Seven Counties, a mental health agency, removed itself from the Kentucky Employees Retirement Systems Non-Hazardous Plan earlier this summer in an attempt to avoid the mounting pension obligations it claimed would leave it insolvent.

Soon after, a judge affirmed that Seven Counties could indeed leave the system—a decision that sent shockwaves through Kentucky because of the precedent it set for similar agencies facing similar problems.

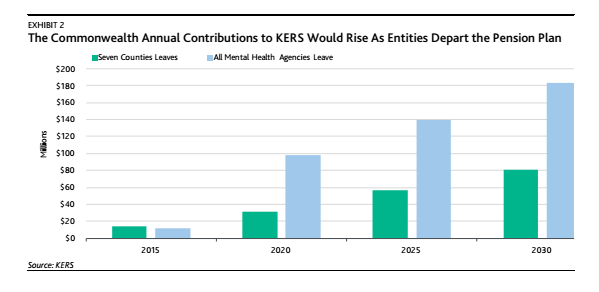

The problem for Kentucky, of course, is that it now has to contribute more money annually into the system to cover its growing funding shortfalls.

A new report from Moody’s delves deeper into the extra costs Kentucky faces in the wake of Seven Counties’ departure—and the costs that could come if other agencies follow in Seven Counties footsteps.

The Moody’s report is behind a paywall, but Insider Louisville did everyone the great justice of giving us the details:

Debt rating agency Moody’s Investor Services has just issued a new report finding the departure of mental health services provider Seven Counties Services from Kentucky Employees Retirement Systems Non-Hazardous Plan means the state now assumes an additional $1 billion or so in pension costs.

If the remaining mental health organizations leave the state pension system, that amount could rise to $2.4 billion, according to the New York City-based agency.

Which of course has sparked a big political battle, with legislators and state officials panicked at the thought all community health agencies could exit the pension systems, leading to a meltdown.

The chart at the top of this post illustrates the burden Kentucky is, and could be, facing.

Insider Louisville pulled out one jarring quote from the Moody’s report:

The Commonwealth of Kentucky (rated Aa2/stable outlook) has Moody’s third highest adjusted net pension liability for all states at 211 percent of its revenue.

But Moody’s was quick to point out that they don’t think Kentucky will be falling apart in the near future; the agency believes the state can “absorb” the mounting pension costs as a result of cost-cutting measures elsewhere.