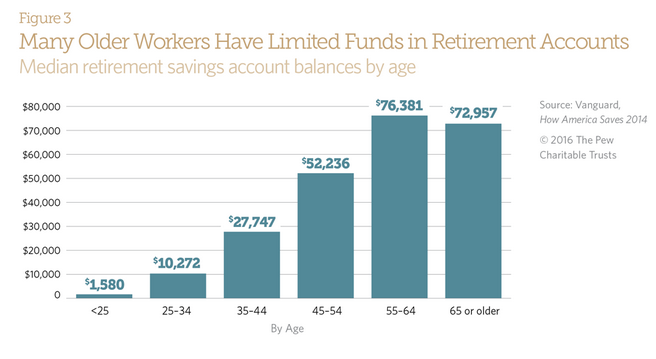

A report from the Charitable Pew Trusts found that the average American has $72,383 in 401(k) balance, but the actual median for those surveyed is only $18,433.

A report from the Charitable Pew Trusts found that the average American has $72,383 in 401(k) balance, but the actual median for those surveyed is only $18,433.

The report compliments another recent study on retirement income disparity from the Employee Benefit Research Institute, which found 40% of 401(k) plan participants have less than $10,000 and 20% have more than $100,000 in their accounts.

The Motley Fool explored the possible reasons for this picture:

The average American has $72,383 stashed in a 401(k), which sounds encouraging.

However, the average can sometimes be misleading, because a large balance in a few 401(k)s can skew the result — after all, consider a hypothetical example of five people with a combined 401(k) savings of $500,000. The average is $100,000, which sounds pretty good until you discover that one person has $450,000, two people have $15,000, and the other two have $10,000 each in their 401(k)s.

[…]

Millions delay enrolling in 401(k)s — or don’t enroll at all. This is in large part because of status quo bias. The idea behind status quo bias is that people tend not to change things unless they see a clear need for change. (Ever put off doing paperwork because it wasn’t your top priority? Yeah, me too.) It’s one of the reasons why millions of Americans who have access to 401(k)s delay enrollment; it’s just one more piece of paperwork, and they have other things to do.

Workers simply aren’t saving enough. Many will simply enroll in their 401(k) at whatever the automatic rate is and ignore it after that. An analysis of Vanguard plans revealed that 65% of plans had an automatic rate of 3% or less — not nearly enough for most workers to build a sufficient nest egg.

The article went on to propose solutions for managing 401(k) retirements including automating enrollment, increasing the default contribution rate, incorporating automatic savings increases in the plans, and spreading out matching funds.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712