Facing a $1 billion budget deficit, New Jersey Gov. Chris Christie made the bold decision last week to reverse course on his previous pension reform efforts and divert the state’s upcoming pension contributions into the general budget to help cover its budget shortfall. All told, Christie will take $2.45 billion out of his state’s pension system over the next two years.

Journalists, politicians and commentators had much to say on the matter. Here’s a roundup of the most important reactions from around the country:

Wendell Steinhauer–President of the New Jersey Education Association:

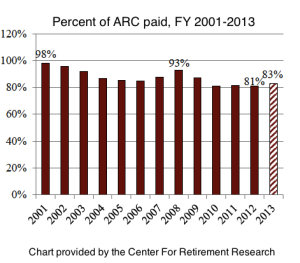

“This much should be abundantly clear to every New Jersey resident: Gov. Christie is much better at making pension promises than keeping them. As a candidate, he pledged to educators that ‘nothing about your pension is going to change when I am governor.’ He broke that promise in 2011 when he signed a law that reduced pension benefits even for current retirees. In signing that law, he made a new promise that the state would slowly return to responsible pension funding practices by phasing in its contributions at a rate of 1/7 per year. Now he says he intends to break that promise, too. Gov. Christie’s illegal, irresponsible and reckless proposal to further delay a return to sound pension funding practices will irreparably harm New Jersey and cannot be allowed.” Click to read more.

Bob and Barbara Dreyfuss–The Nation:

“When Christie announced in May that he was unilaterally canceling more than $2.4 billion in state contributions to the public employee pension fund, he tore up his signature legislative achievement, a pension reform plan that he had hoped would be the basis for his run at the White House. On the one hand, that law was supposed to show his ability to work across the aisle to enact hard budget choices, since the legislation—which slashed benefits, hiked employee payments and raised the retirement age—had been rammed through with the help of a few Democratic party bosses allied to Christie. But it was also supposed to show Christie’s ability at sound economic stewardship by putting the state pension system on a sound footing. It might have done that, by 2018—had not Christie decided to take the money to balance the state budget, rather than raising taxes. (Raising taxes is poisonous for the chances for any GOP standard-bearer, in today’s toxic Republican party climate.) But shredding his great legislative achievement may now have also doomed his chances at being president.” Click to read more.

Barry Chalofsky–Times of Trenton:

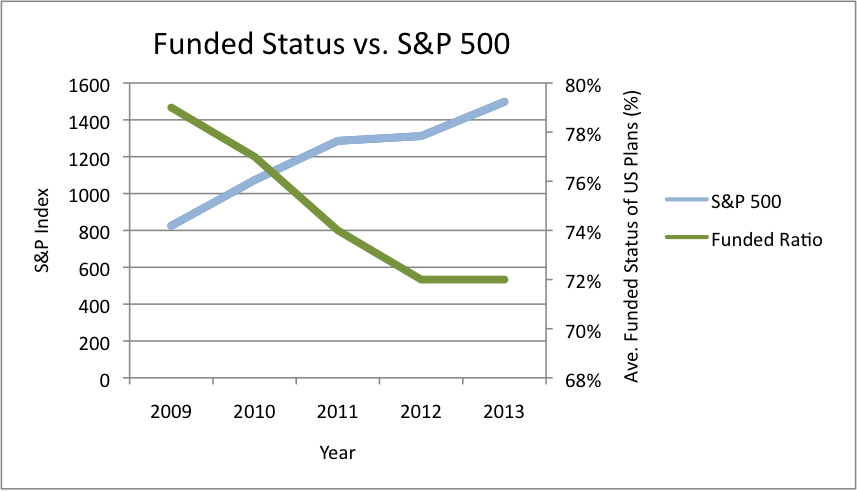

“For four years, most of New Jersey’s economic problems were blamed on former Gov. Corzine. Now we are starting to see the governor blame public retirees’ pension and health benefits as the cause for the unfunded liability in the pension system. In 2011, when the pension reform act was passed, the governor took credit for restoring the pension plan. Now, only three years later, these reforms “are not enough.” The governor has made a lot of claims about the “New Jersey comeback,” but the reality is that we have one of the highest unemployment rates in the country (38th out of the 50 states, according to the U.S. Department of Labor) and have created far fewer jobs – only about half the jobs lost in the recession. Our overall economic growth, the engine that drives prosperity, is nowhere near as powerful as that of other states. Why? Because the governor has refused to see reality and finds more comfort in blaming others. But maybe there is more to the pension liability than the governor is admitting to.” Click to read more.

Charles Lane–The Washington Post:

“The conventional wisdom about New Jersey Gov. Chris Christie’s political fortunes is that he still has a shot at the 2016 Republican presidential nomination — if he can just get past Bridgegate, the scandal over his aides’ allegedly politically motivated partial closure of the George Washington Bridge last year. In that regard, Christie’s fortunes have arguably improved since the memorable January news conference in which he condemned his aides but denied advance knowledge of their wrongdoing. No one has yet produced a “smoking gun” to disprove his version; polls still put him in the top tier of GOP contenders; and he’s resumed fund-raising for Republican candidates in 2014, with an itinerary that includes Iowa, New Hampshire and South Carolina. Alas for Christie, his problems go deeper than Bridgegate: Specifically, he’s governor of a state that may not actually be governable.” Click to read more.

Editorial Board–The Express Times:

“Faced with a $1 billion budget deficit, Christie decided to rob the pension-payment schedule of $2.43 billion over the next two years to meet current expenses and balance the budget. There’s little need to explain that New Jersey, like Pennsylvania, is rolling the dice in a game that threatens to impoverish future generations and diminish public services and jobs. As Christie announced his 180-degree turn on Tuesday, credit agencies warned of another downgrade in the state’s bond rating. On Wednesday, public unions followed through on a promise to sue to ensure the state makes its annual pension payments. Christie said the state can’t keep paying for “sins of the past” — and on that narrow point, he has a wholly defensible argument. But much of the current deficit — an $875 million shortfall in revenue — was caused by overly optimistic budgeting by the administration, coupled with a change in federal rules that reduced income tax projections.” Click to read more.

Photo Credit: Bob Jagendorf via Wikimedia Creative Commons