Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Timothy W. Martin of the Wall Street Journal reports, Calpers Reports Lowest Investment Gain Since Financial Crisis:

The largest U.S. public pension posted its lowest annual gain since the last financial crisis due to heavy losses in stocks.

The California Public Employees’ Retirement System, or Calpers, said it earned 0.6% on its investments for the fiscal year ended June 30, according to a Monday news release.

It was the second straight year Calpers failed to hit its internal investment target of 7.5%. Workers or local governments often must contribute more when pension funds fail to generate expected returns. Calpers oversees retirement benefits for 1.7 million public-sector workers.

Calpers’ annual results are watched closely in the investment world. It is considered a bellwether for U.S. public pensions because of its size and investment approach. Many pensions currently are struggling because of a sustained period of low interest rates.

“This is a challenging time to invest,” Ted Eliopoulos, Calpers’ chief investment officer, said in the release.

The last time Calpers lost money was during fiscal 2009 when the fund’s holdings fell 24.8%.

The giant California plan ended 2016 with roughly $295 billion in assets, and more than half of those funds are invested with publicly traded stocks. Those investments declined 3.4%, though the performance beat internal targets.

Fixed income produced the largest returns at 9.3%, though the results under performed Calpers’ benchmark. The California retirement giant’s private-equity portfolio posted returns of 1.7%.

Real estate holdings returned 7.1%, but that was below Calpers’ internal target by more than 5.6 percentage points.

Rory Carroll of Reuters also reports, CalPERS reports worst year since 2009 amid market volatility:

California’s largest public pension fund posted a 0.61 percent return on investment in its most recent fiscal year, its worst showing since 2009, which it blamed on global market volatility.

The result marked the second straight year the California Public Employees’ Retirement System or CalPERS failed to meet its assumed investment return of 7.5 percent.

If the $302 billion public pension fund consistently misses the 7.5 percent target, state taxpayers could be forced to make up any shortfall in pension funding.

Last fiscal year, CalPERS returned 2.4 percent on its total portfolio, marking a significant decline from previous years when the fund earned double digit returns of more than 10 percent. The result for the year ending June 2016 was the worst since an investment loss of 23.6 percent in 2009.

The yearly rates of return, once audited, help determine contribution levels for state agency employers and for contracting cities, counties and special districts in fiscal year 2016-2017.

Speaking at a CalPERS meeting, Chief Investment Officer Ted Eliopoulos said performance for the year was driven primarily by global equity markets, which represent a little over half of the fund’s portfolio. Equities delivered a return of negative 3.4 percent.

“When 52 percent of your portfolio is achieving a negative 3.4 percent return, that certainly sets the main driver for the overall performance of the fund,” said Eliopoulos, who had projected flat returns for the year in June.

Inflation assets returned a negative 3.6 percent return, helping drag down the fund’s overall performance, Eliopoulos said.

Fixed income and real estate investments were bright spots in the portfolio, posting 9.3 percent and 7.1 percent returns respectively.In response to the drop from previous years, Eliopoulos said CalPERS would reduce risk from its portfolio and have simpler investments that do not require paying fees to money managers.

Fund officials, recognizing that the wave of retiring baby boomers means it will pay out more in benefits than it takes in from contributions and investment income, have projected that the fund could have negative cash flow for at least the next 15 years.

You can read more articles on CalPERS’s fiscal 2015-2016 results here. CalPERS’s comprehensive annual report for the fiscal year ending June 30, 2015 is not yet available but you can view last year’s fiscal year annual report here.

I must admit I don’t track US public pension funds as closely as Canadian ones but let me provide you with my insights on CalPERS’s fiscal year results:

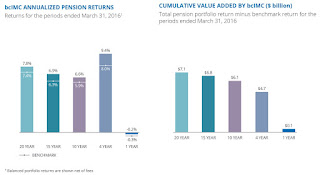

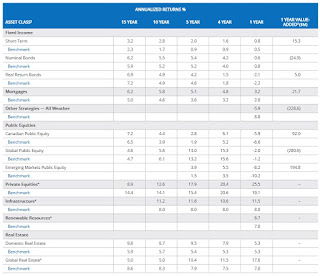

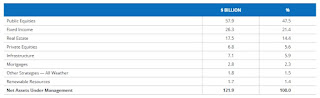

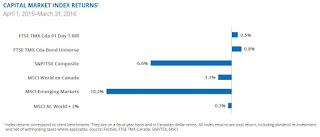

- First, the results aren’t that bad given that CalPERS’s fiscal year ends at the end of June and global equity markets have been very volatile and weak. Ted Eliopoulos, CalPERS’s CIO, is absolutely right: “When 52 percent of your portfolio is achieving a negative 3.4 percent return, that certainly sets the main driver for the overall performance of the fund.” In my last comment covering why bcIMC posted slightly negative returns during its fiscal 2016, I said the same thing, when 50% of the portfolio is in global equities which are getting clobbered during the fiscal year, it’s impossible to post solid gains (however, stocks did bounce back in Q2).

- Eliopoulos is also right, CalPERS and the entire pension community better prepare for lower returns and a lot more volatility ahead. I’ve been warning about deflation and how it will roil pensions for a very long time.

- As far as investment assumptions, all US public pensions are delusional. Period. CalPERS and everyone else needs to lower them to a much more realistic level. Forget 8% or 7%, in a deflationary world, you’ll be lucky to deliver 5% or 6% annualized gains over the next ten years. CalPERS, the government of California and public sector unions need to all sit down and get real on investment assumptions or face the wrath of a brutal market which will force them to cut their investment assumptions or face insolvency. They should also introduce risk-sharing in their plans so that all stakeholders share the risks of the plan equally and spare California taxpayers the need to bail them out.

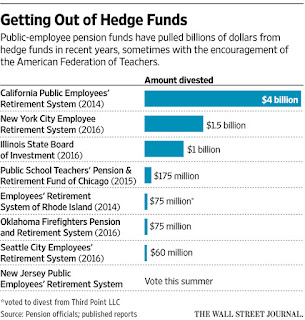

- What about hedge funds? Did CalPERS make a huge mistake nuking its hedge fund program two years ago? Absolutely not. That program wasn’t run properly and the fees they were doling out for mediocre returns were insane. Besides, the party in hedge funds is over. Most pensions are rightly shifting their attention to infrastructure in order to meet their long dated liabilities.

- As far as portfolio returns, good old bonds and infrastructure saved them, both returning 9% during the fiscal year ending June 30, 2016. In a deflationary world, you better have enough bonds to absorb the shocks along the way. And I will tell you something else, I expect the Healthcare of Ontario Pension Plan and the Ontario Teachers’ Pension Plan to deliver solid returns this year because they both understand liability driven investments extremely well and allocate a good chunk into fixed income (HOOPP more than OTPP).

- I wasn’t impressed with the returns in CalPERS’s Real Estate portfolio or Private Equity portfolio (Note: Returns in these asset classes are as of end of March and will end up being a bit better as equities bounced back in Q2). The former generated a 7.06 percent return, underperforming its benchmark by 557 basis points and suffered relative underperformance in the non-core programs, including realized losses on the final disposition of legacy assets in the Opportunistic program. CalPERS Private Equity program bested its benchmark by 253 basis points, earning 1.70 percent, but that tells me returns in this asset class are very weak and the benchmark they use to evaluate their PE program isn’t good (they keep changing it to make it easier to beat it). So I’m a little surprised that CalPERS new CEO Marcie Frost is eyeing to boost private equity.

In a nutshell, those are my thoughts on CalPERS fiscal 2015-16 results. Is CalPERS smearing lipstick on a pig? No, the market gives them and everyone else what the market gives and unless they’re willing to take huge risks, they need to prepare for lower returns ahead.

But CalPERS and its stakeholders also need to get real in terms of investment projections going forward and they better have this conversation sooner rather than later or risk facing the wrath of the bond market (remember, CalPERS is a mature plan with negative cash flows and as interest rates decline, their liabilities skyrocket).

Hope you enjoyed reading this comment, please remember to kindly donate or subscribe to this blog on the right-hand side to show your support and appreciation for the insights I provide you.