Phoenix voters struck down a pension reform measure, Prop. 487, on Election Day. But in the weeks since the defeat, several local lawmakers have vocally called for a renewed discussion of pension reform.

Perhaps the most prominent of those voices is Phoenix City Councilman Sal DiCiccio, who supported Proposition 487 and wants the conversation about pension reform to continue.

The Councilman has claimed that the city’s pension costs rise by $18 million every year—and those costs will have a major impact on the funding of other public services.

Eighteen million dollars is a lot of money. But is that claim true? The Arizona Republic fact-checked the figure:

In 2011, state pension-reform laws raised the employee contribution to 11.05 percent, and it will continue increasing until it hits 11.65 percent in 2015-16. The city contributes whatever is needed to completely fund the pensions.

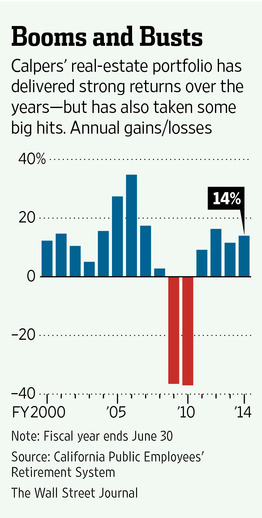

Poorer-than-expected investment returns on both pension funds during the recession raised the city’s contribution in recent years. In 2010-11, Phoenix spent approximately $93.9 million on general pensions, $60.4 million on police pensions and $30 million on fire pensions.

By the 2014-15 budget, the city’s planned contributions had risen to $129 million for general pensions, $91 million for police pensions and $46 million for fire pensions.

DiCiccio’s $18 million figure comes from a projection made before the city approved its budget. It forecast Phoenix would spend $271 million on pensions, $18 million more than it budgeted in 2013.

However, when the city finalized its budget, the numbers had changed. Phoenix set aside $266 million for pension contributions, $13 million more than in 2013.

So, the $18 million figure isn’t exactly right. But the sentiment of the statement is generally correct – the city’s pension costs have risen by millions of dollar each year.

The Arizona Republic also checked DiCiccio’s statement on pension costs hurting funding for public services:

Overall city spending on fire, parks and police has increased in recent years, but the city has also hired fewer police officers and firefighters. The Phoenix Law Enforcement Association estimates that the city has 550 fewer police officers now than it did at its peak employment in 2009.

The United Phoenix Fire Fighters didn’t have similar numbers available, but Phoenix went from 1,671 firefighters in 2009 to 1,578 in 2012.

Staffing cuts caused Phoenix police officers to expand their patrol areas, DiCiccio said.

Phoenix also delayed more than $200 million in capital bond projects in 2010. Voter-approved bond projects allow construction of new public facilities, such as parks or libraries, or renovating existing buildings.

Phoenix’s pension payments have grown at a steeper rate than funding for such services.

Overall, the Arizona Republic said DiCiccio’s statement were “mostly true.”