Pensions are one of many issues taking a prominent hold in the race for the Illinois governorship.

Both candidates, Pat Quinn and Bruce Rauner, recently sat down in front of the Chicago Tribune’s editorial board for an informal debate on, among other issues, how they would each handle the state’s pension crisis.

One member of the Chicago Tribune’s editorial board, Eric Zorn, listened to both sides. Now he says both Quinn and Rauner need to stop living in their “pension fantasies”.

On Quinn, Zorn writes:

Gov. Pat Quinn says he doesn’t need a “Plan B” to address the problem because he believes the Illinois Supreme Court will uphold the pension reform law he signed in December.

[…]

Quinn’s faith in the Illinois Supreme Court is farfetched. In July, the court issued a thumping 6-1 ruling striking down a previous legislative effort to cut health care subsidies to state retirees and employing language that seemed to serve as a funeral oration for the pension reform law.

Addressing the state’s “but we can’t afford to provide the benefits we promised!” argument, the majority wrote that the unequivocal pension protection clause in the Illinois Constitution “was aimed at protecting the right to receive the promised retirement benefits, not the adequacy of the funding to pay for them.”

Even if Quinn genuinely has hope that the court will gymnastically OK the pending law nevertheless, he still owes it to us to reveal what he proposes to do when — I mean if — those hopes are dashed.

Zorn then shifts to Rauner and his plan to shift Illinois workers into a 401(k)-style system:

Rauner owes it to us to explain why his ideas — he admits they’ve yet to rise to the level of a plan — are any more likely to survive court challenges than the bipartisan reform law, which he strenuously opposed.

…When I asked if joining such a plan would be mandatory, spokesman Mike Schrimpf echoed word-for-word the dodge Rauner employed in his Tribune candidate questionnaire: “We need to wait to see the parameters of what the Supreme Court says in order to carefully craft a plan that will pass constitutional muster.”

Mandatory enrollment of current public employees into 401(k)-style accounts by which they will ultimately fund their own retirements would likely not pass that muster. They’re generally not as lucrative for employees as plans that guarantee monthly pension payments.

Rauner knows this. It’s why he’s promised to allow police officers and firefighters to keep their “special retirement” that includes a standard pension, and why he projects “billions” in savings.

Zorn also decried the administrative costs associated with 401(k) plans. You can read his full editorial here (subscription required).

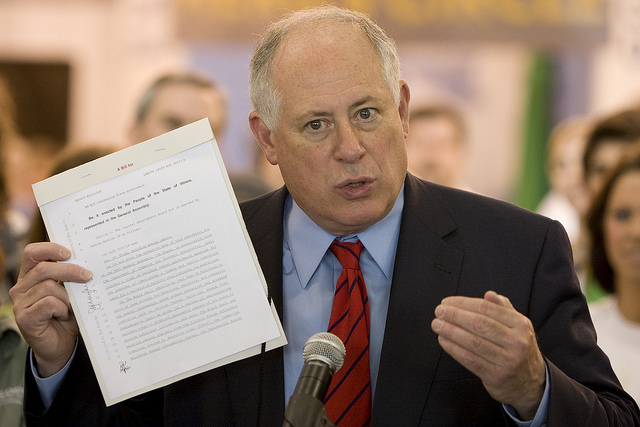

Photo by Chris Eaves via Flickr CC License