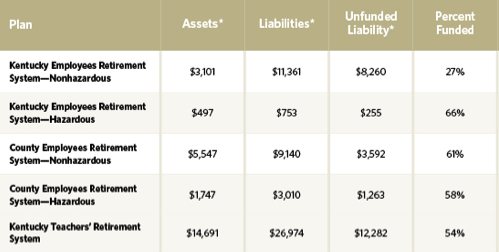

Here’s a chart of the funding situations of Kentucky’s largest public pension funds as of 2012. At 27 percent funded, the KERS non-hazardous fund was considered among the unhealthiest in the country. Since 2012, its funding ratio has dipped even further. But the entire system is experiencing big shortfalls.

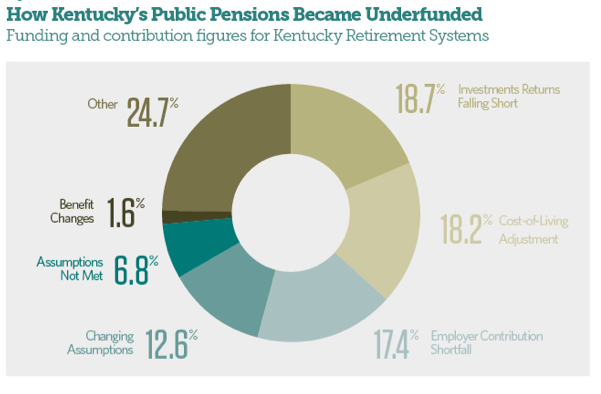

How did they get this way? Pension360 covered earlier today the system’s lackluster investment performance — but the state’s funding shortfall has been influence by a confluence of factors.

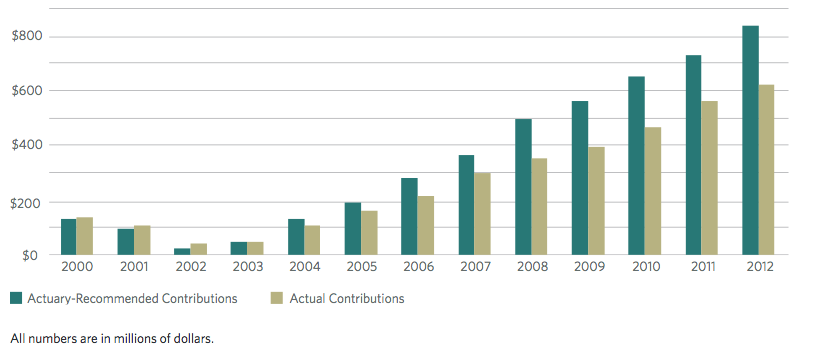

One of the largest reasons for the shortfall is the state failing to make its actuarially-required payments into the system:

One of the largest reasons for the shortfall is the state failing to make its actuarially-required payments into the system:

Chart credits: Pew Charitable Trusts