CalPERS calculates that it will cut investment-related fees by 8 percent in fiscal year 2015-16, according to a report by Bloomberg.

The pension fund has been looking to cut costs recently by reducing the number of private equity managers it invests with and moving more investment management in-house.

According to CalPERS’ proposed budget, obtained by Bloomberg, the 8 percent decrease in fees will come from several areas:

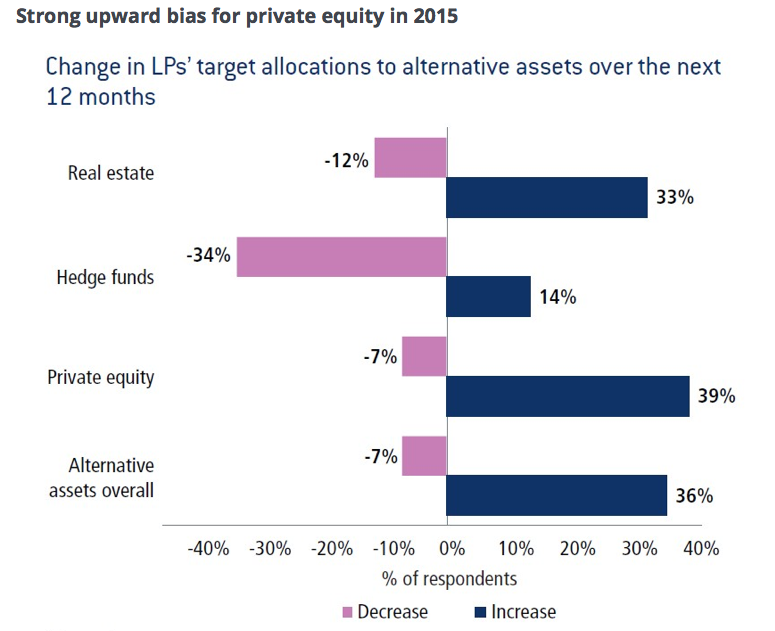

Calpers projects it will pay about $100 million less in fees for hedge-fund investments. The pension has said it would take about a year to unwind all its holdings. It paid $135 million in fees in the fiscal year that ended June 30 for hedge-fund investments, which earned 7.1 percent and added 0.4 percent to its total return, according to Calpers figures.

Brad Pacheco, spokesman for the pension fund, wasn’t immediately available for comment.

Base fees for private-equity investments are projected to decline 7.5 percent to $440.6 million as some investments matured, the number of managers was reduced and Calpers won better terms for new deals.

Base fees for company stock managers are projected to increase 25 percent to $51.3 million. Fees for performance are projected to decrease by $32.6 million because of favorable renegotiated contract terms, Calpers said.

[…]

The largest U.S. state pension fund, known as Calpers, projects that it will pay $930.7 million in base and performance fees to investment firms in the fiscal year that begins July 1, down from more than $1 billion this year and $1.3 billion last year, according to the fund’s proposed budget.

CalPERS managed $295.8 billion in assets as of December 31, 2014.

Photo by rocor via Flickr CC License