Pennsylvania Gov. Tom Corbett has spent the first week of August touring the state as part of his re-election campaign, and he’s using the opportunity to hammer home Pennsylvania’s need to lower the costs of its retirement system, and tout his policy ideas on the subject.

One idea that Corbett has frequently proposed is shifting some state workers from their defined-benefit plans into 401(k)-style plans. Nearly every state burdened with pension obligations has considered this policy option. Many have even implemented it. From PennLive:

Only Alaska and Michigan have shifted new hires into 401(k)-style programs, but nearly a dozen states have crafted hybrid programs featuring smaller lifetime pension plans along with a 401(k)-style plan, and some states, such as Florida, are giving new employees the option of going entirely into a 401(k)-style plan, our pal Deb Erdley at The Tribune-Review reports.

Corbett’s repeated harping on the pension issue has gotten him, to some extent, what he wanted back in June: a debate. Even if state lawmakers remain on vacation, many experts have been weighing in on the issue.

Richard Johnson, director of the Washington-based Urban Institute’s Program on Retirement Policy, makes this note on the switch from DB to DC:

“These defined-benefit plans work very well if you’re going to stay for 30-35 years, but they require a pretty large employee contribution, and they don’t work very well for the shorter-term worker,” Johnson tells the newspaper.

Stephen Herzenberg of the Keystone Research Center points to the experiences of other states as an argument against switching to a 401(k)-style plan:

In fact, when Florida created this choice, its traditional pension was overfunded. In a decade-plus since, the investment returns of Florida’s traditional pension have been 10 percent higher than the return on individual accounts. Over the 30 years that typical retirement contributions grow, this difference would become a one-third gap in savings available for retirement.

Alaska and Michigan did shift all new hires into 401(k)-style plans but the switch did not, in fact, work. Pension debt in both states grew.

Rhode Island did save some money but only because of deep cuts in traditional pensions, including for current retirees. The state then wasted some savings on a “hybrid plan” for new employees that included 401(k)-type accounts with low returns and high fees.

Guaranteed pensions need sound management and can get in trouble if politicians fail to make required contributions. But long term, there’s no beating the high returns of professional managers and the low costs of pooled pension assets. That’s why Pennsylvania’s current pension design is the best deal, long term, for taxpayers and retirees.

Nathan A. Benefield, Vice President of Policy Analysis at the Commonwealth Foundation, took issue with that critique:

Herzenberg claims that reforms moving state workers to a 401(k)-style retirement plan in other states have “failed” because their traditional, non-401(k) pension funds lost value during the most recent recession. Huh?

Every state¹s pension fund lost value when the stock market fell, including Pennsylvania’s, which went from being fully funded to today having more than $50 billion (and growing) in unfunded liabilities. That’s about $10,000 per household in the state.

Now here’s the rub. States like Michigan and Alaska would have lost more from their pension funds had they not started to convert new employees into a 401(k). In fact, without reform, Michigan’s unfunded liability would be upwards of $4.3 billion more.

Thankfully, because lawmakers in the Wolverine state acted early, they saved taxpayers those additional costs. Pennsylvania would have also had substantial savings had we followed Michigan’s lead.

Corbett has tried desperately to make pension reform a campaign issue. It has worked. He’s gotten the media, thought leaders and everyday citizens talking about Pennsylvania’s retirement system and the policy options to address the issues Corbett foresees.

That’s healthy for the state—but make no mistake, it’s probably just as healthy for Corbett’s election chances.

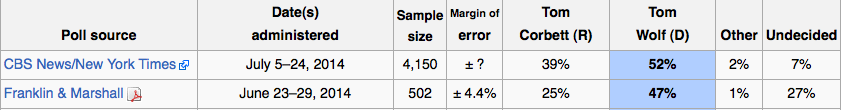

He’s been gaining ground on challenger Tom Wolf in recent weeks.