Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Benefits Canada reports, PSP Investment consortium acquires U.S. data centre:

A consortium that includes the Public Sector Pension Investment Board has acquired Vantage Data Centers, a U.S.-based provider of data centre solutions.

The consortium, which also includes Digital Bridge Holdings LLC and TIAA Investments, has purchased Vantage Data Centers from technology investor Silver Lake. The terms of the private purchased were not disclosed.

Vantage Data Centers was founded in Silicon Valley, California in 2010. It has four data centres at this location, as well as a campus in Quincy, Washington.

“We are confident that Vantage is ideally positioned to successfully deploy its winning expansion strategy, and look forward to supporting the company’s . . . management team,” said Daniel Garant, executive vice-president and chief investment officer at PSP Investments. “Vantage’s leading market position, in a sector which we believe will grow significantly in the coming years, makes it an attractive investment for PSP Investments.”

Vantage will continue to be led by its president and chief executive officer Sureel Choksi and the existing management team, each of whom has made an investment in the business alongside the consortium. “We’re thrilled about the opportunities to serve our customers’ future expansion plans going forward.,” said Choksi.

“We have been fortunate to have had a great partner in Silver Lake, and are excited to partner with Digital Bridge, PSP Investments and TIAA Investments as we enter this exciting new phase of the company’s growth.”

Bill Stoller of Data Center Knowledge provides more details in his article, Digital Bridge Buys Vantage, Silicon Valley’s Largest Wholesale Data Center Firm:

Boca Raton-based Digital Bridge Holdings just cut another large notch into its already ample M&A belt, acquiring Vantage Data Centers, the largest wholesale data center landlord in Silicon Valley, a deal that has been rumored since January.

Santa Clara-based Vantage becomes the wholesale data center platform for Digital Bridge, a communications infrastructure investor that got into the data center space last year, intending to become one of the forces driving the current wave of consolidation in the market. Digital Bridge plans to invest in expanding Vantage, which is currently in Silicon Valley and Quincy, Washington, into new markets along with its existing cloud, IT services, and large enterprise customers.

The due-diligence process around the deal showed Digital Bridge that Vantage “under promised and over delivered,” Digital Bridge CEO Marc Ganzi said in an interview with Data Center Knowledge. “At the end of the day, Vantage will be able to expand if customers have confidence and want to follow Vantage into other markets to assist with future capacity needs.”

Rapidly Buying Data Centers

Digital Bridge began its data center buying spree last July with acquisition of retail colocation and managed services provider DataBank. In January 2017, DataBank announced acquisition of Salt Lake City-based C7 Data Centers, as well as two data centers located in Cleveland and Pittsburgh, considered “key interconnection assets,”, purchased from 365 Data Centers.

Vantage was purchased by a consortium, including: “Digital Bridge Holdings, LLC, a leading global communications infrastructure company, Public Sector Pension Investment Board (PSP Investments), and TIAA Investments (an affiliate of Nuveen), which made the investment on behalf of TIAA’s general account.” Financial terms of the private purchase from Silver Lake were not disclosed.

To steer Digital Bridge’s data center strategy, Ganzi brought on board Michael Foust, co-founder of the world’s largest wholesale data center provider Digital Realty Trust and its former CEO. He’s been serving as DataBank chairman and has now also been named chairman of Vantage.

In addition to data centers, Digital Bridge owns several wireless tower and communications infrastructure companies, including: Vertical Bridge, ExteNet Systems, Mexico Tower Partners, and Andean Tower Partners.

“Resetting the Shot Clock”

Sureel Choksi, Vantage president and CEO who is staying in his seat post-acquisition, told Data Center Knowledge that he felt “relieved and excited” to be teaming up with Digital Bridge and Foust after an eight-month process. He said the deal was “the ideal scenario,” since existing Vantage management, employees, and customer relationships all remain in place.

Each member of the Vantage management team has also invested in the company alongside the buyer consortium, the company said in a statement.

As the company’s former private-equity owners Silver Lake Partners were exploring their options regarding a sale of Vantage, it felt like “running out the clock” at the end of an NCAA tournament game, he said. The shot clock has now been reset.

Since 2010, Vantage has built 51MW of IT load in Santa Clara and secured expansion capacity for 93MW total. The company’s Quincy campus currently has a 6MW data center and additional land and power for expansion.

Building a Platform of Scale

According to Ganzi, in addition to building first-class facilities, the Vantage team understood the intricacies of underwriting and allocating capital wisely, things that are very important to the long-time real estate investor.

The three investors acquiring Vantage in aggregate have over $1 trillion worth of assets under management.

Ganzi previously was CEO and sole founder of Global Tower Partners, which was acquired by publicly traded wireless tower REIT American Tower Corporation (AMT) in October 2013.

“The data center space is actually in the early innings,” he told us in an interview earlier this year. “There’s still a fantastic opportunity to roll up the space and to create a platform of scale.”

His company is now well on its way to making that happen with both Choksi and Foust on board.

Lastly, PSP Investments put out this press release, Consortium of Digital Bridge, PSP Investments and TIAA Investments Acquires Vantage Data Center:

Vantage Data Centers, a leading provider of data center solutions in support of mission-critical applications, today announced it has been acquired by a consortium which includes Digital Bridge Holdings, LLC, a leading global communications infrastructure company, Public Sector Pension Investment Board (PSP Investments), and TIAA Investments (an affiliate of Nuveen), which made the investment on behalf of TIAA’s general account. Financial terms of the private purchase from Silver Lake were not disclosed.

Founded in 2010 in the heart of Silicon Valley, Vantage’s customer base includes the world’s leading cloud service providers and large enterprises. With four data centers on the flagship Santa Clara campus, two more under construction, and a second large-scale campus under development, Vantage has the largest wholesale data center footprint in Silicon Valley. The company has built 51 megawatts of IT load in Santa Clara and has secured expansion capacity totaling 93 megawatts of IT load. The company also owns and operates a data center campus in Quincy, Washington, including a 6 megawatt data center and additional expansion land and power in that market. Vantage is well positioned for continued growth in the industry, with plans to significantly expand its data center footprint in existing and new markets.

“Vantage is one of the highest quality businesses I have encountered in more than two decades of investing in the sector,” stated Marc Ganzi, co-Founder and CEO of Digital Bridge. “This is a unique and special opportunity to invest in a company that has operational excellence, quality customers, and a current lease portfolio with long duration. It also has significant expansion capacity in Silicon Valley, perhaps the best data center market in the U.S.”

Vantage will continue to be led by President & CEO Sureel Choksi and the existing management team, each of whom has made an investment in the business alongside the consortium. In connection with the transaction, Mike Foust, Senior Advisor to Digital Bridge and former CEO of Digital Realty, will join the Vantage board of directors as Chairman, and Raul Martynek of Digital Bridge will also join the board.

“We’re incredibly proud of what the Vantage team has achieved by providing flexible solutions to our customers and delivering an industry-leading service experience,” said Choksi. “We’re thrilled about the opportunities to serve our customers’ future expansion plans going forward. We have been fortunate to have had a great partner in Silver Lake, and are excited to partner with Digital Bridge, PSP Investments and TIAA Investments as we enter this exciting new phase of the company’s growth.”

“We are confident that Vantage is ideally positioned to successfully deploy its winning expansion strategy, and look forward to supporting the company’s top tier management team,” said Daniel Garant, Executive Vice President and Chief Investment Officer at PSP Investments. “Vantage’s leading market position, in a sector which we believe will grow significantly in the coming years, makes it an attractive investment for PSP Investments.”

“This communication infrastructure investment represents a growing and attractive asset class within TIAA’s infrastructure portfolio,” stated Marietta Moshiashvili, Managing Director & Head of Infrastructure Asset Management for TIAA Investments. “Partnering with the successful Vantage management team and this group of investors will strengthen the firm’s expansion plans and position in the marketplace, generating what we believe will be significant value for all parties.”

“Silver Lake is proud to have supported Vantage’s vision and accomplishments since inception,” said Greg Mondre, Managing Partner at Silver Lake. “From a standing start seven years ago, the company has become a leading wholesale data center provider, with an established platform for long-term growth.”

RBC Capital Markets, LLC and DH Capital served as financial advisors, and Simpson, Thacher & Bartlett LLP acted as legal advisor to Vantage in connection with the transaction. Jones Day acted as lead M&A counsel, Kleinbard LLC acted as investment structure counsel, and Ernst and Young LLP served as accounting advisor to Digital Bridge. Davies Ward Phillips & Vineberg LLP acted as legal advisor to PSP Investments, and Arnold & Porter Kaye Scholer LLP acted as legal advisor to TIAA Investments. TD Securities together with CIT Bank, N.A., RBC Capital Markets, and SunTrust Robinson Humphrey provided debt financing commitment for the acquisition.

About Vantage Data Centers

Vantage is a leader in highly scalable, flexible and efficient data center solutions offering unique value through its commitment to exceptional customer service. Operating campuses in Silicon Valley, Calif., and Quincy, Wash., Vantage offers industry leading data center design solutions engineered to meet the unique requirements of enterprises, technology companies and service providers. Vantage’s first Silicon Valley campus includes four data centers totaling 51 megawatts (MW) of critical IT load, with an additional 24MW of expansion capacity under development. In addition, Vantage is developing a second Vantage Silicon Valley campus offering an additional 69MW of capacity. Vantage also operates a 6MW data center in Quincy, Washington with plans to add four additional data centers to the campus. For more information, visit www.vantagedatacenters.com.

About Digital Bridge Holdings, LLC

Founded in 2013 by Marc C. Ganzi and Ben Jenkins, Digital Bridge is focused on the ownership, investment, and active management of companies in the mobile and internet infrastructure sector. Since inception, Digital Bridge has raised over $6.5B USD of equity and debt capital used to acquire and invest in all three core pillars (data centers, towers and fiber/small cells) of mobile and internet infrastructure through six businesses, including Vantage Data Centers, DataBank, ExteNet Systems, Vertical Bridge, Andean Tower Partners, and Mexico Tower Partners. For more information, please visit http://www.digitalbridgellc.com/

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is one of Canada’s largest pension investment managers with C$125.8 billion of net assets under management as at September 30, 2016. It manages a diversified global portfolio composed of investments in public financial markets, private equity, real estate, infrastructure, natural resources and private debt. Established in 1999, PSP Investments manages contributions to the pension funds of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has business offices in Montréal, New York and London. For more information, visit investpsp.com or follow Twitter @InvestPSP.

About Nuveen

Nuveen offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. As the investment management arm of TIAA, Nuveen has $882 billion in assets under management as of 12/31/16 and operations in 16 countries. Its affiliates offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com.

Nuveen, formerly known as TIAA Global Asset Management, provides investment services through TIAA and its registered investment advisers. C38555

About Silver Lake

Silver Lake is the global leader in technology investing, with over $24 billion in combined assets under management and committed capital and a team of approximately 100 investment and value creation professionals located in Silicon Valley, New York, London, Hong Kong and Tokyo. Silver Lake’s portfolio of investments collectively generates more than $142 billion of revenue annually and employs more than 300,000 people globally. The firm’s current portfolio includes leading technology and technology-enabled businesses such as Alibaba Group, Ancestry, Broadcom Limited, Ctrip, Dell Technologies, Fanatics, Global Blue, GoDaddy, Motorola Solutions, Sabre, SolarWinds, Symantec, and WME│IMG. For more information about Silver Lake and its entire portfolio, please visit www.silverlake.com.

Even though the details of this latest deal are not public, Fortune reported back in October of last year that Silver Lake Partners was looking to sell Vantage Data Centers and was hoping to value the company well in excess of $1 billion, including debt.

Despite the terms being private, I think PSP and its consortium partners just made a great deal acquiring Vantage Data Centers, a leading whole wholesale data center platform.

Over the last five years, everything in the IT space is about the rise of data analytics and cloud computing. Everyone from Amazon, Google, IBM, Microsoft, and a lot of other smaller technology players are investing heavily in data analytics and cloud computing, as are many other non tech companies, and they all need state of the art data centers.

Moreover, US businesses’ burgeoning demand for data and video is fueling a revival in fiber optic services and data storage. Many technology companies have turned to vendors such as Vantage to host and maintain their servers in a bid to cut costs.

The players involved in this deal are experts in IT. Silver Lake is arguably the best private equity fund in this space and Digital Bridge Holgings is a top communications infrastructure investor.

I find it particularly interesting that Marc Ganzi, co-Founder and CEO of Digital Bridge, was previously the CEO and sole founder of Global Tower Partners, which was acquired by publicly traded wireless tower REIT American Tower Corporation (AMT) in October 2013.

So these data centers fall in between real estate, private equity and communications infrastructure. It’s a very exciting, high growth area and it’s a super hot sector right now with tremendous long-term potential.

In fact, Bill Stoller wrote a great article on data center REITS last November, asking whether the sky is falling, and he went over the pros and cons of investing in this space.

But this deal is private, so just like CPPIB and GIC bought a $1.6 billion US student housing portfolio along with their partner, the Scion Group, PSP invested directly in this private company to avoid market beta and paying fees to any REIT manager.

Get it? When you’re the size of CPPIB and PSP, you can invest directly in great properties and private companies, avoiding fees and public market beta.

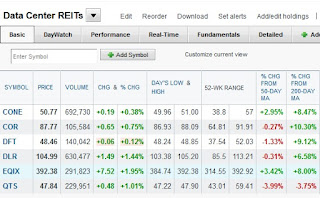

Retail investors looking to invest in data centers can do so through data center REITs but they’re volatile and move with other REITs and the market (click on image):

Still, this is definitely a sector worth investing in through public or private markets like PSP and others have done.

Again, without beating the drum too loudly, this is a great deal for PSP and the consortium. It comes on the heels of other great IT deals like CPPIB acquiring GlobalLogic and Ontario Teachers’ Pension Plan’s acquisition of Compass Datacenters, a wholesale data center developer it acquired in partnership with RedBird Capital Partners.

Speaking of Ontario Teachers’, its 2016 results are out and I had a chance to go over them and a lot more with Ron Mock, OTPP’s President and CEO, earlier today. I will go over the results and my conversation with Ron as soon as possible.

All I can say is that I definitely don’t get paid enough to provide you with this information and remind all of you reading my blog posts to kindly support my work (on Pensionpulse.blogspot.ca) via PayPal donations or subscriptions on the top right-hand side. I thank those few who do so without me asking them.

Anyway, one last news item on PSP, it settled its lawsuit with Saba Capital over bond valuations, which is a good thing for both parties.