Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

California Gov. Jerry Brown’s plan to reduce state worker retiree health care costs got only a small nod in a tentative CSU faculty contract agreement last week. But three unions have agreed to begin paying down one of the state’s fastest-growing costs and largest debts.

Part of the plan Brown proposed last year hit a wall of opposition in the Legislature. An optional low-cost health plan would have taken less from the paycheck, but more from the pocket before insurance begins paying medical expenses.

The new state budget Brown proposed in January still expects major long-term savings from the retireee health care plan requiring state workers to begin paying some of the cost while on the job, work longer to become eligible, and pay higher premiums after retiring.

“Even though the private sector is eliminating these types of benefits, the state can preserve retiree health benefits for career workers,” said the governor’s Finance department budget summary.

How fast are costs growing?

The state paid $458 million in 2001 (0.6 percent of the general fund) for state worker retiree health care and is expected to pay $2 billion (1.7 percent of the general fund) next fiscal year — up 80 percent in just the last decade. (see Finance chart below)

The debt or “unfunded liability” for retiree health care promised state workers has grown to $74.1 billion, state controller Betty Yee reported in January — much larger than the unfunded liability reported by CalPERS for state worker pensions, $43.3 billion.

As the budget summary noted, employer paid retiree health care is rare in the private sector. And in what Brown has called an “anomaly,” the state pays a larger share of retiree health care costs for retirees than for active workers.

The state usually pays 100 percent of the health care insurance premium for retirees and 90 percent of the premium for dependents. For active workers, the state pays 80 to 85 percent of the premium and for their dependents 80 percent, depending on bargaining.

State workers, who can retire as early as age 50 though few do, are expected to switch to federal Medicare when they become eligible at age 65. A state supplement continues to cover costs not paid by Medicare.

Brown’s plan, meanwhile, could take decades to cut costs. But without action, said the budget summary, the state worker retiree health care debt could grow to $100 billion in five years and to $300 billion in three decades.

The big change puts money into a pension-like investment fund to yield earnings that can help pay retiree health care in the future. CalPERS expects its investment fund, valued at $288 billion last week, to pay two-thirds of future pension costs.

The state has only been paying annual retiree health care premiums, setting no money aside to “prefund” or pay for the retiree health care earned by active workers each year.

This “pay-as-you-go” policy forces future generations to help pay for the cost of current workers. By passing on the debt, lawmakers have more money to spend on other programs.

In the early 1990s, legislation by former Assemblyman Dave Elder, D-Long Beach, created an investment fund for state worker retiree health care. But lawmakers chose not to put money into the fund.

Brown’s plan, as in his previous pension reform, calls for the state and its current employees to pay equal shares of the “normal cost,” a contribution to the investment fund to cover the estimated cost of the retiree health care earned during a year.

But as with pensions, only the state, not the employee, has to pay for the debt from previous years often caused by investments failing to earn the expected amount, a big risk at the center of the public pension debate.

Brown’s plan also requires five more years of service to become eligible for retiree health care. Current workers are eligible for 50 percent coverage after 10 years on the job, increasing to 100 percent after 20 years. The new thresholds are 15 and 25 years.

A third part of the plan eventually ends the anomaly of employer-paid health coverage increasing on retirement, regarded by some as an incentive for early retirement. For new hires, retiree health coverage is capped at the level of active workers.

“Over the next 50 years, this approach will save $240 billion statewide,” said the state budget summary. “The Budget sets aside $300 million General Fund to pay for potential increases in employee compensation as part of these good faith negotiations.”

Pay raises are part of three new state worker contracts bargained by the Brown administration that begin prefunding retiree health care under the governor’s plan.

A tentative contract with the California Correctional Peace Officers Association last month, which members are being asked to ratify now, phases in a retiree health contribution of 4 percent of pay by 2019 along with three annual 3 percent pay raises.

A contract with a scientists union phases in a 2.8 percent retiree health contribution by 2019 with three 5 percent annual pay raises. An engineers contract phases in a 2 percent contribution by 2019 with a 5 percent pay raise next year and a 2 percent raise the following year.

The state has not reached an agreement on another contract that expired last July, crafts and maintenance. It’s one of three bargaining units that began prefunding retiree health care prior to the governor’s plan, contributing 0.5 percent of pay.

Physicians are contributing 0.5 percent of pay under a contract that expires this July. State worker retiree health care prefunding began in 2010 with the Highway Patrol contributing 0.5 percent of pay, which is now 2 percent until 2018.

The big round of state worker retire health care bargaining begins when 15 contracts expire this July, nine of them in bargaining units represented by the largest state worker union, SEIU Local 1000.

California State University employees have been paying less for the same pension received by most state workers, 5 percent of pay instead of 8 percent. To shift the shortfall in employee funding to CSU, the Brown administration reduced its funding.

The tentative contract announced last week, negotiated by CSU not the Brown administration, averted a strike by giving a 10.5 percent pay raise over two years to a CSU faculty that contended its pay has lagged UC and community colleges for a decade.

A CSU faculty association summary of the agreement shows no change in the pension contribution. But for faculty hired after July 1, 2017, ten years of service will be needed to be eligible for retiree health care, up from five years for current employees.

The nonpartisan Legislative Analyst’s Office suggested last year that there is “some ambiguity” about whether retiree health care is, like pensions, a “vested right” widely believed to be protected against cuts by a series of state court decisions.

Possibly strengthening the right to retiree health care was not mentioned as an incentive in the negotiations that led to the first contract that the state budget summary said “lays out the approach” for the Brown retiree health care plan.

“Vesting didn’t come up in bargaining,” said Bruce Blanning, executive director of Professional Engineers in California Government. “It wasn’t implied or suggested at all.”

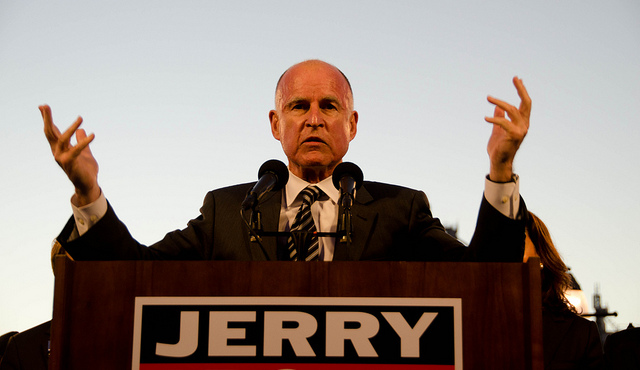

Photo by Steve Rhodes via Flickr CC License

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712