Barely a majority of 401(k) participants are confident about their retirement readiness, and many were unsure of their investment options and how much they should be saving, according to a new survey from BlackRock.

Further, education and engagement can serve as wellsprings of confidence for unsure participants.

PlanAdviser has the cliffnotes:

BlackRock’s DC Pulse Survey of 1,003 DC plan participants found 28% reported feeling “unsure” about whether they are on track for retirement. The survey revealed people “unsure” about their retirement prospects are much more likely than those “on track” to admit that “I don’t know as much as I should about investing for my retirement” (66% vs. 38%, respectively) and “I don’t know how much money I need to save in order to fund the retirement I want” (68% vs. 32%, respectively).

“Unsure” participants also are less likely to be taking proactive steps to improve their knowledge.

[…]

According to BlackRock’s analysis, the link between a basic understanding of key retirement planning principles and retirement confidence holds true for people at all income levels—suggesting that such confidence is not simply a function of greater financial resources.

“Unfortunately, many individuals who consider themselves ‘off track’ face financial realities requiring support beyond their DC plan,” says Anne Ackerley, head of BlackRock’s U.S. & Canada Defined Contribution Group. “But the good news is that people who are unsure about their retirement standing may be able to build their confidence with relative ease by working in the near term to close critical knowledge and saving gaps.”

BlackRock’s findings on engagement:

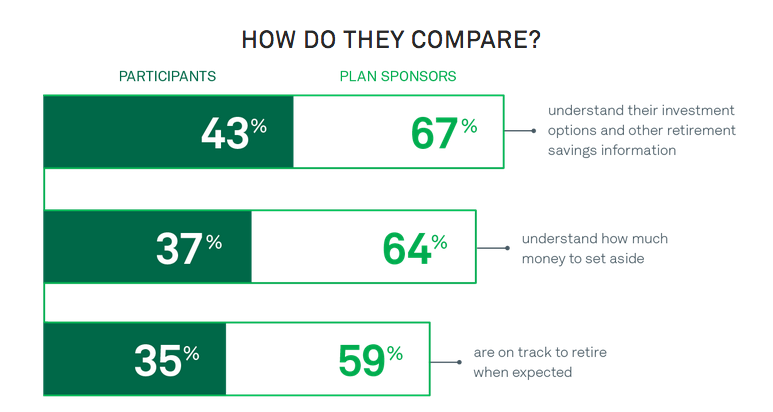

The survey also found that across the board, “unsure” individuals are less likely than “on track” participants to engage with their DC plan. Those “unsure” were less likely than those “on track” to say they take full advantage of retirement savings guidance provided by their employer (43% vs. 67%, respectively) and also less likely to have increased their contribution in the past 12 months (35% vs. 47%). They also reported less engagement in evaluating their investment options (25% vs. 38%) and were less likely to report that they evaluate their investment options at least quarterly (29% vs. 50%).

“Our survey shows that plan engagement is a key vehicle for boosting retirement confidence—and that’s a critical message for plan participants and sponsors alike,” says Ackerley. “Individuals need to take greater advantage of the tools already available to them through their plan. And plan sponsors can feel confident that adding more and better tools for their DC participants is a worthy effort—because a robust, participant-focused DC plan really does have the power to make a difference.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712