The Kentucky Teachers’ Retirement System is seeking help from the state legislature in easing its pension obligations. The plan involves the state issuing bonds.

Details on the proposal are sparse, but KTRS officials will present their plan to lawmakers on Wednesday.

From the Courier Journal:

The Kentucky Teachers’ Retirement System is proposing that the state issue a new bond to help shore up underfunded teacher pensions.

Officials from KTRS will present the proposal to lawmakers on the Interim Joint Committee on State Government on Wednesday afternoon. An official said last week that the plan will center on using existing revenue streams that will soon become available once the state retires debt service on older bonds.

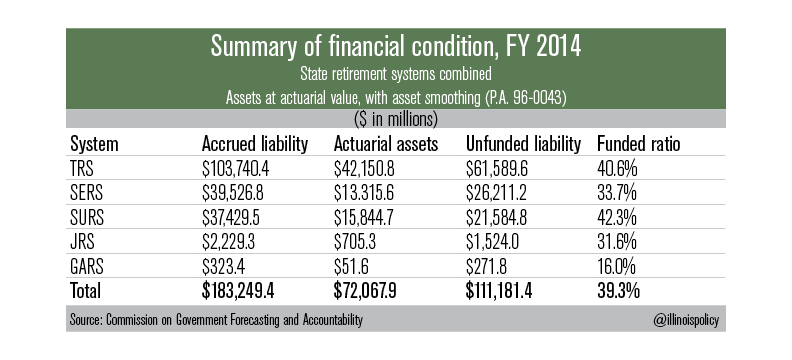

According to the 2013 valuation, KTRS faces more than $13.8 billion in unfunded liabilities and has only 52 percent of the money it needs to pay out pension benefits in coming decades.

The system has asked the state to provide around $400 million in additional funding each year to keep the system solvent.

The plan could well be for the state to issue “pension obligation bonds”. Governing magazine explains the concept of POB’s:

Pension Obligation Bonds (commonly referred to as POBs), allow governments to issue taxable bonds for the purposes of putting money toward or fully paying off the unfunded portion of a pension liability. The proceeds from the bond issue go in the pension fund. The theory is that the rate of return on the investment will be greater than the interest rate the government pays to bond investors so that the transaction is favorable to the government; it makes money off the deal.

KTRS manages $17.5 billion in assets. The system is about 51 percent funded.