Canada’s Pensions Worried About Brexit?

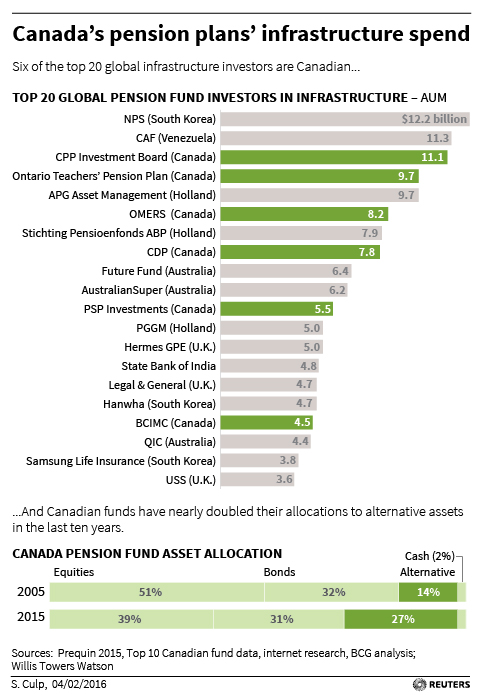

Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse. Matt Scuffham of Reuters reports, Canada pension funds hold back on U.K. deals ahead of Brexit vote: Some of Canada’s top pension funds, among the world’s biggest investors in British real estate and infrastructure, are … Continue reading Canada’s Pensions Worried About Brexit?