One of the hottest issues in the race for Illinois governor is also one where the candidates differ starkly: how to fix the state’s retirement system.

So it’s no surprise that pensions came up during the race’s first debate.

There were no revelations here; Pat Quinn and Bruce Rauner both used the time to double-down on their stances. From the Associated Press:

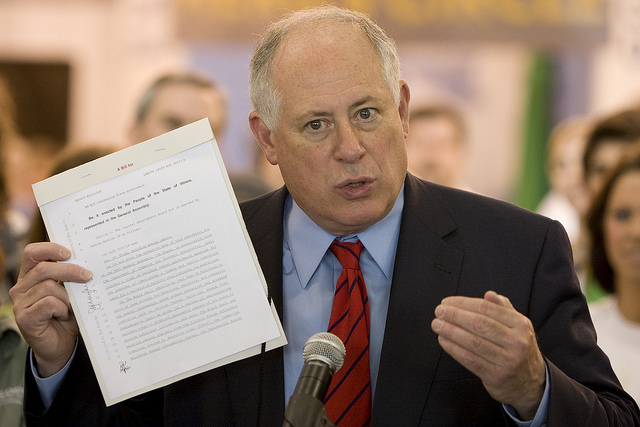

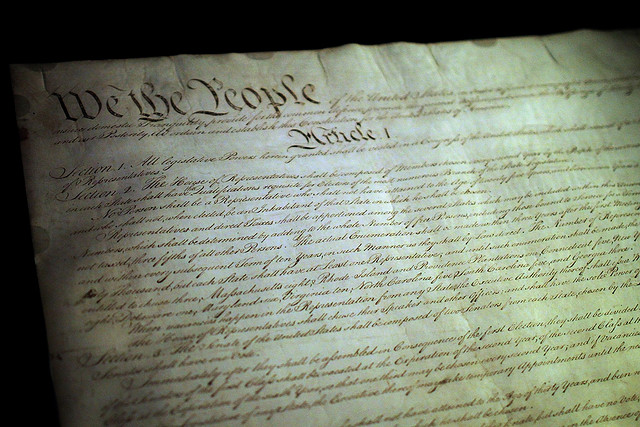

Quinn signed legislation last year that would fully fund the retirement systems by 2045, in part by cutting benefits. Public-employee unions have sued, saying the overhaul violates a provision of the constitution that says benefits can’t be reduced.

Rauner supports letting retirees keep the benefits they’ve been promised but freezing the systems and moving employees to a 401(k)-style plan in which workers are not guaranteed a certain level of benefits. He said that plan — similar to what most private-sector workers have — wouldn’t save much money to start but would save billions in the long term.

“I don’t believe it’s right to change the payments to a retiree after they are already retired, and that’s what Gov. Quinn did,” Rauner said.

But Quinn called Rauner’s plan “risky” because workers’ retirements would depend largely on market performance. He said he deserves credit for making Illinois’ full pension payment each year he’s been governor — something his predecessors didn’t do. That contributed to Illinois having the worst-funded pension systems of any state in the U.S.

Illinois’ pension reform law has spent the last 6 months being fast-tracked through lower courts. A ruling on the constitutionality of the law could come before the end of the year.