Reporter Ed Mendel covered the California Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

CalPERS is focusing on avoiding another big loss, not risky attempts to maximize investment earnings.

A shift from stocks and growth investments in September to lower the risk of losses had reduced CalPERS gains by $900 million, the CalPERS board was told on Feb. 13. The post-election market surge has continued since then, increasing the Dow blue-chip average Friday for the 11th day in a row.

CalPERS also sped up its “risk mitigation” policy this month, lowering the trigger for tiny cuts of .05 to .25 percent in the earnings forecast used to discount future pension obligations. Now cuts will occur when annual earnings are 2 percent above the forecast, not 4 percent.

Reflecting a major change of outlook, CalPERS lowered its discount rate from 7.5 percent to 7 percent in December, causing a large increase in employer rates to help fill the projected gap created by a lower investment earnings forecast.

The lower discount rate will be phased in over three years, easing the strain on local government budgets from the fourth CalPERS employer rate increase since 2012. The risk mitigation policy was delayed until fiscal 2020, when the discount rate phase-in is complete.

The policy could gradually lower the discount rate by 1 percentage point over several decades. Whether even the smallest incremental rate decrease, .05 percent, would be enough to cause an employer rate increase is “unique to each individual employer,” Scott Terando, CalPERS chief actuary, told the board.

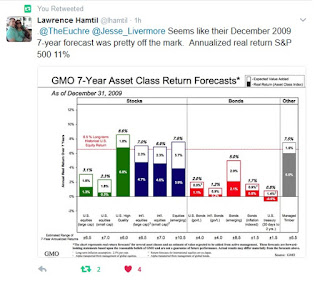

The lower discount rate adopted in December was mainly a response to Wilshire consultants’ view that CalPERS investments were likely to earn 6.2 percent during the next decade, before rebounding to 7.8 percent in the following two decades.

Critics contend that CalPERS and other public pensions have overly optimistic earnings forecasts that conceal massive debt, avoid needed contribution increases, and encourage risky higher-yielding investments that increase the chances of big losses.

The shift to investments with less risk of loss adopted by the California Public Employees Retirement System in September dropped the earnings forecast to 5.8 percent. It looks like a rare attempt at market timing by an extremely long-term investor.

The new short-term investment allocation is intended to remain in place only until CalPERS completes its usual lengthy review, done every four years, and adopts a new allocation next February, taking effect in July 2018.

Ted Eliopoulos, CalPERS chief investment officer, told the board on Feb. 13 that the investment fund had earned about $900 million less than would have been earned under the previous allocation.

After a dispute with Eliopoulos about the link between the lower discount rate and the short-term investment shift, board member Theresa Taylor said: “I just want to make sure that you guys are exploring all options so that we are not leaving money on the table.”

The CalPERS investment fund, valued at $300.7 billion on Nov. 10, was worth $311.3 billion last week. Some attribute the market rally to the election of President Trump and a Republican-controlled Congress that is expected to cut taxes and roll back business regulation.

Eliopoulos reminded the board that the short-term investment allocation was a response to factors such as uncertain market conditions, the size of the negative cash flow gap, and a greater “downside” risk to the CalPERS funding level.

“That is our primary concern and our primary portfolio priority right now — to try and lower the risk of falling to a lower funding status,” he said.

Rob Feckner, CalPERS board president, made a similar point in a news release when the original risk management policy was adopted in November 2015 with a 4 percent above the earnings forecast trigger, taking effect without delay.

“Ensuring the long-term sustainability of the fund is a priority for everyone on this board, and this policy helps do that,” Feckner said. “It makes significant strides in lowering risk and volatility in the system, and helps lessen the impacts of another financial downturn.”

After a long bull market nearing eight years, CalPERS only has 63 percent of the projected assets needed to pay future pension obligations, little changed from its 61 percent funding level at the market bottom.

You might think that CalPERS would be trying to maximize investment earnings, which are expected to cover two-thirds of the cost of future pensions. Most of the rest is expected from employers, who are on the hook for pension debt, and a smaller share from employees.

But CalPERS is still suffering from a massive $100 billion investment loss during the financial crisis and stock market crash. Its investments plunged from $260 billion to $160 billion, dropping the funding level from 101 percent in 2007 to 61 percent in March 2009.

Now CalPERS has no cushion if the market plunges again. Experts have told the CalPERS board that a funding level that drops below 40 percent, or perhaps even 50 percent, could be a crippling blow.

Raising employer contribution rates (already at an all-time high) and the discount rate (still criticized as too optimistic) high enough to project 100 percent funding could become impractical.

Rising CalPERS employer rates for police and firefighters have already reached 60 percent of pay in cities like Costa Mesa, 50 percent for the Highway Patrol, and 40 percent for Richmond, where a CALmatters/Los Angeles Times project reported some fear bankruptcy.

CalPERS employer rates for the non-teaching employees of school districts are expected to double from 13.9 percent of pay this fiscal year to 28.2 percent of pay in fiscal 2023-24.

With CalSTRS teacher rates that also are more than doubling, the school district pension cost increase next fiscal year, $1 billion, is more than the $744 million funding increase proposed by Gov. Brown’s new budget, the Legislative Analyst’s Office said this month.

While adopting the risk mitigation policy two years ago, the CalPERS board rejected a proposal from a Brown administration board member, Richard Gillihan, to lower the discount rate from 7.5 to 6.5 percent, which would have resulted in a major employer rate increase.

Brown said the incremental lowering of the discount rate was “irresponsible” and would “expose the fund to an acceptable level of risk.” Feckner replied that the policy emerged from concern about putting more strain on cities “still recovering from the financial crisis.”

As a maturing pension system, CalPERS faces new structural problems. The number of retirees will exceed the number of active workers. “Negative cash flow” means some investment funds must be used to help pay annual pension costs.

Last year, CalPERS said, about $5 billion in investment funds was added to $14 billion in employer and employee contributions to pay the $19 billion in pensions received by retirees.

But perhaps the main structural change that made avoiding another major investment loss a top CalPERS priority is what actuaries call the “asset ratio volatility.” In board discussions it’s often referred to as the “volatility level” and quantified. (See risk mitigation staff report)

The investment fund in a maturing pension system becomes much larger than the active worker payroll, which means that replacing an investment loss requires a much larger employer contribution increase.

The California State Teachers Retirement System board was given this example last November:

Replacing a 10 percent investment loss below the earnings forecast in 1975, when the teacher payroll and investment fund were about equal, would have required a contribution increase of 0.5 percent of payroll.

Replacing a 10 percent investment loss today, when the investment fund is six times greater than the payroll, requires a contribution increase of 3 percent of pay.