When it comes pension liabilities, investors are skeptical of the numbers they’re being presented with. That’s according to a study released today by Llewellyn Consulting that examined how investors react to the stated liabilities of corporate defined-benefit plans.

The study comes from the UK, but it has great relevance to the United States, where watchdog groups believe pension liabilities are chronically under-reported.

From Financial Times:

The study, to be published on Monday, found company valuations were being significantly impacted by investors taking a more sceptical view on the risk of defined benefit pension schemes, which remain a large and volatile component of corporate balance sheets.

“The implication is that reported pension liabilities are regarded by markets as being systematically undervalued; that markets give larger weight to pension liabilities than to pension assets; and/or that a higher level of liabilities is viewed as representing a higher risk,” said the report.

[…]

The report, conducted by Llewellyn Consulting, a London economics advisory, in conjunction with academics at Queen Mary University, is the first-in depth analysis to quantify the weight that investors put on DB pension scheme risk.

Researchers matched company financial and DB-pension-related data taken from FTSE 100 company statements from 2006-2012 with corresponding stock market performance and company valuation data.

The report found that FTSE 100 companies with the largest DB pension schemes were penalised “most heavily” by the market, even when the scheme was reported as fully funded, and regardless of the stated recovery plan.

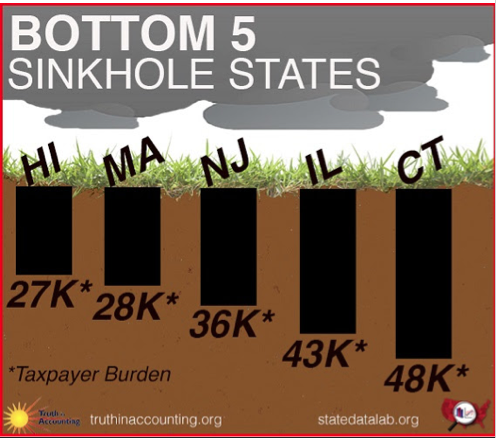

The financial watchdog group Truth In Accounting believes that the United States is under-reporting its unfunded pension liabilities by $980 billion.

Photo by www.SeniorLiving.Org