On Monday, Pension360 covered the debate over a recent investment in a 115,000 acre tract of Saskatchewan farmland by the Canada Pension Plan Investment Board (CPPIB).

On one side of the fight is Dan Patterson, a rancher and former general manager of the Farm Land Security Board who is skeptical of the effect the investment will have on local people and land prices, among other things.

On the other side is CPPIB, who argues that the farmland will prove to be a good fit for both the pension fund and the locals.

On Tuesday, Leo Kolivakis of Pension Pulse weighed in on the broader issue of whether farmland is a good fit for pension funds. His comment is printed below.

______________________

By Leo Kolivakis, Pension Pulse

I have to admit, Mr. Patterson raises some excellent points that need to be properly addressed by CPPIB. In particular, how is CPPIB going to “maximize returns” without hurting the livelihood of local farmers and squeezing them out of owning farmland?

And when Mr. Leduc claims “CPPIB is quintessentially Canadian,” I say prove it by hiring a truly diverse workforce that reflects Canada’s multicultural landscape and takes into account the plight of our minority groups, especially aboriginals and persons with disabilities, the two groups with scandalously high unemployment.

In fact, I have publicly criticized all of Canada’s large pensions for lack of diversity in the workplace, and for good reason. They simply don’t do enough to hire all minorities and it seems that operating at arms-length from the government is convenient when it suits their needs, like justifying their hefty payouts, but less so when it comes to taking care of society’s most vulnerable and diversifying their workforce (even though they should all abide by the Employment Equity Act).

Importantly, as someone who suffers from multiple sclerosis and has faced outright discrimination from all of Canada’s venerable public pensions, especially the Caisse and PSP, I challenge all of you to publish an annual diversity report which shows exactly what you’re doing to truly diversify your workforce. And no lip service please, I want to see hard statistics on the hiring of women, visible minorities, aboriginals and especially persons with disabilities.

So, when Mr. Leduc claims “CPPIB is quintessentially Canadian,” it just rubs me the wrong way. Let’s not kid each other, all of Canada’s large pensions are more Canadian for some groups than they are to others. And I take CPPIB to task because it should be leading the rest when it comes to diversity in the workplace.

Now that I got that off my chest, let me discuss some other concerns I have with pensions investing in farmland. Jesse Newman of the Wall Street Journal recently reported, Farmland Values in Parts of Midwest Fall for First Time in Decades:

Farmland values declined in parts of the Midwest for the first time in decades last year, reflecting a cooling in the market driven by two years of bumper crops and sharply lower grain prices, according to Federal Reserve reports on Thursday.

The average price of farmland in the Federal Reserve Bank of Chicago’s district, which includes Illinois, Iowa and other big farm states, fell 3% in 2014, marking the first annual decline since 1986, the Chicago Fed said. Prices for cropland during the fourth quarter remained steady compared with the previous quarter, according to the bank’s survey of agricultural lenders, though half of all respondents said they expect farmland values to decline further in the current quarter.

In the St. Louis Fed’s district, which includes parts of Illinois, Kentucky and Arkansas, prices for “quality” farmland gained 0.8% in the fourth quarter compared with year-ago levels, despite lower crop prices and farm incomes in the region. A majority of lenders in the district expect values to cool in the current quarter compared with the first quarter of last year, reflecting reduced demand for land amid tighter profit margins for farmers.

The reports spotlight an overall slowdown in the U.S. farm economy and in the appreciation of farmland prices. Crop prices had soared for much of the past decade, fueled by drought and rising demand for corn from ethanol processors and foreign importers. The gains pushed agricultural land values so high that some analysts warned of a bubble.

On Tuesday, the U.S. Department of Agriculture projected net U.S. farm income this year would fall to $73.6 billion, the lowest since 2009, from $108 billion in 2014.

Prices for corn, the biggest U.S. crop by value, have tumbled more than 50% since the summer of 2012, when they soared to record highs amid a severe U.S. drought. Growers produced the nation’s largest corn and soybeans harvests ever last autumn, helped by nearly flawless weather over much of the growing season.

In the Chicago Fed district, farmland values in the latest quarter dropped in major corn-producing states like Illinois, Iowa and Indiana compared with year-ago levels, while land values in Wisconsin increased slightly and were unchanged in Michigan. The fourth quarter of 2014 marked the first time since the third quarter of 2009 that cropland values in the district dropped overall compared with a year earlier.

“Lower corn and soybean prices have been primary factors contributing to the drop in farmland values,” David Oppedahl, senior business economist at the Chicago Fed, wrote in Thursday’s report, adding that for 2015, “district farmland values seem to be headed lower.”

While exceptional returns for livestock producers in 2014 helped blunt the impact of falling crop prices on land values, Mr. Oppedahl said, the trend may come to a halt if prices for animal feed grains stabilize somewhat this year.

Meanwhile, the St. Louis Fed said farm income, household spending by farms and expenditures on farm equipment declined in its region. Midwestern bankers expect a continued slowdown in the current quarter in those three categories.

“It is very difficult for farmers to buy farmland and new equipment with corn prices in the $3.50 range,” said one Missouri lender in the St. Louis Fed report.

Bankers in the Midwest also noted a rise in financial strain for crop farmers in the latest quarter. Lenders in the Chicago region reported a dramatic increase in demand for farm loans compared with year-ago levels, with an index of loan-demand reaching the highest level since 1994. Farm loan repayment rates also were “much weaker,” in the fourth quarter of 2014 compared with the same period a year earlier, the bank said, with an index of loan-repayment falling to the lowest level since 2002.

As if that’s not bad enough, just yesterday, Joe Winterbottom and P.J. Huffstutter of Reuters reported, Rent walkouts point to strains in U.S. farm economy:

Across the U.S. Midwest, the plunge in grain prices to near four-year lows is pitting landowners determined to sustain rental incomes against farmer tenants worried about making rent payments because their revenues are squeezed.

Some grain farmers already see the burden as too big. They are taking an extreme step, one not widely seen since the 1980s: breaching lease contracts, reducing how much land they will sow this spring and risking years-long legal battles with landlords.

The tensions add to other signs the agricultural boom that the U.S. grain farming sector has enjoyed for a decade is over. On Friday, tractor maker John Deere cut its profit forecast citing falling sales caused by lower farm income and grain prices.

Many rent payments – which vary from a few thousand dollars for a tiny farm to millions for a major operation – are due on March 1, just weeks after the U.S. Department of Agriculture (USDA) estimated net farm income, which peaked at $129 billion in 2013, could slide by almost a third this year to $74 billion.

The costs of inputs, such as fertilizer and seeds, are remaining stubbornly high, the strong dollar is souring exports and grain prices are expected to stay low.

How many people are walking away from leases they had committed to is not known. In Iowa, the nation’s top corn and soybean producer, one real estate expert says that out of the estimated 100,000 farmland leases in the state, 1,000 or more could be breached by this spring.

The stakes are high because huge swaths of agricultural land are leased: As of 2012, in the majority of counties in the Midwest Corn Belt and the grain-growing Plains, at least 40 percent of farmland was leased or rented out, USDA data shows.

“It’s hard to know where the bottom is on this,” said David Miller, Iowa Farm Bureau’s director of research and commodity services.

SIGNS OF TROUBLE

Grain production is, however, unlikely to be affected in any major way yet as landowners will rather have someone working their land, even at reduced rates, than let it lie fallow.

But prolonged weakness in the farm economy could send ripples far and wide: as farms consolidate, “there would be fewer machinery dealers, fewer elevators, and so-on through the rural economy,” said Craig Dobbins, professor of agricultural economics at Purdue University.

Possibly also fewer new farmers.

Jon Sparks farms about 1,400 acres of family land and rented ground in Indiana. His nephew wants to return to work on the farm but margins are tight and land rents high. Sparks cannot make it work financially.

“We can’t grow without overextending ourselves,” Sparks said. “I don’t know what to do.”

Landowners are reluctant to cut rents. Some are retirees who partly rely on the rental income from the land they once farmed, and the rising number of realty investors want to maintain returns. Landlords have also seen tenants spend on new machinery and buildings during the boom and feel renters should still be able to afford lease payments.

“As cash rent collections start this spring, I expect to see more farm operators who have had difficulty acquiring adequate financing either let leases go or try and renegotiate terms,” said Jim Farrell, president of Farmers National Co, which manages about 4,900 farms across 24 states for land-owners.

Take an 80-acre (32 hectare) farm in Madison County, Iowa, owned by a client of Peoples Company, a farmland manager. The farmer who rented the land at $375 an acre last year offered $315 for this year, said Steve Bruere, president of the company. The owner turned him down, and rented it to a neighbor for $325 — plus a hefty bonus if gross income tops $750.

There are growing numbers of other examples. Miller, of the Iowa Farm Bureau, said he learned about a farmer near Marshalltown, in central Iowa, who had walked away from 650 acres (263 hectares) of crop ground because he could not pay the rent. Just days later, he was told a north-central Iowa farmer breached his lease on 6,500 acres.

COURTS OR LOANS

Concern about broken leases has some landlords reviewing legal options, according to Roger A. McEowen, director of the Iowa State University Center for Agricultural Law and Taxation. His staff began fielding phone calls from nervous landowners last autumn.

One catch is that many landlords never thought to file the paperwork to put a lien on their tenants’ assets. That means landowners “can’t go grab anything off the farm if the tenant doesn’t pay,” McEowen said. “It also means that they’re going to be behind the bank.”

Still, farmers could have a tough time walking away from their leases, said Kelvin Leibold, a farm management specialist at Iowa State University extension.

“People want their money. They want to get paid. I expect we will see some cases going to court over this,” he added.

To avoid such a scenario, farmers have begun turning to banks for loans that will help fund operations and conserve their cash. Operating loans for farmers jumped 37 percent in the fourth quarter of 2014 over a year ago to $54 billion, according to survey-based estimates in the Kansas City Federal Reserve bank’s latest Agricultural Finance Databook.

Loans with an undefined purpose — which might be used for rents, according to the bank’s assistant vice-president Nathan Kauffman — nearly doubled in the fourth quarter of 2014 from a year earlier to $25 billion.

Total non-real estate farm loan volumes jumped more than 50 percent for the quarter, to $112 billion.

“It’s all about working capital and bankers are stressing working capital,” said Sam Miller, managing director of agricultural banking at BMO Harris Bank. “Liquidity has tightened up considerably in the last year.”

These articles highlight two things: First, the bubble in farmland is bursting and second, when it bursts and farmers walk away from their leases, it could potentially mean costly and lengthy court battles pitting landowners (ie. endowment funds and public pension funds like CPPIB and PSPIB which also invests in farmland) against farmers. That doesn’t look good at all for pensions.

All this to say, while it’s really cool following Harvard’s mighty endowment into timberland and farmland, when you come down to it, managing and operating farmland is a lot harder than it seems on paper and the risks are greatly under-appreciated. Add the potential of global deflation wreaking havoc on all private market investments and you understand why I’m skeptical that farmland is a good fit for pensions, even if they invest for the long, long run.

Photo by Mark Robinson via Flickr CC License

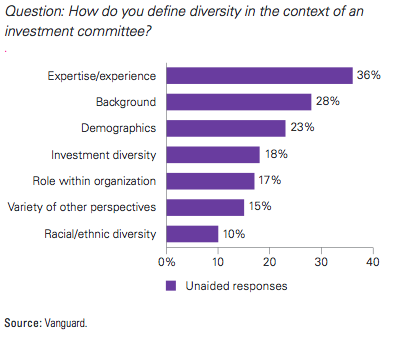

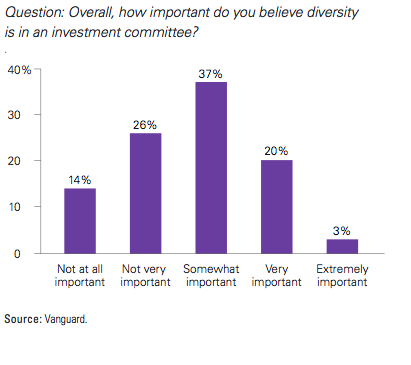

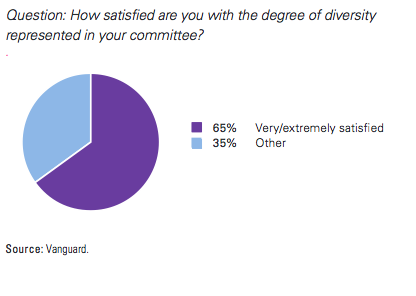

A recent Vanguard survey probed the thoughts of pension investment committee members on the topic of diversity. The members’ thoughts on the meaning of diversity can be seen in the chart above. Below, respondents rated how important they thought diversity was in an investment committee:

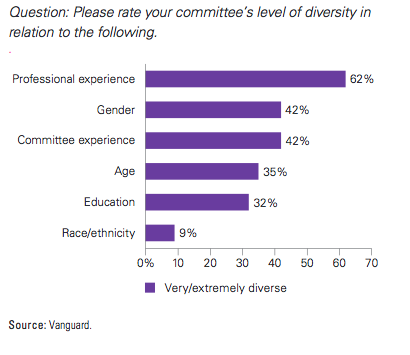

A recent Vanguard survey probed the thoughts of pension investment committee members on the topic of diversity. The members’ thoughts on the meaning of diversity can be seen in the chart above. Below, respondents rated how important they thought diversity was in an investment committee: Respondents were asked about their satisfaction with the level of diversity on their committees:

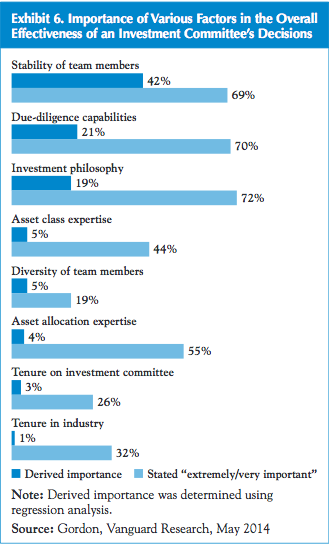

Respondents were asked about their satisfaction with the level of diversity on their committees: Finally, respondents were asked to rate the importance of various factors to committee effectiveness. 19 percent said diversity was “extremely important.”

Finally, respondents were asked to rate the importance of various factors to committee effectiveness. 19 percent said diversity was “extremely important.”