Yesterday, Pioneer Institute Senior Fellow Iliya Atanasov called the annual required contribution (ARC) the “biggest joke of the costing and funding process”. He said in a column at Public Sector Inc:

Yesterday, Pioneer Institute Senior Fellow Iliya Atanasov called the annual required contribution (ARC) the “biggest joke of the costing and funding process”. He said in a column at Public Sector Inc:

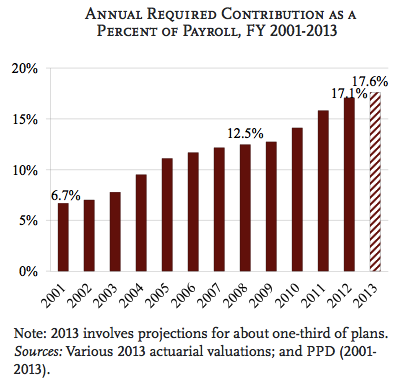

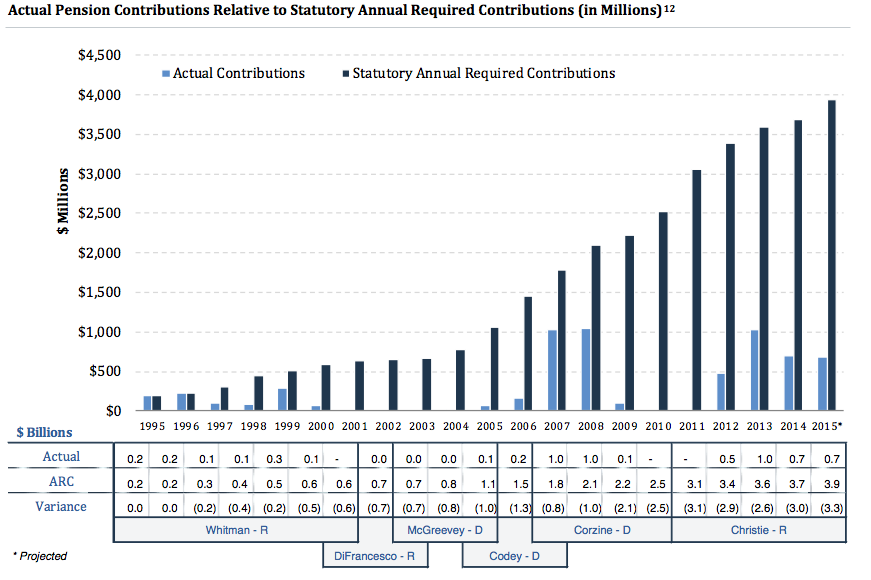

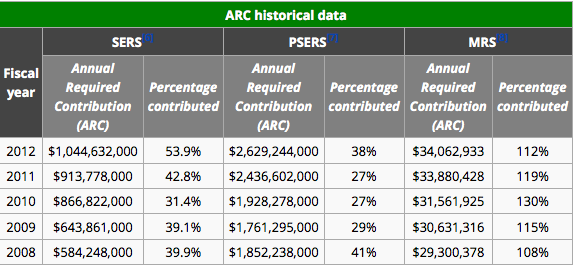

The biggest joke of the costing and funding process is the so-called annual required contribution (ARC) that the actuarial valuation is supposed to determine. In reality, there is nothing “required” about the ARC – most jurisdictions can contribute absolutely nothing and face no legal repercussions, at least in the short run. And when state and local governments don’t make the ARC, they rarely look at, let alone disclose, the long-term cost of postponing the payment and how much more expensive the benefits become as a result. Just look at Illinois, New Jersey and Pennsylvania, which owe some $300 billion in unfunded liabilities between them, or at the sad condition of once glorious cities like Philadelphia, Chicago and Detroit, teetering towards or already in bankruptcy.

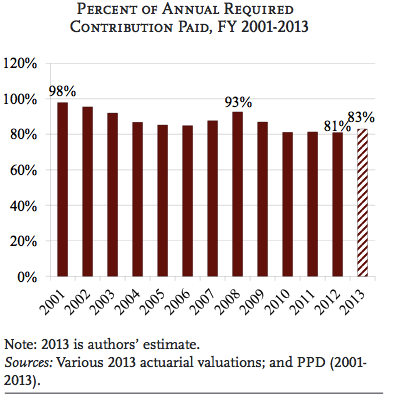

As the above chart shows, the country’s public pension funds are indeed failing to pay 100 percent of their ARCs. Often, states and municipalities make full payments to smaller systems but fail to make consistent, meaningful contributions to larger systems. Another chart for more context: