Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Theophilos Argitis and Kristine Owram of Bloomberg report, Home Capital Is a Minor Meltdown That’s Left a Major Mark on Canada:

The story Canada has been telling itself about its economy is starting to sound like wishful thinking.

It’s too early for the meltdown at Home Capital Group Inc. to show up in the data — and, with just 1 percent of the national market, the mortgage lender may be too small to do so anyway. But it’s already had a big impact on how investors and analysts are weighing the country’s weaknesses against its strengths.

[Note: Home Capital accounts for only 1 percent of the national market but is much more present in the Greater Toronto Area, and this is where the concern lies.]

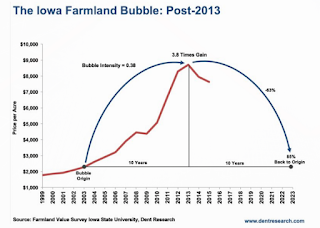

Boom-times in Vancouver and Toronto look increasingly like the spillovers from debt-fueled housing bubbles, the kind that wrought havoc in so many Western countries last decade. A banking system long considered among the world’s soundest got hit by a Moody’s downgrade this week. The government has touted a transition away from commodity-dependence and toward hi-tech smarts; Canadians are waking up to the possibility that their economy got hooked on real-estate instead.

None of that is to say that Canada has become a basket case overnight, of course. Still, expectations that it’ll grow faster than developed-world peers this year — as forecast by the Bank of Canada — may be unsustainable, according to Craig Fehr, Canadian investment strategist at money-manager Edward Jones & Co.

“Every time I see estimates for 2 plus percent GDP growth this year I just think they’re far too rosy,” he said. “It’s a function of the imbalances that exist in the economy.”

Housing is exhibit no. 1. Estimates of its direct contribution to the economy exceed 20 percent (click on image).

The figure is much higher when secondary effects are included, from lawyer fees to higher government revenue to increased retail spending driven by homeowners’ inflated sense of their own wealth, as house prices in some regions shot up more than 20 percent a year. Consumer spending as a share of gross domestic product is hovering around the highest since possibly as far back as the 1960s.

“The question is just how will the economy look as that ceases to contribute quite so forcefully,” said Eric Lascelles, chief economist at RBC Global Asset Management Inc. “All bubbles come to an end. I think it could be an interesting year or two ahead.”

Both home-ownership and consumption are being financed by record levels of household debt. Canada’s traditional remedy for commodity busts involved scraping together enough foreign financing to cushion the initial blow, then depreciating the currency to stoke manufacturing and exports.

This time, after the oil crash of 2014, there’s little sign of an industrial revival. There has been plenty of overseas borrowing: External debt was about 60 percent of GDP a decade ago; now, at C$2.3 trillion, it’s larger than the economy. But much of it has been channeled to households.

As a result, they’re “indebted to a level that is unprecedented,” said Michael Emory, chief executive officer of Allied Properties Real Estate Investment Trust, who describes that as the economy’s biggest concern. “Canadian consumers historically have been very prudent with the levels of debt they bear,” he said.

Not anymore (click on image).

Moody’s Investors Service cited the private-debt burden when it cut ratings on the country’s six biggest banks, expressing concern about asset quality.

That backdrop makes the Home Capital crisis more threatening than it otherwise might have been. A run on deposits, even at a small lender, sparks concern about contagion. Default levels across the system remain low, but could rise if the economy slows and financial conditions tighten.

Which they likely will, according to David Rosenberg, chief economist at Gluskin Sheff & Associates Inc. in Toronto, who expects credit growth to tail off. “That alone will probably cause the Bank of Canada to keep interest rates that much lower for longer,” he said.

Investors looking for the drama of a full-blown financial crash may be disappointed.

Even while downgrading Canadian banks, Moody’s acknowledged that they “maintain strong buffers in terms of capital and liquidity.” Regulators keep a relatively tight grip on the system.

And history shows that, when forced to confront problems, the industry tends to circle the wagons. Home Capital’s troubles, for example, have prompted other lenders to step up to limit the fallout. MCAP Corp. agreed to pick up C$1.5 billion in mortgages and renewals from its rival, according to the Globe and Mail. Investment funds at Canadian Imperial Bank of Commerce are buying Home Capital’s equity.

All has that contributed to a rally in the shares this week. They’re still trading at less than half the level of a month ago, and plunged again at the market’s opening on Friday after company management said on a conference call that there’s no immediate prospect of additional asset sales.

Canada’s wider financial markets have been lackluster rather than dismal. The loonie is down 1.9 percent this year, the most among 16 major currencies tracked by Bloomberg. The main stock gauge has underperformed other developed countries, but it’s still up 1.7 percent.

So investors aren’t exactly flashing warning signals. Still, they’re finding more things to worry about than was the case a month ago.When the U.S. housing bubble collapsed, it triggered first a financial crisis and then a recession. In the event of a replay north of the border, Canada might avoid the first pitfall, if its banks are as sound as everyone says. That doesn’t mean its economy won’t get hurt in the fallout.

On Friday, Matt Scuffham of Reuters reports, Home Capital shares fall after flagging going concern issues:

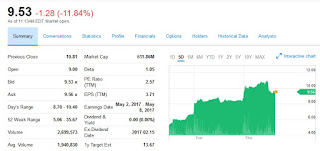

Shares in Home Capital Group Inc (HCG.TO) fell as much as 20 percent in early trading on Friday after the lender said uncertainty around future funding had cast doubt about whether it could continue as a going concern.

Shares in Canada’s biggest non-bank lender hit a low of C$8.70 in early deals before recovering to trade down 11 percent at C$9.60.

Home Capital issued first-quarter results after the market closed on Thursday, alongside which it stated that: “Management believes that material uncertainty exists regarding the company’s future funding capabilities as a result of reputational concerns that may cast significant doubt upon the company’s ability to continue as a going concern.”

Depositors have withdrawn nearly 94 percent of funds from Home Capital’s high-interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

The withdrawals accelerated after April 19, when Canada’s biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business.

Home Capital relies on deposits from savers to fund its lending to borrowers, such as self-employed workers or newcomers to Canada, who may not meet the strict criteria of the country’s biggest banks.

Reuters reported on Thursday that Home Capital was in talks to divest about C$2 billion in assets to help pay down a high-interest loan, according to people familiar with the situation.

The lender needs to raise funds to help repay a C$2 billion loan from Healthcare of Ontario Pension Plan (HOOPP), which provided the high-interest line of credit last month, charging interest of 10 percent on outstanding balances. Home Capital has so far drawn down C$1.4 billion from the facility but is hoping to secure alternative funding on more favorable terms.

In a conference call with investors on Friday, Chief Financial Officer Robert Morton confirmed the company is considering selling assets to enable it to refinance quicker and pay off the emergency loan provided by HOOPP.

[Note: Boyd Erman of Longview Communications reached out to me and provided a transcript of the conference call which shows it wasn’t Robert Morton but a director, Robert J. Blowes, who said this.]

“Given the cost of the C$2 billion credit line repayment of amounts, repayment of the amounts drawn under this facility in a timely fashion is an essential part of management’s plans. This may necessitate asset dispositions,” he said.Home Capital disclosed data on Friday that showed the rate of withdrawals by depositors was slowing, a day after the company raised doubts about its ability to continue as a going concern.

At this writing, late Friday morning, shares of Home Capital Group (HCG.TO) are down roughly 12% but enjoyed a hell of a run this week, doubling from the lows before falling back, and this on much higher than normal volume (click on image):

While some see this as a ‘classic contrarian opportunity’, I’m on record stating I wouldn’t touch these shares with a ten-foot pole given the uncertainty surrounding the fate of the company. But I also said that you shouldn’t be surprised to see them bounce every time some potentially good news story leaks and shorts sellers cover.

Ten days ago, Reuters reported that buyout firms Apollo Global Management, Blackstone Group, and Centerbridge Partners LP are among potential suitors studying bids for Canada’s biggest alternative mortgage lender. According to the article, Brookfield Asset Management and Fairfax Financial Holdings are also among other firms interested in buying Home Capital.

On Thursday, Reuters reported, Home Capital plans $2 billion in asset sales to ease loan burden:

Home Capital Group, Canada’s biggest non-bank lender, is in talks to divest about C$2 billion in assets to help pay down a high-interest loan and delay a potential sale of the entire company, according to people familiar with the situation.

The company wants to sell all or part of its commercial mortgage portfolio, its consumer finance business and a small portion of its traditional residential mortgage portfolio to raise the $2 billion, the people said.

U.S. buyout firms Cerberus Capital Management L.P., Fortress Investment Group LLC and Apollo Global Management LLC are among those in active talks with Home Capital about buying some of its assets, the people said, declining to be named as the matter is not public.

Home Capital and Cerberus declined comment. Fortress and Apollo did not respond to requests for comment.

Toronto-based Home Capital expects the proceeds of the sales to help repay a $2 billion loan from Healthcare of Ontario Pension Plan, which provided a high-interest line of credit last month, the people said. Home Capital has said it plans to secure a loan on more favorable terms.

Caisse de depot et placement du Quebec, as well as other pension funds and some private equity firms, are in talks with Home Capital about providing an alternative loan, the people said.

Caisse did not immediately respond to a request for comment.Depositors have withdrawn more than 90 per cent of funds from Home Capital’s high-interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

The withdrawals accelerated after April 19, when Canada’s biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business. The company has said the accusations are without merit.

The pace of decline of withdrawals has slowed down, recent data shows..

The sale of assets, if successful, is likely to delay the sale of the entire company, the people said.

Home Capital’s commercial mortgage business, which includes both residential and non-residential mortgages targeting higher-quality borrowers, may be worth about C$2 billion, the people said.The consumer finance business includes secured and unsecured credit cards and could be worth about C$400 million, the people said. Home Capital could also sell as much as C$1 billion in single-family residential mortgages, the people said.

Reuters reported last week that buyout firms Apollo and Blackstone Group LP are among potential suitors studying bids for Home Capital.

On Friday morning, Matt Scuffham of Reuters confirmed Home Capital eyes disposals to address funding issues, stating this in his article:

Reuters reported on Thursday that Home Capital was in talks to divest about C$2 billion in assets to help pay down a high-interest loan, according to people familiar with the situation.

The lender needs to raise funds to help repay a C$2 billion loan from Healthcare of Ontario Pension Plan (HOOPP), which provided the high-interest line of credit last month, charging interest of 10 percent on outstanding balances. Home Capital has so far drawn down C$1.4 billion from the facility but is hoping to secure alternative funding on more favorable terms.

In a conference call with investors on Friday, Chief Financial Officer Robert Morton confirmed the company is considering selling assets to enable it to refinance quicker and pay off the emergency loan provided by HOOPP, which he said would significantly impact the company’s performance in 2017.

[Note: Boyd Erman of Longview Communications reached out to me and provided a transcript of the conference call which shows it wasn’t Robert Morton but a director, Robert J. Blowes, who said this.]

“Given the cost of the C$2 billion credit line repayment of amounts, repayment of the amounts drawn under this facility in a timely fashion is an essential part of management’s plans. This may necessitate asset dispositions,” he said.

Alan Hibben, a former Royal Bank of Canada executive who was brought in a week ago to bolster Home Capital’s board, replacing company founder Gerald Soloway, fielded many of the questions on the call, which was the first time Home Capital executives have spoken publicly since the withdrawal of deposits sparked concerns over the lender’s liquidity.

Hibben said he “fundamentally believed in the funding model of Home Capital and the role that it played in the market”.

“This company has faced a crisis in confidence and liquidity but a number of steps have been taken to address both our governance and near-term liquidity issues, which will provide a platform which we can build on to assess our strategic alternatives,” he said.Hibben said he was taking on a grater role, alongside management, to address a “wide range of potential funding sources and strategic transactions”.

He added, however, that he did not expect deals in the coming weeks.

“We have some breathing room so that we can address medium and longer-term issues in a thoughtful way. I don’t expect there to be any new, significant, transactions within the next days and weeks,” he said.

Home Capital disclosed data on Friday that showed the rate of withdrawals by depositors was slowing, a day after the company raised doubts about its ability to continue as a going concern.

Alan Hibben wasn’t the only person Home Capital brought in to shore up its board. Earlier this week, the company announced that pension heavyweights Claude Lamoureux, Ontario Teacher’s former CEO (featured in the image at the top), and Paul Haggis, the former CEO of OMERS are joining Home Capital’s Board along with Sharon Sallows.

I don’t know if traders and investors picked up on that, but in my opinion, the addition of these credible board members had a lot to do with the rally in Home Capital’s shares this week, along with the news of interest from top buyout funds, the Caisse and other pensions.

All this got me thinking if Canada’s big pensions are behind the move to save Home Capital to limit contagion risks to the Canadian financial system.

It sounds crazy but think about it, Canada’s big pensions have a material interest in making sure the big banks don’t suffer significantly from Home Capital’s woes.

First, we had HOOPP giving the company a big loan with hefty terms and now we have interest from top buyout funds, the Caisse and “other pensions”, and well-known former CEOs of big Canadian pensions being nominated to Home Capital’s Board (soon after Jim Keohane stepped down).

If I didn’t know any better, it sounds like Canada’s big pensions are all colluding to save Home Capital Group to limit contagion risk to the Canadian financial system.

And that’s my weekend conspiracy theory. Buy Home Capital’s shares at your own risk. I’m still kicking myself for not holding my nose and buying Valeant Pharmaceuticals (VRX) for a quick trade earlier this week. Oh well, could have, should have, didn’t and that trade has sailed!

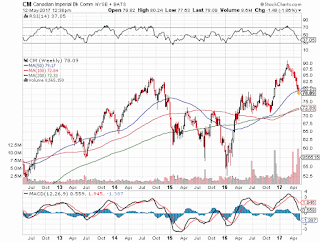

As far as Canadian banks, I don’t like them for a lot of reasons, and they have nothing to do with Home Capital’s problems. I see the US economy slowing down considerably in the second half of the year and we could have a perfect storm hitting the Canadian economy — US and global slowdown, lower oil prices and the bursting of the housing bubble — all of which don’t bode well for Canada’s big banks.

Add to this intensifying deflationary headwinds which will cap any increases in rates, and you understand why I don’t like financials in general, although I’m particularly worried about Canada’s big banks.

In fact, I was looking at the weekly chart of CIBC (CM), one the big six banks that’s most exposed to a downturn in housing, and it’s been hit very badly recently (click on image):

The thing with Canadian banks is every time they dip hard, Canada’s big pensions come in to buy them, but I wouldn’t rush to buy any dip here, there could be another crisis on its way, which will give investors the opportunity to buy at a lower price.

That’s all from me, hope you enjoyed reading this comment. As always, these are my views and have nothing to do with Canada’s pension giants. Do your own due diligence before buying and selling anything. I’m just providing you with my two cents.

Also, please remember to kindly donate and/ or subscribe to this blog on the right-hand side under my picture. I accept all donations and thank those of you who take the time to contribute (I’ve heard PayPal is frustrating but it should be simple, if you encounter problems, email me at LKolivakis@gmail.com).