Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

The Caisse de dépôt et placement du Québec today released its financial results for calendar year 2016, posting a 10.2% five-year annualized return:

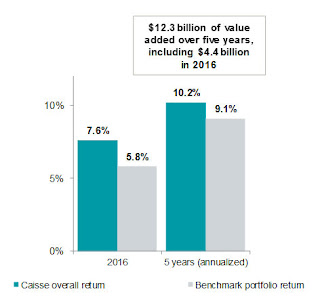

La Caisse de dépôt et placement du Québec today released its financial results for the year ended December 31, 2016. The annualized weighted average return on its clients’ funds reached 10.2% over five years and 7.6% in 2016.

Net assets totalled $270.7 billion, increasing by $111.7 billion over five years, with net investment results of $100 billion and $11.7 billion in net deposits from its clients. In 2016, net investment results reached $18.4 billion and net deposits totalled $4.3 billion.

Over five years, the difference between la Caisse’s return and that of its benchmark portfolio represents more than $12.3 billion of value added for its clients. In 2016, the difference was equivalent to $4.4 billion of value added.

Caisse and benchmark portfolio returns

“Our strategy, focused on rigorous asset selection, continues to deliver solid results,” said Michael Sabia, President and Chief Executive Officer of la Caisse. “Over five years, despite substantially different market conditions from year to year, we generated an annualized return of 10.2%.”

“On the economic front, the fundamental issue remains the same: slow global growth, exacerbated by low business investment. At the same time, there are also significant geopolitical risks. Given the relative complacency of markets, we need to adopt a prudent approach.”

“However, taking a prudent approach does not mean inaction, because there are opportunities to be seized in this environment. Through our global exposure, our presence in Québec, and the rigour of our analyses and processes, we’re well-positioned to seize the best opportunities in the world and face any headwinds,” added Mr. Sabia.

RETURNS BY ASSET CLASS

HIGHLIGHTS OF THE ACCOMPLISHMENTS

The strategy that la Caisse has been implementing for seven years focuses on an absolute-return management approach in order to select the highest-quality securities and assets, based on fundamental analysis. La Caisse’s strategy also aims to enhance its exposure to global markets and strengthen its impact in Québec. The result is a well-diversified portfolio that generates value beyond the markets and brings long-term stability.

Bonds: performance in corporate credit stands out

The Bonds portfolio, totalling more than $68 billion, posted a 3.9% return over five years, higher than that of its benchmark. The difference is equivalent to value added of $1.6 billion. Securities of public and private companies and the active management of credit spreads in particular contributed to the portfolio’s return.

In 2016, despite an increase in interest rates at year-end, the portfolio posted a 3.1% return. It benefited from continued investment in growth market debt and from the solid performance of corporate debt, particularly in the industrial sector.

Public equity: sustained returns over five years and the Canadian market rebound in 2016

Over the five-year period, the annualized return of the entire Public Equity portfolio reached 14.1%. In addition to demonstrating solid market growth over the period, the return exceeded that of the benchmark, reflecting the portfolio’s broad diversification, its focus on quality securities and well-selected partners in growth markets. The Global Quality, Canada and Growth Markets mandates generated, respectively, annualized returns of 18.6%, 10.6% and 8.1%, creating $5.8 billion of value added.

For 2016, the 4.0% return on the Global Quality mandate reflects the depreciation of international currencies against the Canadian dollar. The mandate continued to be much less volatile than the market. The Canada mandate, with a 22.7% return, benefited from a robust Canadian market, driven by the recovery in oil and commodity prices and the financial sector’s solid performance, particularly in the second half of the year.

Less-liquid assets: globalization well underway and a solid performance

The three portfolios of less-liquid assets – Real Estate, Infrastructure and Private Equity – posted a 12.3% annualized return over five years, demonstrating solid and stable results over time. During this period, investments reached more than $60.1 billion. In 2016, $2.4 billion were invested in growth markets, including $1.3 billion in India, where growth prospects are favourable and structural reforms are well underway. The less-liquid asset portfolios are central to la Caisse’s globalization strategy, with their exposure outside Canada today reaching 70%.

More specifically, in Real Estate, Ivanhoé Cambridge invested $5.8 billion and its geographic and sector-based diversification strategy continued to perform. In the United States, the Caisse subsidiary acquired the remaining interests in 330 Hudson Street and 1211 Avenue of the Americas in New York and completed construction of the River Point office tower in Chicago. In the residential sector, the strategy in cities such as London, San Francisco and New York and the steady demand for residential rental properties generated solid returns. In Europe, Ivanhoé Cambridge and its partner TPG also completed the sale of P3 Logistic Parks, one of the largest real estate transactions on the continent in 2016. In Asia-Pacific, Ivanhoé Cambridge acquired an interest in the company LOGOS, its investment partner in the logistics sector, alongside which it continues to invest in Shanghai, Singapore and Melbourne.

In Private Equity, la Caisse invested $7.8 billion over the past year, in well-diversified markets and industries. Through the transactions carried out in 2016, la Caisse developed strategic partnerships with founders, families of entrepreneurs and operators that share its long-term vision. In the United States, it acquired a significant ownership stake in AlixPartners, a global advisory firm. La Caisse also acquired a 44% interest in the Australian insurance company Greenstone and invested in the European company Eurofins, a world leader in analytical laboratory testing of food, environmental and pharmaceutical products. In India, la Caisse became a partner of Edelweiss, a leader in stressed assets and specialized corporate credit. It also invested in TVS Logistics Services, an Indian multinational provider of third-party logistics services.

In Infrastructure, la Caisse partnered with DP World, one of the world’s largest port operators, to create a $5-billion investment platform intended for ports and terminals globally. The platform, in which la Caisse holds a 45% share, includes two Canadian container terminals located in Vancouver and Prince Rupert. In India’s energy sector, la Caisse acquired a 21% interest in Azure Power Global, one of India’s largest solar power producers. Over the year, la Caisse also strengthened its long-standing partnership with Australia’s Plenary Group by acquiring a 20% interest in the company. Together, la Caisse and Plenary Group have already invested in seven social infrastructure projects in Australia.

Impact in Québec: a focus on the private sector

In Québec, la Caisse focuses on the private sector, which drives economic growth. La Caisse’s strategy is built around three main priorities: growth and globalization, impactful projects, and innovation and the next generation.

Growth and globalization

In 2016, la Caisse worked closely with Groupe Marcelle’s management team when it acquired Lise Watier Cosmétiques to create the leading Canadian company in the beauty industry. It also supported Moment Factory’s creation of a new entity dedicated to permanent multimedia infrastructure projects, and worked with Lasik MD during an acquisition in the U.S. market. Furthermore, by providing Fix Auto with access to its networks, la Caisse facilitated Fix Auto’s expansion into China and Australia where the company now has around 100 body shops.

Impactful projects

In spring 2016, CDPQ Infra, a subsidiary of la Caisse, announced its integrated, electric public transit network project to link downtown Montréal, the South Shore, the West Island, the North Shore and the airport. Since then, several major steps have been completed on the Réseau électrique métropolitain (REM) project, with construction scheduled to begin in 2017.

In real estate, Ivanhoé Cambridge and its partner Claridge announced their intention to invest $100 million in real estate projects in the Greater Montréal area. La Caisse’s real estate subsidiary also continued with various construction and revitalization projects in Québec, including those underway at Carrefour de l’Estrie in Sherbrooke, Maison Manuvie and Fairmont The Queen Elizabeth hotel in Montréal, as well as at Place Ste-Foy and Quartier QB in Québec City.

Innovation and the next generation

In the new media industry, la Caisse made investments in Triotech, which designs, manufactures and markets rides based on a multi-sensorial experience; in Felix & Paul Studios, specialized in the creation of cinematic virtual reality experiences; and in Stingray, a leading multi-platform musical services provider. La Caisse also invested in Hopper, ranked among the top 10 mobile applications in the travel industry. Within the electric ecosystem, la Caisse reinvested in AddÉnergie to support the company’s deployment plan, aimed at adding 8,000 new charging stations across Canada in the next five years.

In the past five years, la Caisse’s new investments and commitments in Québec reached $13.7 billion, with $2.5 billion in 2016. These figures do not include the investment in Bombardier Transportation and the $3.1-billion planned commitment by la Caisse to carry out the REM project. As at December 31, Caisse assets in Québec totalled $58.8 billion, of which $36.9 billion were in the private sector, which is an increase in private assets compared to 2015.

FINANCIAL REPORTING

La Caisse’s operating expenses, including external management fees, totalled $501 million in 2016. The ratio of expenses was 20.0 cents per $100 of average net assets, a level that compares favourably to that of its industry.

The credit rating agencies reaffirmed la Caisse’s investment-grade ratings with a stable outlook, namely AAA (DBRS), AAA (S&P) et Aaa (Moody’s).

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at December 31, 2016, it held $270.7 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ invests globally in major financial markets, private equity, infrastructure and real estate. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

You can view this press release and other attachments here at the bottom of the page. You can also read articles on the results here.

I think the overall results speak for themselves. The Caisse outperformed its benchmark by 180 basis points in 2016, and more importantly, 110 basis points over the last five years, generating $12.3 billion of value added over its benchmark for its clients.

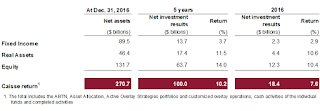

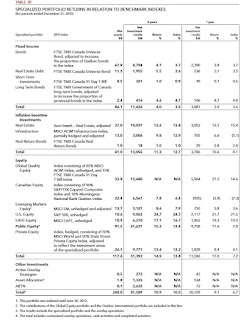

There is no Annual Report available yet (comes out in April), but the Caisse provides returns for the specialized portfolios for 2016 and annualized five-year returns (click on image):

As you can see, Fixed Income generated 2.9% in 2016, beating its benchmark by 110 basis points, and 3.7% annualized over the last five years, 60 basis points over the benchmark.

The press release states:

The Bonds portfolio, totalling more than $68 billion, posted a 3.9% return over five years, higher than that of its benchmark. The difference is equivalent to value added of $1.6 billion. Securities of public and private companies and the active management of credit spreads in particular contributed to the portfolio’s return.

In 2016, despite an increase in interest rates at year-end, the portfolio posted a 3.1% return. It benefited from continued investment in growth market debt and from the solid performance of corporate debt, particularly in the industrial sector.

In other words, Bonds returned 3.1% or 140 basis points over its index, accounting for $1.6 billion of the $4.4 billion of value added in 2016, or 36% of the value added over the total fund’s benchmark last year.

That is extremely impressive for a bond portfolio but I would be careful interpreting these results because they suggest the benchmark being used to evaluate the underlying portfolio doesn’t reflect the credit risk being taken (ie. loading up on emerging market debt and corporate bonds and having a government bond index as a benchmark).

I mention this because this type of outperformance in bonds is unheard of unless of course the managers are gaming their benchmark by taking a lot more credit risk relative to that benchmark.

Also worth noting how the outperformance in real estate debt over the last year and five years helped the overall Fixed Income returns. Again, this is just taking on more credit risk to beat a benchmark and anyone managing a fixed income portfolio knows exactly what I am talking about.

It’s also no secret the Caisse’s Fixed Income team has been shorting long bonds over the last few years, and losing money on carry and rolldown, so maybe they decided to take on more emerging market and corporate debt risk to make up for these losses and that paid off handsomely. Also, the backup in US long bond yields last year also helped them if they were short.

Now, before I get Marc Cormier and the entire Fixed Income team at the Caisse hopping mad (don’t want to get on anyone’s bad side), I’m not saying these results are terrible — far from it, they are excellent — but let’s call as spade a spade, the Caisse Fixed Income team took huge credit risk to outperform its benchmark last year, and this needs to be discussed in detail in the Annual Report when it comes out in April.

Going forward, the Caisse thinks the party is over for bonds:

Caisse de Depot et Placement du Quebec, Canada’s second-largest pension fund manager, is reducing its bond holdings and devoting more resources to corporate credit and real estate debt.

“The party is over, that’s why we are going to restructure this portfolio to lower investment in traditional bonds and increase and diversify our investment in credit,” Chief Executive Officer Michael Sabia said in Montreal Friday.

He said the Caisse will reduce the amount of fixed income in its portfolio and increase over the next few years the share of less liquid assets. The fixed-income portfolio will be broken into two portions: traditional fixed income — federal and provincial Canadian bonds — which will become “significantly smaller,” and another section based on credit, such as corporate credit and real estate debt, he said.

“We’re going to put more priority on building that portfolio because we think that can offer us still a relatively low level of risk but somewhat higher returns,” he said of the credit-focused plan. Investment in Canadian provincial and federal bonds will shrink “not dramatically, but bit by bit,” he said.

[Note: I like private debt as an asset class but disagree, it’s not the beginning of the end for bonds]

Apart from Bonds, what else did I notice? Very briefly, excellent results in Real Estate, outperforming its benchmark by 320 basis in 2016. Over the last five years, however, Real Estate has slightly underperformed its benchmark by only 40 basis points.

Again, a word of caution for most people that do not understand how to read these results correctly. The benchmark the Caisse uses to evaluate its Real Estate portfolio is much harder to beat than any of its large peers in Canada.

I’ve said it before and I’ll say it again, the Caisse’s Real Estate subsidiary, Ivanhoé Cambridge, is doing a truly excellent job and it is one of the best real estate investors in the world.

As far as Infrastructure, CDPQ Infra marginally beat its benchmark in 2016 by 30 basis points, but it’s trailing its benchmark by 250 basis points over the last five years.

Again, the benchmark in Infrastructure is very hard to beat (infrastructure benchmark has lots of beta in it which makes it much tougher to beat when markets are surging), so I don’t worry about this underperformance over the last five years. Just like in Real Estate, the people working at CDPQ Infra are literally a breed apart, infrastructure experts in brownfield and greenfield projects.

When Michael Sabia recently came out to defend the Montreal REM project, he was being way too polite. I set the record straight on my blog and didn’t hold back, but it amazes me how many cockroaches are still lurking out there questioning the “Caisse’s governance” on this project (what a joke, they have a blatant agenda against the Caisse and this unique project but Michael Sabia’s mandate was renewed for four more years so he will have the last laugh once it’s completed and operational).

In Private Equity, the outperformance over the index in 2016 was spectacular (520 basis points or 5.2%) but over the last five years, it’s a more modest outperformance (120 basis points). Like other large Canadian pensions, the Caisse invests in top private equity funds all over the world and does a lot of co-investments to reduce overall fees.

[Note: Andreas Beroutsos who formerly oversaw all of La Caisse’s private equity and infrastructure investment activities outside Quebec is no longer there (heard some unsubstantiated and interesting stories). In April, the Caisse reorganized infrastructure and private equity units under new leaders.]

In Public Equities, a very impressive performance in Canada, outperforming the benchmark by 260 basis points in 2016 and by 160 basis points over the last five years. The Global Quality portfolio edged out its benchmark by 30 basis points in 2016 but it still up outperforming it by almost 500 basis points over the last five years.

Again, I question this Global Quality portfolio and the benchmark they use to evaluate it and I’ve openly stated if it’s that good, why aren’t other large Canadian pension funds doing the exact same thing? (Answer: it doesn’t pass their board’s smell test. If these guys are that good, they should be working for Warren Buffet, not the Caisse)

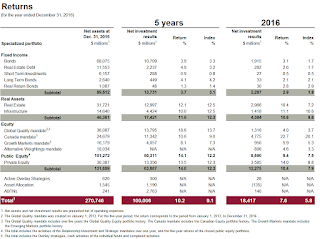

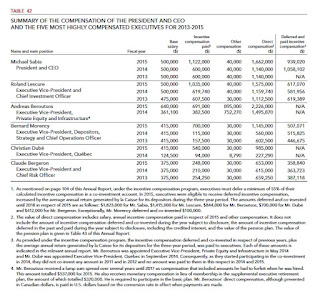

That is it from me, I’ve already covered enough. Take the time to go over the 2015 Annual Report as you wait for the 2016 one to appear in April. There you will find all sorts of details like the benchmarks governing the specialized portfolios (click on image):

Like I said, there are no free lunches in Real Estate and Infrastructure benchmarks but there are issues with other benchmarks that do not reflect the risks being taken in the underlying portfolios (Bonds and Global Quality portfolios, for example).

Net, net, however, I would say the benchmarks the Caisse uses are still among the toughest in Canada and it has delivered solid short-term and more importantly, long-term results.

It’s a tough job managing these portfolios and beating these benchmarks, I know, I’ve been there and people don’t realize how hard it is, especially over any given year. This is why I primarily emphasize long-term results, the only ones that truly count.

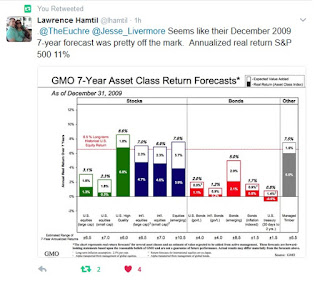

And long-term results are what counts in terms of compensating the Caisse’s senior managers (from 2015 Annual Report, click on image):

Again, Mr. Beroutsos is no longer with the Caisse and neither is Bernard Morency. You can see the members of the Caisse’s Executive Committee here (one notable addition last year was Jean Michel, Executive Vice-President, Depositors and Total Portfolio; he has a stellar reputation and helped Air Canada’s pension rise from the ashes to become fully funded again).

The other thing worth mentioning is the Caisse’s executives are paid fairly but are still underpaid relative to their peers at large Canadian funds (fuzzy benchmarks at other shops play a role here but also the culture in Quebec where people get jealous and mad if senior pension fund executives managing billions get paid million dollar plus packages even if that’s what they are really worth).

Lastly, one analyst told me that the Caisse’s ABCP portfolio has contributed roughly 0.5% annualized to the overall results since 2010 stating “this paper was sold at 45 cents to the dollar and now trades at $1 to the dollar”. No doubt ABCP has come back strongly after the crisis, but I cannot verify his figures (will leave that up to you!).

I will embed clips from the Caisse’s press conference as they become available so come back to revisit this comment. If you have anything to add, please email me at LKolivakis@gmail.com.