Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Ed Bartholomew, a consultant on pension financial management, and Jeremy Gold, a Fellow of the Society of Actuaries, wrote a comment for MarketWatch, The $6 trillion public pension hole that we’re all going to have to pay for:

U.S. state and local employee pension plans are in trouble — and much of it is because of flaws in the actuarial science used to manage their finances. Making it worse, standard actuarial practice masks the true extent of the problem by ignoring the best financial science — which shows the plans are even more underfunded than taxpayers and plan beneficiaries have been told.

The bad news is we are facing a gap of $6 trillion in benefits already earned and not yet paid for, several times more than the official tally.

Pension actuaries estimate the cost, accumulating liabilities and required funding for pension plans based on longevity and numerous other factors that will affect benefit payments owed decades into the future. But today’s actuarial model for calculating what a pension plan owes its current and future pensioners is ignoring the long-term market risk of investments (such as stocks, junk bonds, hedge funds and private equity). Rather, it counts “expected” (hoped for) returns on risky assets before they are earned and before their risk has been borne. Since market risk has a price — one that investors must pay to avoid and are paid to accept — failure to include it means official public pension liabilities and costs are understated.

The current approach calculates liabilities by discounting pension funds cash flows using expected returns on risky plan assets. But Finance 101 says that liability discounting should be based on the riskiness of the liabilities, not on the riskiness of the assets.

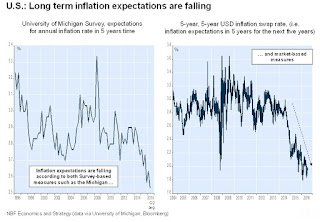

With pension promises intended to be paid in full, the science calls for discounting at default-free rates, such as those offered by Treasurys. Here’s the problem: 10-year and 30-year Treasurys now yield 1.5% and 2.25%, respectively. Pension funds on average assume a 7.5% return on their investments — and that’s not just for stocks. To do that, they have to take on a lot more risk — and risk falling short.

Much debate focuses on whether 7.5% is too optimistic and should be replaced by a lower estimate of returns on risky assets, such as 6%. This amounts to arguing about how accurate is the measuring stick. But financial economists widely agree that the riskiness of most public pension plans liabilities requires a different measuring stick, and that is default-free rates.

Ignoring this risk leaves about half of the liabilities and costs unrecognized. At June 30, 2015, aggregate liabilities were officially recognized at more than $5 trillion, funded by assets valued at almost $4 trillion and leaving $1 trillion — or more than 20% — unfunded. These are debts that must be paid by future taxpayers, or pensioners lose out. Taking into account benefits paid, passage of time and newly earned benefits, we estimate June 30, 2016 liabilities at $5.5 trillion and assets roughly unchanged at that same $4 trillion, indicating a $1.5 trillion updated shortfall.

Now let’s factor in both the cost of risk and low U.S. Treasury rates. We estimate the 2016 risk-adjusted liabilities nearly double to about $10 trillion, leaving unfunded liabilities of about $6 trillion, rather than $1.5 trillion.

Because today’s actuarial models assume expected returns and ignore the cost of risk, risk isn’t avoided; indeed it is sought! By investing in riskier assets, pension plans’ models then enable them to claim they are better funded and keep required contributions from rising further.

Risky assets (like stocks) are of course expected to return more than default-free bonds. If that weren’t true, no investor would hold risky assets. But expected to return more doesn’t mean will return more.

Risky assets might well earn less than default-free bonds, perhaps much less, even over the long term — that’s what makes them risky. And if that weren’t true, no investor would hold default-free bonds.

Compounding the problem, today’s aggregate annual contributions of $160 billion don’t even pay for newly earned benefits, adding more debt to be paid by future generations. State and local governments already face making bigger required contributions — even under the measurement approach that ignores risk — requiring higher taxes and crowding out other government spending. That is already happening in Chicago. In Detroit, Stockton, Calif., and Puerto Rico, bondholders haven’t been paid.

Some actuaries argue it’s time to change this approach. This was spelled out in a recent paper written by several members of a pension finance task force jointly created by two industry groups 14 years ago. We are two of those authors.

The leadership of the American Academy of Actuaries, which speaks for its 18,500 members on public policy matters, rejected the paper. It also persuaded the Society of Actuaries, the other industry group, not to publish it. On Aug. 1, the presidents of the two organizations issued a joint letter disbanding the task force and declaring that the authors couldn’t publish the paper anywhere.

This is more than just an internal dispute. Today’s public plan actuaries serve their clients, who want lower liabilities and costs, even at the expense of future taxpayers and other stakeholders.

Plans are in trouble. Every year they are in deeper trouble. Many taxpayers are aware that state and local government pension plans are underfunded. They generally aren’t aware just how dire the situation is.

Good numbers don’t assure success, but bad numbers lead to bad decisions and may invite disaster.

Ed Bartholomew is a former banker and now is a consultant on pension financial management. You can follow him on Twitter @e_bartholomew. Jeremy Gold is a Fellow of the Society of Actuaries (and recent vice president and board member) and a member of the American Academy of Actuaries (and former vice chairman of the Pension Practice Council. Follow him on Twitter @jeremygold.

Actuaries are typically known as very nice, extremely smart and sensible people but reading this article you get the sense the Society of Actuaries wants to cover up a $6 trillion pension hole.

Are these authors way off? Are they engaging in classic fear mongering to make the US pension deficit problem seem much bigger than it actually is?

Yes and no. Last Friday, I discussed why the pension Titanic is sinking, stating the following:

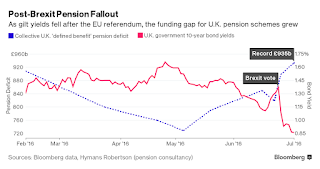

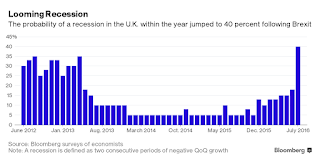

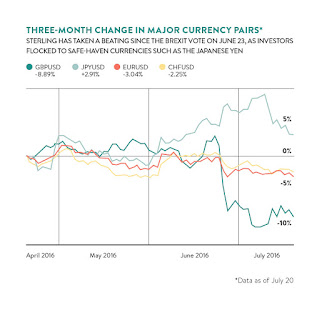

[…] while low returns are taking a toll on all pensions, especially US public pensions, the most pernicious factor driving pension deficits is record low or negative bond yields.

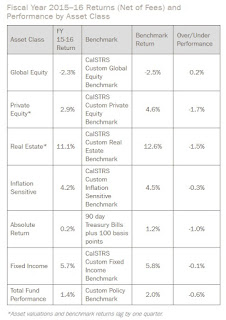

Importantly, at a time when pretty much all asset classes are fairly valued or over-valued, if another financial crisis hits and deflation sets in for a prolonged period, it will decimate all pensions.

To understand why, you need to understand what pensions are all about, namely, matching assets with liabilities. The liabilities most pensions have in their books go out 75+ years, while the investment life of most of the assets they invest in is much shorter (this is why pensions are increasingly focusing on infrastructure).

This means that a drop in rates will disproportionately impact pension deficits, especially when rates are at record lows because the duration of pension liabilities is much bigger than the duration of pension assets.

So even if stocks and corporate bonds are soaring, who cares, as long as rates keep declining, pension deficits will keep soaring. And if another financial crisis hits, watch out, both assets and liabilities will get hit, the perfect storm which will sink the pension Titanic.

Interestingly, very few people know this but pension deficits soared two years after the tech bubble crashed and in 2009 after the financial crisis hit even though stocks and corporate bonds (risk assets) came roaring back precisely because the Fed cut interest rates and kept them low to reflate risk assets.

The problem right now is interest rates are close to zero in the US and in many countries they are negative, so if another financial crisis hits, it will decimate all pensions, especially chronically underfunded public pensions like the ones in Chicago and the state of Illinois.

Pension deficits are path dependent, which in effect means the starting point matters a lot as do investment and other decisions along the way. If a pension plan is already underfunded below the 80% threshold (ie. assets cover 80% of liabilities) many consider to be manageable, then taking more investment risk at a time when assets are fairly valued or over-valued can lead to a real disaster, a point of no return where the only thing left is to ask taxpayers to bail them out or introduce cuts to benefits and increases to contributions.

The authors rightly note:

“Here’s the problem: 10-year and 30-year Treasurys now yield 1.5% and 2.25%, respectively. Pension funds on average assume a 7.5% return on their investments — and that’s not just for stocks. To do that, they have to take on a lot more risk — and risk falling short.”

Now, some economist will tell you, bond yields are “artificially low,” a product of what is going on outside the United States. I keep hearing such silly arguments and all I can tell you is there is no big illusion going on in the bond market, it’s definitely delivering an ominous warning to all investors to prepare for a long period of low and volatile returns.

Now, I don’t want to claim that Ed Bartholomew and Jeremy Gold are 100% right and all other actuaries are ignorant fools. We can certainly debate their figures as well as their use of current market rates to discount future liabilities. Some actuaries prefer a “smoothing of rates” to smooth out market fluctuations and avoid excessive volatility in the funding status.

But what if rates continue to go lower or even go negative in the United States? Two years ago, I warned of the possibility of deflation coming to America and even though it seemed highly unlikely back then, it certainly isn’t as far-fetched as you may think now. This is why I keep warning you of the deflation tsunami headed our way, it will wreak havoc across financial markets and cripple pension plans for years.

Ah, don’t worry, the Fed will raise rates, the global recovery is well underway, interests rates will normalize and all these pension deficits we are worried about today will magically disappear.

If you believe that, go out and buy yourself a Powerball ticket and try your luck there. I prefer to live in reality and from where I stand, things don’t look good for pensions, banks, insurance companies, retail investors and even elite hedge funds trying to outsmart markets.

And I’m concerned as to why the American Academy of Actuaries would cover up the findings of these authors and disband the task force, declaring that the authors couldn’t publish the paper anywhere. This isn’t the way scientists work. Let the authors publish their findings and if other actuaries take issue with their findings, let them publish counter arguments.

I’m not taking sides here. I think Bartholomew and Gold raise many excellent points but they are also grossly inflating the problem, providing detractors of public pensions with ammunition to attack them. Don’t get me wrong, there’s no doubt in my mind the pension Titanic is sinking but as is often the case, the solutions to this problem are worse than the disease.

On this note, let me unequivocally state my support for large, well-governed defined benefit plans like the ones we have here in Canada. Go read the Funding Q&A of the Ontario Teachers’ Pension Plan to gain an understanding of why I feel so strongly that the solution to pension deficits isn’t to switch people into defined-contribution plans, that will only exacerbate the long-term problem.

The brutal truth on defined-contribution plans is they leave too many workers and retirees exposed to the vagaries of markets. There is a misconception that switching people into DC plans saves taxpayers but it doesn’t because as more people succumb to pension poverty, it increases social welfare costs and the national debt.

The sooner policymakers understand the benefits of large, well governed defined-benefit plans, the better off the United States and other countries struggling with an aging demographics with little or no savings will be.

Update: Bernard Dussault, Canada’s former Chief Actuary, shared this with me after reading the article above:

Consistent with the attached actuarial financing policy that I am promoting for Defined Benefit (DB) plans, I almost completely disagree with the observations made in the MarketWatch article you cited in your comment.

Indeed, the valuation assumption in respect of the investment return (yield) on the pension fund should be as realistic as possible, i.e. based on actual past experience regarding the average return actually expected in the long term. Obviously, the riskier the assets, while the more volatile will be the yield, the higher it will be.

I am not in a position to assess whether the 7.5% assumed yield to which reference is made in the concerned article is realistic, but if it is, then it should be assumed. Besides, for indexed pensions, the main assumption to look after if the real rate (i.e. assumed nominal rate minus assumed inflation/indexation rate) of return as opposed to the nominal return.

While preparing the 16th actuarial report on the Canada Pension Plan in 1996 (http://www.osfi-bsif.gc.ca/Eng/Docs/cpp16.pdf), I concluded (please refer to section B on of pages 10 and 11 of that report) on the basis of statistics looking at several investment types from 1923 to 1995 that a diversified investment portfolio should not realistically be expected to produce a real of return of more than 4%.

One has to keep in mind that once the assumed realistic of return is determined for both liabilities and contribution rates purposes, the valuation actuary shall look at the other important, simple and not too numerous aspects of my attached proposed financing policy, in particular:

- the prohibition of contribution holidays;

- the amortization over 15 years of all emerging surpluses and deficits.

Bernard’s comments prompted this response from Ed Bartholomew on Twitter (click on image):

And that prompted this response from Bernard Dussault who doesn’t have a Twitter account:

Regarding your questions “who bears risk even for 4%? And are they getting paid to take that risk?” in respect of my proposed financing policy for DB plans. As you know, in most cases the plan sponsor is responsible for amortizing deficits under a DB pension plan. It could well fall partially or totally on the shoulders of plan members. In any event, this deficit-related risk is exhaustive and encompassing, i.e. I do not see the need to include a premium or investment risk within the valuation of liabilities. If both the normal contribution rate and liabilities are calculated on a realistic and long term basis (i.e. avoiding changing the long term term assumptions from one valuation date to another), deficits would normally in the medium and long term be essentially offset by surpluses, provided there are no changes in plan design, no contribution holidays and no avoidance of both surplus and deficit amortization. In that sense, either your second question is not relevant or I do not understand it. Any DB plan is normally sponsored freely by an employers, which involves a business risk for which he/she will be paid for to the extent of how good is that risk.

I thank Bernard for his valuable insights on this and other pension issues I’ve covered on my blog and thank Ed Batholomew and Jeremy Gold for sharing their views on this important issue.