Illinois’ payments to its pension systems will jump by almost $700 million in 2015 after three of its state-level systems lowered their assumed rates of return.

From the Journal-Standard:

The total state contribution to the five state-funded pension systems next year is $7.537 billion. That’s an increase of more than $680 million over the amount the state had to contribute to the systems in the current fiscal year.

The numbers are compiled by the pension systems, but were reviewed and contained in a report by the state actuary issued Wednesday by Auditor General William Holland’s office.

The increase for next year’s budget is sharply higher than the increase in the current state budget. This year, lawmakers only needed to find an additional $100 million to meet the pension obligations. It was the smallest increase in years after a series of $1 billion hikes.

No reason was identified for the increase, although the report did note that three of the five systems lowered the estimated rate of return they expect to receive on their investments. Pension systems get their money through employee contributions, state contributions and investment income. When the systems expect to make less on their investments, the difference is usually made up with higher state contributions.

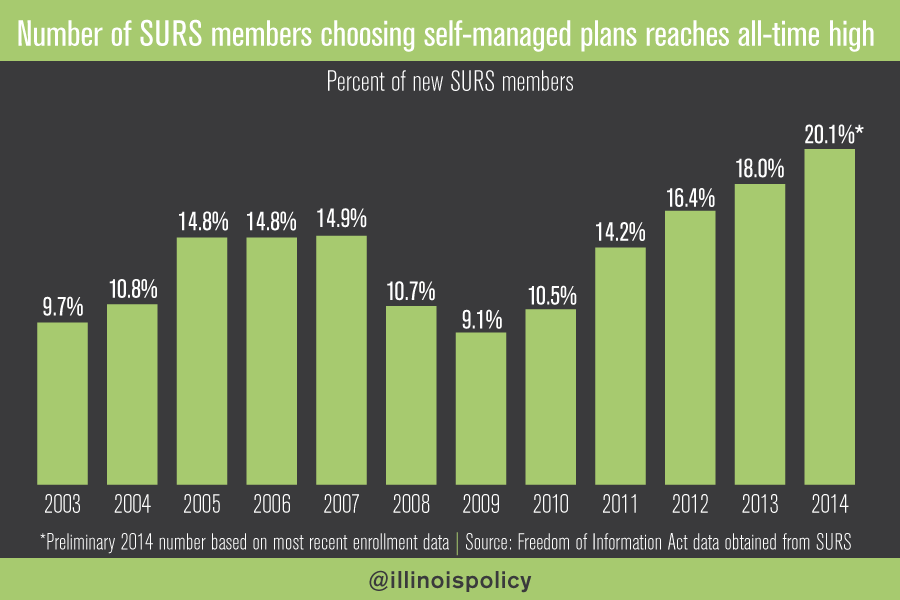

Cheiron, the state’s actuary, said last year it thought the three biggest pension systems were being overly optimistic about how much investment income they could earn. Since then, the Teachers Retirement System, State Universities Retirement System and State Employees Retirement system, all cut their expected rate of return on investments.

The Judges Retirement System and General Assembly Retirement System had previously cut their estimates.

Illinois shoulders approximately $111 billion in pension debt.