Center for State and Local Government Excellence released a study last week examining the practices of the best-funded public pension plans in the United States.

The report, titled “Success Strategies for Well-Funded Pension Plans,” attempted to determine if the best-funded pension plans utilized the same strategies to achieve their success.

The report found that there were several keys to maintaining a well-funded pension system: using realistic actuarial assumptions, occasionally adjusting benefits and maintaining residence in a state that makes its full required contributions to the pension system.

BenefitsPro summarized the findings:

The study indicated that each of the systems employed various strategies for making good on the basic concept of a thorough commitment to pension funding, for example:

* The Delaware Public Employees’ Retirement System employs what the study called “a solid and consistent investment strategy that does not change when markets are volatile,” which allowed the system to weather the 2008-2009 financial crisis.

* The Illinois Municipal Retirement Fund has the political authority to enforce the collection of annual required contributions from those government bodies that participate, and can in fact sue government entities for failing to pay in, or ask the state to withhold funding until payment is rendered.

* The Iowa Public Employees’ Retirement System takes what the study called “incremental actions to reduce the unfunded liability to maintain the plan’s long-term fiscal health.”

* North Carolina Retirement Systems consistently employs the use of conservative actuarial assumptions — for example, a 7.25 percent return on investments — and also requires a full actuarial analysis of any proposal that could potentially have an impact on costs or benefits.

Elizabeth K. Kellar, president and CEO of the Center for State and Local Government Excellence, said the findings of the case studies illustrated “the importance of basing a government’s pension funding policy on an actuarially determined contribution, being disciplined about making required contributions, and clearly reporting how and when pension plans will be funded.”

The funding ratios of the featured plans were as high as 99 percent.

Read the full report here.

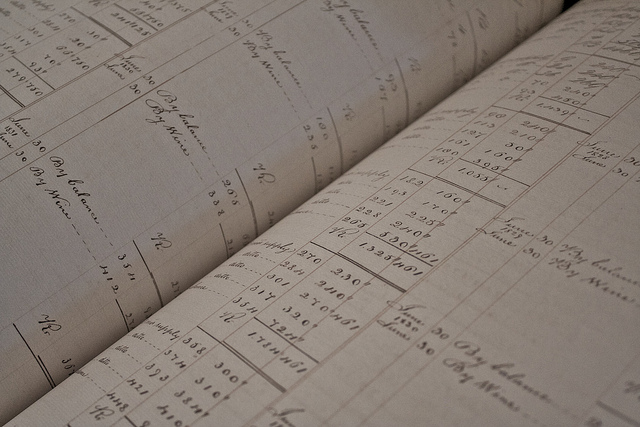

Photo by TaxRebate.org.uk