When Californians go to vote on November 4, they will find a ballot stuffed with tax hikes. There will be 140 different proposed tax increases on ballots across California. Is there a reason behind the surge?

Mark Bucher, president of the California Policy Center, thinks he knows the reason. In a new column he says voters need look no further than pension costs. From Bucher’s column in the Sacramento Bee:

Tax-weary Californians looking to explain this paradox need look only to former Vernon (population 114) city administrator Bruce Malkenhorst for an answer.

Malkenhorst received a $552,000 pension in 2013, according to just-released 2013 CalPERS pension data on TransparentCalifornia.com.

[…]

Malkenhorst is part of a growing number of 99 California retirees who received at least half-million-dollar pension payouts in 2013, up from four in 2012. Such lucrative pensions mean that in 2014, California will spend approximately $45 billion on pensions, equaling total state and local welfare spending for the first time. And in the zero-sum game of government spending, an extra dollar spent on pensions means one less spent on welfare, infrastructure or safety – or returned to the taxpayer.

Though Malkenhorst and his ilk personify California’s pension profligacy, they do not drive it. That distinction goes to the 40,000 California retirees who took home pensions greater than $100,000 in 2013.

These are the pensions of Susan Kent, a retired Los Angeles city librarian, who took home a $137,000 pension in 2013. And Thomas Place, a retired San Joaquin court reporter, whose pension was $105,000. And, Betty Smith, a retired Alameda nurse, who received $116,000.

Anecdotal evidence aside, more tax dollars than ever are going toward paying pension costs. From Bucher:

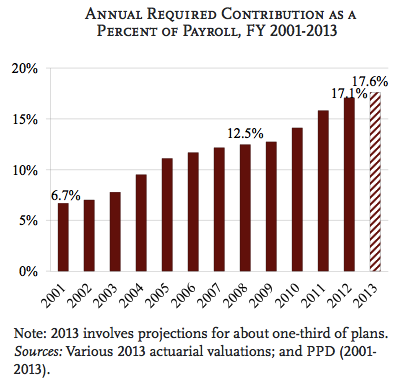

Six-figure pensions for mid-level public servants have brought the state to the point where one out of every nine state and local tax dollars goes to pay for pensions. That’s up from one in 16 tax dollars in 1994. Tax increases now do not increase government services, but simply service government pensions.

And these compensation figures do not include five-figure health benefit obligations, which will only increase as the population ages and health care costs inflate. Bankrupt Stockton, where city employees who worked as little as one month receive a lifetime of retiree health benefits (including spousal coverage), is already paying this price.

Barring pension reform, Stockton – where one in five tax dollars will soon go to pensions – is a harbinger of things to come for other California cities that find themselves at some point on Stockton’s adverse pension spiral: Big pension obligations mean fewer tax dollars for services like safety and infrastructure, driving away taxpayers and increasing pension burdens further. Hence the need for yet more tax increases.

But taxpayers are having trouble keeping up: California pension funds are currently only 74 percent funded. And this is an optimistic estimate given that pension funds assume a very high rate of return of about 7.5 percent per year, an ambitious goal in this investment climate. For every 1 percent this projection drops, California taxpayers must contribute $10 billion more per year to maintain the same funding level, according to a recent analysis by the California Policy Center, using investment formulas provided by Moody’s Investors Service.

The entire column can be read here.