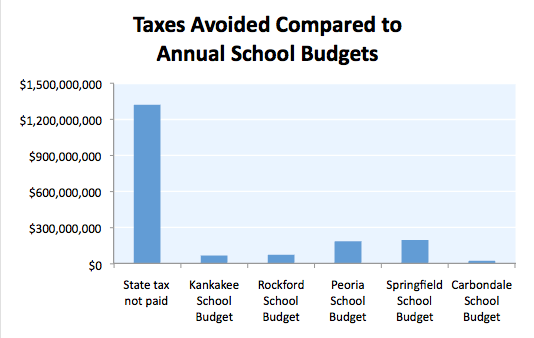

By not taxing the 91,000 currently retired TRS members with ten or more years of service, the state has so far left $1,323,862,729 in revenue on the table, according to Pension360 calculations.

Of the 41 states that tax income, Illinois is one of only three that exclude pension benefits from its income tax, and one of only two states that includes a blanket tax exemption for all retirement income, including Social Security and private pensions.

Advocates of the policy, including unions, senior associations and some lawmakers, say it gives much-needed tax relief to retirees, and encourages seniors to spend their retirement – and their money – in the state.

But it comes at a cost: billions in lost tax revenue for one of the most cash-strapped states in the country.

The lost tax revenue amounts to about $14,500 in unrealized tax revenue per retiree with 10 or more years of service.

The unrealized revenue figure balloons when including all pension systems; a 2013 study by the Chicago Metropolitan Agency for Planning found that the state is losing out on $2 billion every year by not taxing retirement income.

A 2014 study by University of Illinois professor Jeffrey R. Brown found that there is no strong evidence suggesting retirees will leave a state due to state tax policies.

On the campaign trail last year, Gov. Rauner said he didn’t have a position on taxing retirement income.

“I don’t have a position on that yet,” Rauner said during a gubernatorial primary debate. “What I would recommend we do is look at our entire tax code in Illinois, look at every tax and every tax base and every rate and then compare ourselves to other well-run states that we compete with.”

But his recent budget proposal suggests he won’t touch the issue, at least in this fiscal year.

The idea was last considered seriously in 2011, when Senate President John Cullerton suggested imposing a 5 percent tax on pension benefits above a certain amount – $50,000 was the threshold being thrown around at the time.

But the proposal never picked up steam.

Still, the idea – most recently championed by the Civic Federation in Chicago – has become especially pertinent in light of the recent rollback of income tax rates.

As of last January, the state’s individual income tax dropped from 5 percent to 3.75 percent.

Of all of Illinois’ neighbors – Wisconsin, Iowa, Missouri, Kentucky, and Indiana – only Indiana has a lower tax rate for individuals earning $50,000.

But taxing retirement income remains relatively unpopular: only 24 percent of Illinois residents support the idea, according to a 2015 survey.

“There’s going to be a lot of pushback from a lot of retirees, even though you can argue that Illinois is one of three states that exempts retirement income,” state Rep. David Harris (R-Arlington Heights) told WTTW in February. “Voters don’t vote in other states, they vote in Illinois.”

Whether you take the position that public employee retirement benefits were too rich to begin with and retroactively increased and spiked, or that taxpayers didn’t pay their fair share, there is no question that it is past employees and past taxpayers who are guilty. Not future hires and those who might move in or set out on their own in the future.

It is older generations who destroyed the future of Chicago and Illinois, for their own benefit. And yet the retirees are exempted from income taxes? They won’t contribute a penny to what they themselves have done?

“A 2014 study by University of Illinois professor Jeffrey R. Brown found that there is no strong evidence suggesting retirees will leave a state due to state tax policies.”

And it would be fine if they did. They could go right ahead and try to sell their houses to the lower paid, more highly taxed, poorly serviced generations that will follow them. All at once, preferably. Perhaps the prices would fall low enough that younger people would decide to more there anyway. Paying rock bottom prices for housing is the only way younger folks have to take back some money from Generation Greed, and they shouldn’t give that up lightly.

BTW, I live in one of the other two states that doesn’t tax retirement income.

https://larrylittlefield.wordpress.com/2015/03/06/taxes-generational-equity-new-york-state-and-new-york-city-in-2014/

One with a tax burden that, frankly, makes the complaining in Illinois seem like a joke.

https://larrylittlefield.wordpress.com/2015/04/14/taxes-2012-census-of-governments-finance-data/

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

“A 2014 study by University of Illinois professor Jeffrey R. Brown found that there is no strong evidence suggesting retirees will leave a state due to state tax policies.”

But wouldn’t a tax on pension income occur no matter where the retiree lives? I’d certainly consider that money “earned” in Illinois, and thus taxable by it.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Pension income can not be taxed if you leave the state. The state where you reside has the right to tax this income. This is based on federal law, P.L. 104-95.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

What of those on Social Security and only making 24k a year? Tax them too? You would be much better off raising the state employees pension contributions to the 6% that the non state employees paid in their whole working lifetimes.

No taxable retirement income is one of the few things that keep retired people in the state.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Paul, most state employees who do not get Social Security have always paid more than the 6.2% that private sector employees (and employers) pay into SS. For example, when I was a university employee in illinois I had to contribute 8% of salary to SURS; most primary and secondary school teachers who participate in TRS contribute 9.4% of salary. Had the state made proper, actuarially sound contributions to the systems all along (in the case of SURS this would have been about 12% of salary, which is about what Walmart pays into SS and its 401k plan combined), the pensions would be close to 100% funded, which is the case in New York even though their pension formulas (by most measures) are more generous to retirees than those in Illinois. But of course, as we all know, the state chose to have an artificially low income tax for 40+ years and still spend lavishly on social programs, underfunding the pensions in order to be able to do so. Now the chickens are coming home to roost, and politicians (and voters) want to take the shortfall they created out of the hides of state emplyees and retirees, who are entirely blameless – we have been warning about underfunding of our pensions for decades, to no avail. Thank God for an independent judiciary and the rule of law!

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712