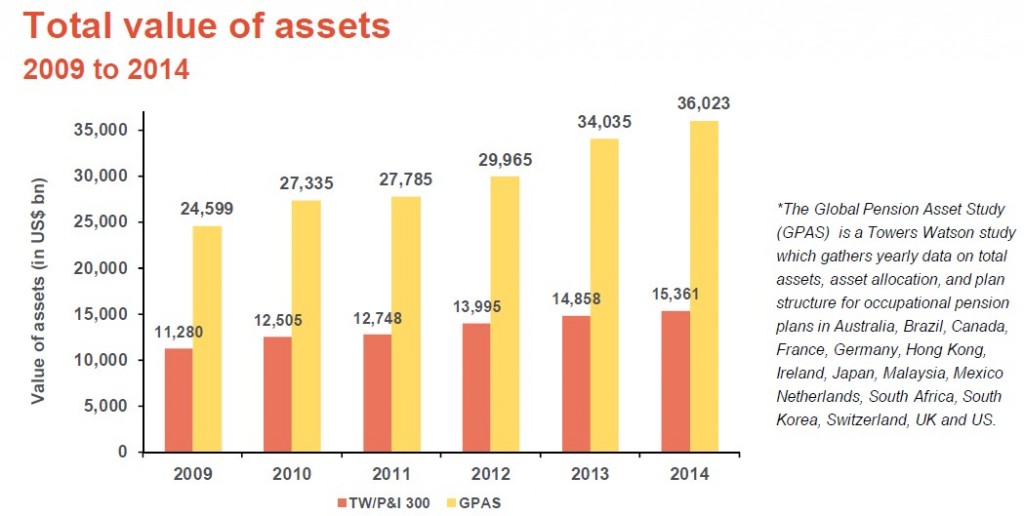

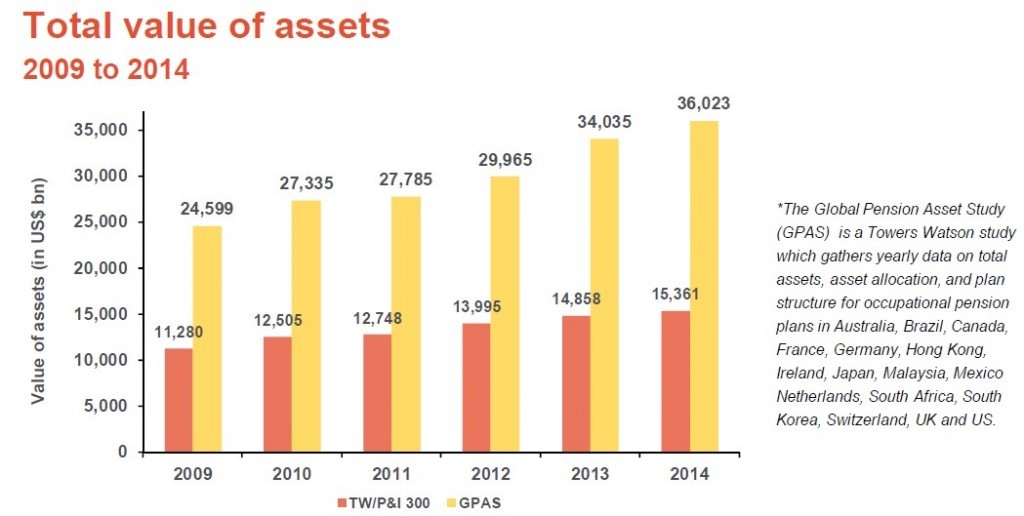

The assets under managements of the top 300 pension funds in the world grew 3.4 percent in 2014, according to a September report from Towers Watson.

The graphic above shows the annual total assets under management of the top 300 funds (orange) vs. global pension assets (yellow).

ValueWalk summarizes:

The top 300 pension funds worldwide did see AUM growth last year, but the 3.4% rate of growth was barely half the rate seen the prior year.

Also of note, the cumulative growth rate for the five year period from 2009 to 2014 was a robust 36.2%. This period, of course, does include several years when the stock market moved up significantly as it was recovering from the damage done in the 2007-2008 financial crisis.

TW’s GPAS study suggests that the 300 largest pension funds accounted for 42.7% of the total global pension assets in 2014. That figure is down slightly from 43.2% a year earlier (2013).

Read the report here.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712