’s assets. Sirota writes:

The high fees associated with those alternative investments — costing Rhode Island $70 million in the 2013 fiscal year alone, the Providence Journal reported — are supposed to buy above-average investment performance. However, according to pension consultant Chris Tobe, the gap between Rhode Island and the median, a gap to which the fees contributed, means the state effectively lost $372 million in unrealized returns.

By way of comparison, $372 million represents more than one-half of the entire annual budget of the state’s largest city, Providence. In all, had Rhode Island’s pension system merely performed at the median for pension systems of similar size, the state would have 5 percent more assets in its $7.5 billion retirement system.

Raimondo’s office defends the investment decisions. A spokesperson told Sirota that the strategy needs to be judged over a longer timeline to more accurately assess its effectiveness.