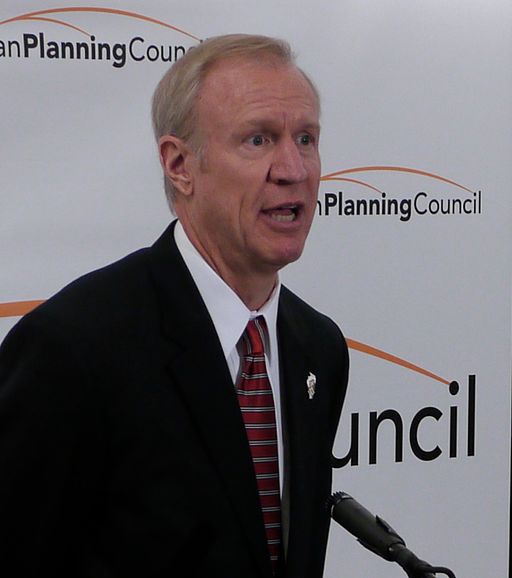

Illinois’ pension reform law currently sits in legal limbo. But if the Supreme Court deems it unconstitutional, all eyes will shift to Illinois Gov. Bruce Rauner, who will need to propose a new solution to the state’s pension woes.

On the campaign trail, Rauner supported a plan to shift workers into a 401(K)-style plan. He has since softened his stance a bit, but hasn’t offered much in the way of clarification as to the specifics of his plan.

From the Chicago Tribune:

With Rauner taking over, the pension debt remains unsettled. As has been the case on many issues, the Republican has offered general answers about his preferences for dealing with public pensions and how he’ll respond if the new law is struck down.

“We have some very specific thoughts on that, but we’ll be developing those with the General Assembly,” Rauner said during a postelection visit to the Capitol. “We need a comprehensive, fair overhaul of the pension system, and we’ll make that a top priority.”

[…]

Asked recently if the state should begin working on a “Plan B” while the pension law is debated by the state Supreme Court, Rauner said his “preference is probably to wait until the Supreme Court rules, so we have some ground rules for what probably works and what won’t work. I think that’s a smarter way to do it.”

Would Rauner’s 401(k) plan work? Would it be constitutional? What are the specifics? And is that still his plan? From the Chicago Tribune:

In his successful campaign, Rauner spoke generally about wanting to shift public employees from receiving a defined pension benefit into becoming members of a defined contribution plan similar to a 401(k)-style system.

Rauner has said public workers should be able to keep the benefits they have already accrued, but, moving forward, go into a defined contribution system. He also has said public safety workers should stay in the current system. And, with 80 percent of public employees not eligible to receive Social Security, Rauner has said he favors some unspecified plan to create a retirement safety net.

But it’s unclear whether Rauner’s concept is constitutional, as he maintains, or how it would address the current unfunded pension liability since payments would go into a new retirement system rather than address the shortfalls in the current system.

“Not only does it not solve the problem, but it makes it worse in the near term,” Dye said. “Whatever the solution is will cost something, and I don’t know how it would be implemented. It’s hard to add (Rauner’s concept) up as a fiscal benefit for the state.”

Illinois is expected to make $6.6 billion in pension payments in fiscal year 2015. The state is saddled with over $100 billion of pension debt.

By Steven Vance [CC-BY-2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712